Kansas law makes a distinction between the lien statement to be filed by a contractor and a subcontractor. Both lien statements serve to inform the property owner that a lien is being claimed against his property for labor or materials provided. A contractor must file his lien statement within four months after the date the last labor was performed or material furnished.

Get the free Lien Statement - Contractor - Individual

Show details

This document is a formal lien statement used by contractors and individuals furnishing labor, equipment, materials, or supplies for the improvement of real property. It includes sections for property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lien statement - contractor

Edit your lien statement - contractor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lien statement - contractor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

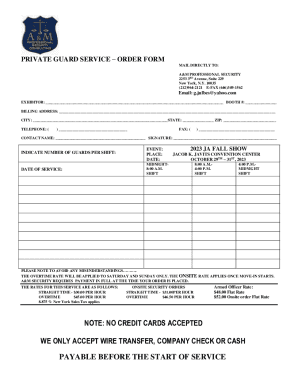

How to fill out lien statement - contractor

How to fill out Lien Statement - Contractor - Individual

01

Begin by downloading the Lien Statement form specific to your jurisdiction.

02

Fill out your personal information, including your name, address, and contact information.

03

Clearly identify the property involved by including its address and a description of the project.

04

State the specifics of the contract, including the date of contract and the amount owed for the services provided.

05

Provide details about the services performed or materials supplied.

06

Include any relevant dates, such as when the services were completed.

07

Sign and date the Lien Statement to validate it.

08

Submit the completed Lien Statement to the appropriate government office or agency as required.

09

Ensure to send copies to the property owner and any other relevant parties.

Who needs Lien Statement - Contractor - Individual?

01

Contractors who have not been paid for their work or materials supplied.

02

Subcontractors who need to secure their right to payment.

03

Individuals or entities who provided labor or material to enhance a property and seek to assert a claim.

Fill

form

: Try Risk Free

People Also Ask about

How can I get a lien release letter?

Obtaining a Lien Release 1 Confirm the FDIC has the authority to assist with a lien release. 2 Compile Required Documents and Prepare Request for a Lien Release. 3 Register/Mail request to FDIC DRR Customer Service and Records Research.

What is the process of releasing a lien?

How do I release a lien? To release a lien, you need to follow a specific process. This typically involves filing a lien release form or lien satisfaction certificate with the appropriate government agency or lien holder, providing proof that the lien has been satisfied or paid in full.

Can someone put a lien on my house without me knowing?

An involuntary lien can occur without your knowledge, depending on the circumstances. A creditor often places a judgment lien after suing you and winning the case.

Can I put a lien on myself?

A property owner can choose to place a lien on their property. A voluntary lien is a claim over the property that a homeowner agrees to give to a creditor as security for the payment of a debt. A mortgage lien is the most common type of voluntary real estate lien, also called a deed of trust lien in some states.

Can an individual put a lien on a business?

A judgment lien may only attach to real property in California. To attach a judgment lien to a small business's real property, the creditor must record an abstract of judgment at the office of the county recorder.

How do I get a copy of a lien release from the IRS?

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.

How do I request a lien release letter?

This request can be made through the DMV or directly to the lender. Visit or contact the DMV and verify that they received the loan satisfaction documents and any liens are removed from the vehicle's title. A new title will be provided or issued to you at this time.

How do you request a lien removal?

How to Remove Lien Identify reason for lien. Clear defaults/dues. Withdraw associated requests. Contact bank for errors. Make required payments. Delete linked cards/services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

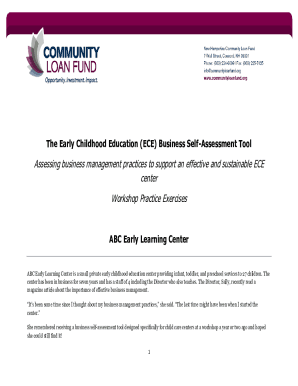

What is Lien Statement - Contractor - Individual?

A Lien Statement - Contractor - Individual is a legal document that a contractor or individual worker files to establish a claim against a property for unpaid services or materials provided in relation to construction or improvement work.

Who is required to file Lien Statement - Contractor - Individual?

A contractor or individual who has provided labor or materials for a construction project and has not been paid for their work is required to file a Lien Statement.

How to fill out Lien Statement - Contractor - Individual?

To fill out a Lien Statement, the contractor should provide details such as their name, address, the property owner's name, a description of the work done, the amount owed, and the legal description of the property.

What is the purpose of Lien Statement - Contractor - Individual?

The purpose of the Lien Statement is to secure payment for services rendered by placing a legal claim on the property, thereby giving the claimant rights over the property until the debt is resolved.

What information must be reported on Lien Statement - Contractor - Individual?

The information that must be reported includes the contractor's name and address, the property owner's name, a detailed description of the work performed, the amount owed for the services, and the legal description of the improved property.

Fill out your lien statement - contractor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lien Statement - Contractor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.