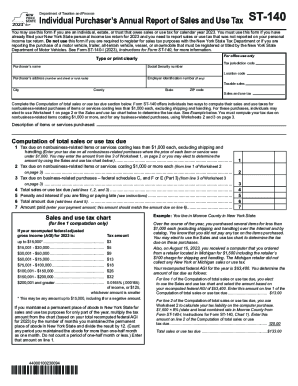

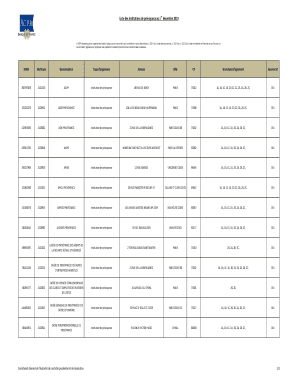

NY DTF ST-140 2017 free printable template

Get, Create, Make and Sign NY DTF ST-140

Editing NY DTF ST-140 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF ST-140 Form Versions

How to fill out NY DTF ST-140

How to fill out NY DTF ST-140

Who needs NY DTF ST-140?

Instructions and Help about NY DTF ST-140

This is Pete I just got my 500 miles left warning signal on the heads-up display, and I've got about 200 miles left already filled one tank two and a half gallons of this I went and bought I got it from my dealer, so I went and bought this one was $15 bought the nozzle for about it was like six dollars and fifty cents here we go I got gloves on undo the cap get it out of the way I'm going to get I'm going to get the nozzle ready all right nope don't lose this seal that's what's going to seal it between the bottle on the cap here take this off put this in there make sure the seal stays in put it on tight all right so when we get over here you want to make sure and take this sill make sure it's fully in there it should click on end she creates a good seal there you go you hear that I'm gonna start filling my diesel exhaust fluid now should see it's starting to go in don't force it doesn't squeeze the bottle I think I got the breather nozzle in there too well, but it's still flowing feels good it's not leaking I'm going to undo this turn my novel around a little because I don't think I got to breed their team in there right see they get stuck looks like they stopped flying you got some extra paper please bring the bottle down here and get our own drink down CHICO can make mess ones call it out go perfect it's all clean no wonder it wasn't

People Also Ask about

Do I have to file New York non resident tax return?

Is a non resident required to file income tax return?

Where can I get NYS tax forms?

Who must file a NY non resident return?

Do I have to file NY state tax return for nonresident?

What is St-101?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NY DTF ST-140 without leaving Chrome?

How do I complete NY DTF ST-140 on an iOS device?

How do I edit NY DTF ST-140 on an Android device?

What is NY DTF ST-140?

Who is required to file NY DTF ST-140?

How to fill out NY DTF ST-140?

What is the purpose of NY DTF ST-140?

What information must be reported on NY DTF ST-140?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.