IRS 1041 - Schedule K-1 2018 free printable template

Show details

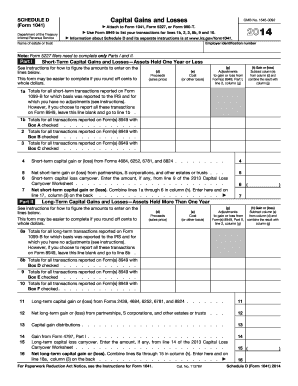

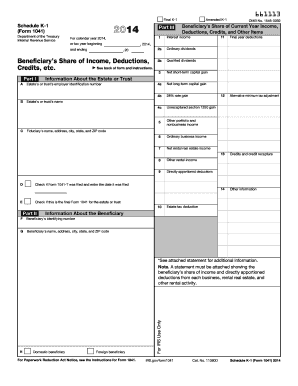

For detailed reporting and filing information see the Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 and the instructions for your income tax return. Report on 13. 661117 Schedule K-1 Form 1041 Department of the Treasury Internal Revenue Service beginning For calendar year 2018 or tax year / ending Beneficiary s Share of Income Deductions Credits etc. See back of form and instructions. Part I A Information About the Estate or Trust Final K-1 Amended K-1 OMB No....1545-0092 Deductions Credits and Other Items Interest income 2a Ordinary dividends 2b Qualified dividends Net short-term capital gain 4a Net long-term capital gain 4b 28 rate gain 4c Unrecaptured section 1250 gain Other portfolio and nonbusiness income Ordinary business income Net rental real estate income Other rental income Directly apportioned deductions Final year deductions Alternative minimum tax adjustment Credits and credit recapture Other information Estate s or trust s employer...identification number B C Fiduciary s name address city state and ZIP code D E Check if Form 1041-T was filed and enter the date it was filed Check if this is the final Form 1041 for the estate or trust F Beneficiary s identifying number G Estate tax deduction H Domestic beneficiary Foreign beneficiary For Paperwork Reduction Act Notice see the Instructions for Form 1041. For IRS Use Only See attached statement for additional information. Note A statement must be attached showing the deductions...from each business rental real estate and other rental activity. www.irs.gov/Form1041 Cat. No. 11380D Page 2 This list identifies the codes used on Schedule K-1 for beneficiaries and provides summarized reporting information for beneficiaries who file Form 1040. For IRS Use Only See attached statement for additional information* Note A statement must be attached showing the deductions from each business rental real estate and other rental activity. Credits and credit recapture Form 1040 line 2b...2a* Ordinary dividends Code 2b. Qualified dividends A Credit for estimated taxes Schedule D line 5 B Credit for backup withholding 4a* Net long-term capital gain C Low-income housing credit 28 Rate Gain Worksheet line 4 Schedule D Instructions D Rehabilitation credit and energy credit 4c* Unrecaptured section 1250 gain Worksheet line 11 Schedule D Instructions F Work opportunity credit income H Biofuel producer credit or f J Renewable electricity refined coal and Indian coal production credit K...Empowerment zone employment credit M Orphan drug credit E Other qualifying investment credit G Credit for small employer health insurance premiums I Credit for increasing research activities L Indian employment credit N Credit for employer-provided child care and facilities O Biodiesel and renewable diesel fuels credit A Depreciation Form 8582 or Schedule E line 33 column c or e B Depletion payments C Amortization R Recapture of credits 10. Estate tax deduction 11. Final year deductions P Credit...to holders of tax credit bonds Z Other credits 14.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

To edit IRS 1041 - Schedule K-1, use the pdfFiller platform. Start by uploading your form to the system. Once the document is opened, utilize the editing tools to make necessary changes to the text fields. Additionally, you can add signatures or annotations as required. Save your edits once completed for your records.

How to fill out IRS 1041 - Schedule K-1

Filling out the IRS 1041 - Schedule K-1 requires accurate information. Follow these steps:

01

Obtain the IRS 1041 - Schedule K-1 form from the IRS website or your tax professional.

02

Enter the estate or trust's name, address, and taxpayer identification number at the top of the form.

03

Input the beneficiary's name, address, and taxpayer identification number.

04

Report the income, deductions, and credits attributed to the beneficiary in the relevant sections.

05

Sign and date the form before distribution to the beneficiaries.

About IRS 1041 - Schedule K-1 2018 previous version

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041 - Schedule K-1 2018 previous version

What is IRS 1041 - Schedule K-1?

IRS 1041 - Schedule K-1 is a tax form used to report income earned by beneficiaries from estates or trusts. It is a supplementary document to Form 1041, which is the income tax return for estates and trusts. Beneficiaries receive a K-1 form to report their share of income, deductions, and credits on their individual tax returns.

What is the purpose of this form?

The primary purpose of the IRS 1041 - Schedule K-1 is to distribute information about income, deductions, and credits from an estate or trust to its beneficiaries. This form ensures that income is correctly attributed and taxed at the individual beneficiary level, fulfilling both reporting and compliance obligations.

Who needs the form?

IRS 1041 - Schedule K-1 must be issued by estates and trusts that generate taxable income. Any beneficiary receiving income, deductions, or credits must receive a K-1 form to properly report this information on their personal tax returns. This includes both individuals and entities that benefit from the estate or trust.

When am I exempt from filling out this form?

Filing an IRS 1041 - Schedule K-1 may not be necessary when the estate or trust does not produce any distributable income during the tax year. Additionally, if a trust is revocable and the grantor is still alive, the form is not typically required, as the income is directly reported on the grantor's tax return.

Components of the form

The IRS 1041 - Schedule K-1 includes several key components: the identity of the estate or trust, the identity of the beneficiary, and various fields to report income types such as interest, dividends, capital gains, and deductions. Each component is vital for ensuring the beneficiary accurately reports their income and tax obligations.

What are the penalties for not issuing the form?

Failure to issue IRS 1041 - Schedule K-1 may result in penalties for the fiduciary responsible for the estate or trust. The IRS can impose fines for each instance of failure to file or failure to furnish correct statements. Additionally, beneficiaries may not be able to report their income accurately, which can lead to further complications and possible penalties on their individual tax returns.

What information do you need when you file the form?

When filing the IRS 1041 - Schedule K-1, the following information is necessary:

01

Name and address of the estate or trust.

02

Taxpayer identification number of the estate or trust.

03

Name and address of the beneficiary receiving the K-1.

04

Taxpayer identification number of the beneficiary.

05

Details about the income, deductions, and credits allocated to the beneficiary.

Is the form accompanied by other forms?

IRS 1041 - Schedule K-1 is typically part of the broader IRS Form 1041 submission. It may also be accompanied by Form 8862 if claiming a credit, or other forms related to specific tax situations of the beneficiaries. Each case should be evaluated to determine what additional forms may be necessary.

Where do I send the form?

The IRS 1041 - Schedule K-1 should be provided to the beneficiaries and submitted alongside Form 1041 to the IRS. Ensure the mailing address for Form 1041 is correct based on the estate or trust's address and the specific IRS submission guidelines for the tax year in question.

See what our users say