Get the free Parent Cash, Savings, and Checking

Show details

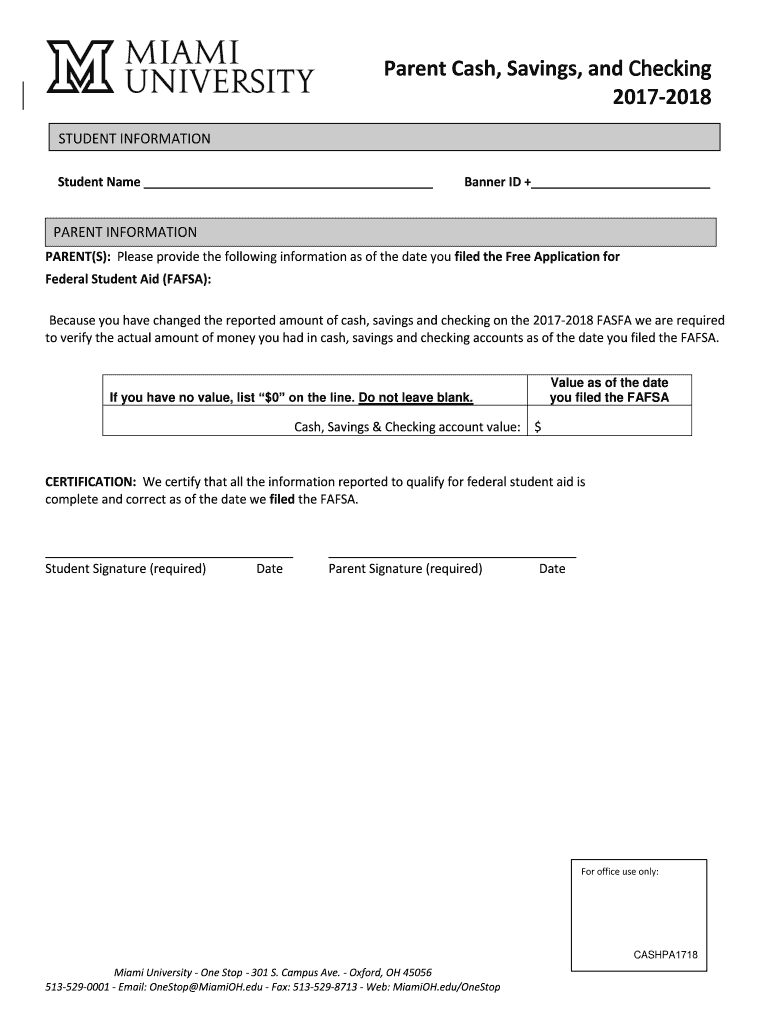

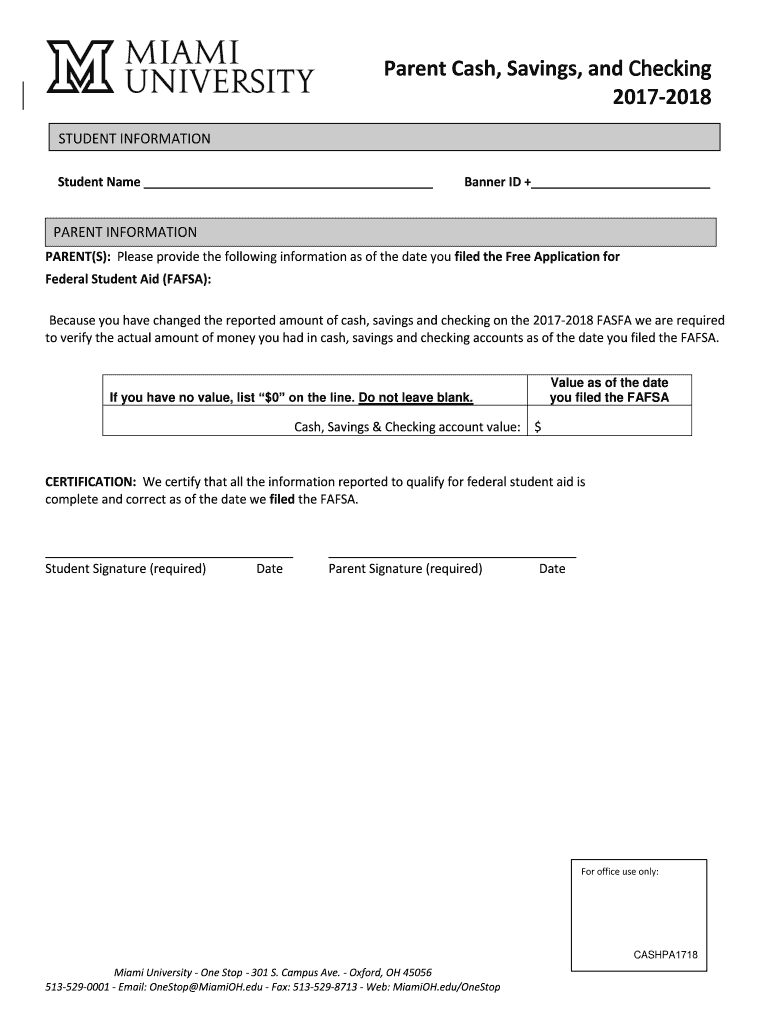

Parent Cash, Savings, and Checking 20172018 STUDENT INFORMATION Student Name Banner ID + PARENT INFORMATION PARENT(S): Please provide the following information as of the date you filed the Free Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign parent cash savings and

Edit your parent cash savings and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your parent cash savings and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing parent cash savings and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit parent cash savings and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out parent cash savings and

How to fill out parent cash savings and

01

To fill out parent cash savings, follow these steps:

02

Start by setting a budget: Determine how much money you can afford to save each month for parent cash savings.

03

Open a separate bank account: It is advisable to have a dedicated account for parent cash savings, to keep it separate from other expenses.

04

Automate savings: Set up an automatic transfer on a monthly basis from your main account to the parent cash savings account.

05

Prioritize saving: Make saving for parent cash a priority over other non-essential expenses.

06

Be consistent: Stick to the savings plan and contribute regularly to the parent cash savings account.

07

Track progress: Monitor the growth of parent cash savings over time and adjust contributions if necessary.

08

Avoid withdrawing funds: Try to resist the temptation of using the savings for other purposes, and keep it intact for parental needs.

09

Invest wisely: Consider investing a portion of the parent cash savings in low-risk options to potentially increase its growth.

10

Review and adjust: Periodically review the savings plan, assess if it aligns with your goals and make any necessary adjustments.

11

Seek professional advice: If needed, consult with a financial advisor to optimize parent cash savings and make informed decisions.

Who needs parent cash savings and?

01

Parent cash savings are beneficial for:

02

Parents: Saving for parent cash can provide a financial safety net for unexpected expenses related to raising children.

03

Expecting parents: Preparing for the arrival of a child involves financial planning, and having cash savings can help manage costs effectively.

04

Single parents: Having a sufficient cash reserve can provide stability and security in managing the responsibilities of raising a child alone.

05

Parents with children entering college: Cash savings can help cover the costs of college education, including tuition, books, and living expenses.

06

Parents planning for retirement: Saving for parent cash ensures financial independence during retirement and can support a comfortable lifestyle.

07

Parents with special needs children: A separate cash savings account can help address the unique financial requirements associated with raising a child with special needs.

08

Any parent looking to secure their children's future: Parent cash savings can be used for various purposes, such as providing for future milestones, emergencies, or even as inheritance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in parent cash savings and?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your parent cash savings and to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the parent cash savings and electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your parent cash savings and.

Can I create an electronic signature for signing my parent cash savings and in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your parent cash savings and right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is parent cash savings and?

Parent cash savings and is a report of the cash savings and investments held by a parent.

Who is required to file parent cash savings and?

Parents or guardians of a dependent student are required to file parent cash savings and.

How to fill out parent cash savings and?

You can fill out parent cash savings and by providing detailed information about your cash savings and investments on the designated form.

What is the purpose of parent cash savings and?

The purpose of parent cash savings and is to assess the financial assets of the parent or guardian of a student applying for financial aid.

What information must be reported on parent cash savings and?

Information such as bank account balances, investment account balances, and any other cash assets must be reported on parent cash savings and.

Fill out your parent cash savings and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Parent Cash Savings And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.