Who needs an SC1040ES form?

This form is used by residents of South Carolina to compute their estimated tax return. The taxpayer has to pay the resulting sum of money to the South Carolina Department of Revenue. In general, every individual must file a declaration if the expected amount of tax will be $100 or more. The exceptions are listed in the instruction to the form.

What is the purpose of the SC1040ES form?

The declaration is used to help the taxpayer calculate the estimated tax return that should be paid to the South Carolina Department of Revenue. The declaration provides information about the taxpayer, the filing quarter, and the payment amount.

What other documents must be attached to the SC1040ES form?

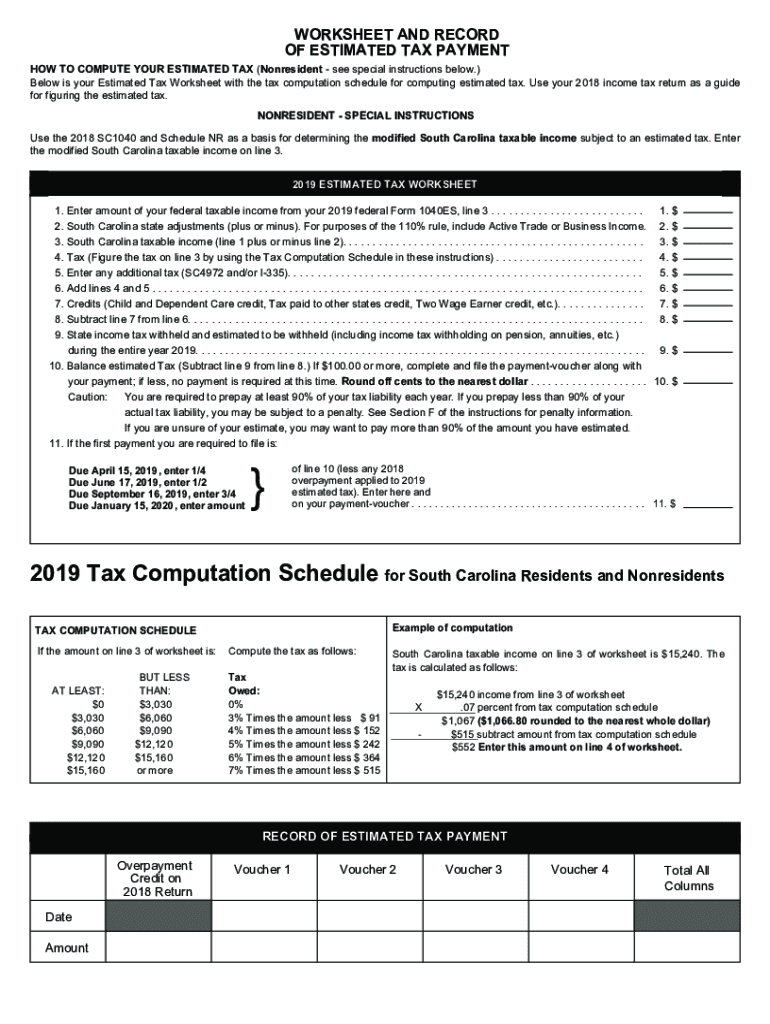

The declaration form includes the Worksheet and Record of Estimated Tax Payment. The form must be accompanied by a check or money order payable to SC Department of Revenue.

When is the SC1040ES form due?

The declaration must be filed on the 15th day of the 4th, 6th, and 9th months of the fiscal year or on April 15th, June 15th, September 15th, and January 15th, 2016 of the calendar year.

What information should be provided in the SC1040ES form?

The declaration asks for the following information:

- Social Security Number of the taxpayer

- Spouse’s Social Security Number

- The filing quarter

- Name and address of the taxpayer

- The payment amount

What do I do with the form SC1040ES after its completion?

The completed form is forwarded to the South Carolina Department of Revenue, Estimated Tax, Columbia, SC 29214-0005.