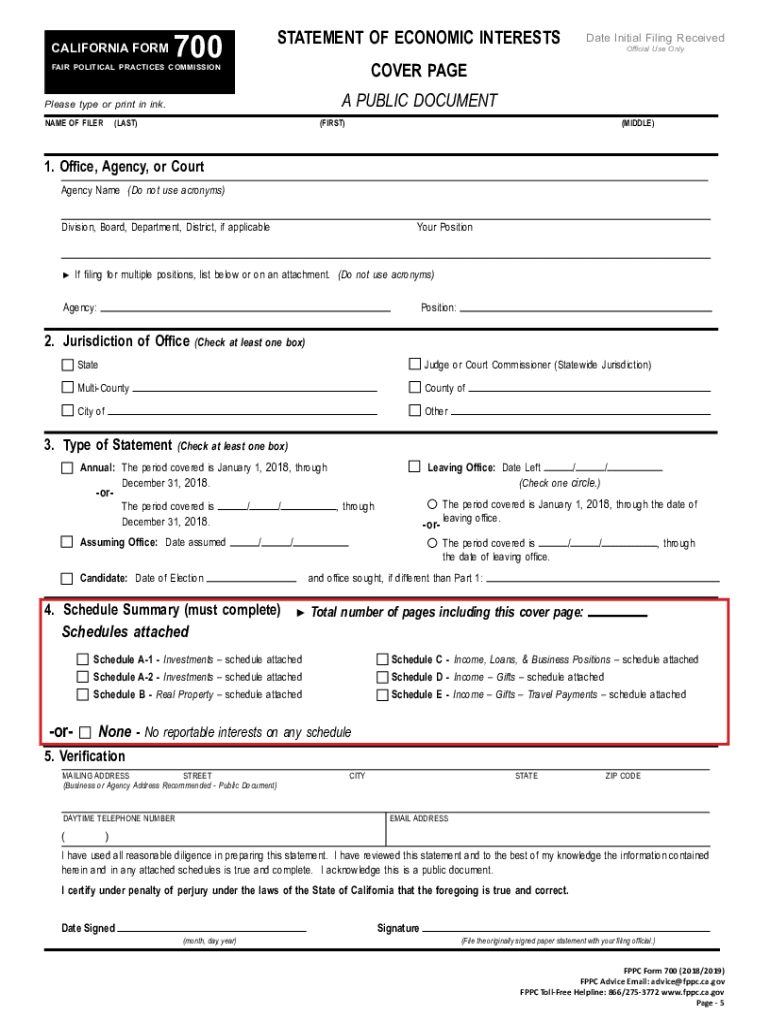

CA FPPC 700 2018 free printable template

Get, Create, Make and Sign form700 fppc ca gov

Editing form700 fppc ca gov online

Uncompromising security for your PDF editing and eSignature needs

CA FPPC 700 Form Versions

How to fill out form700 fppc ca gov

How to fill out CA FPPC 700

Who needs CA FPPC 700?

Instructions and Help about form700 fppc ca gov

Hello were the Fair Political Practices Commission or the FNPC, and we would like to welcome you to our video series for form 700 filers this module will discuss how to complete Schedule II travel payments advances and reimbursements please note the device can be fact-specific and that you should not rely on this video alone for help we are available by phone or email if you would like to contact us directly with your questions additionally there are several other resources which we will be discussing later in this video also note that during the video we will refer to both the form 700 and the statement of economic interests these are in fact the same document but in general the form 700 is the form before it has been completed while the statement is a completed form to get to the form 700 pages on our website start at our home page and click on the box that says file a Form 700 the page that opens not only has a link to the form but two other resources supplemental materials such as the reference pamphlet the Excel form the gift and travel fact sheet form 700 fa QS and amendment schedules can be very helpful to you when completing your statement under the act a travel payment is a payment advance or reimbursement for travel this can include payments for transportation parking lodging and meals depending on the service that the official provides the travel payment can be considered a gift or income if the official provide services whose value is equal to or greater than the value of the payment then the payment is deemed income if the travel payment is valued higher than the service provided by the official then it may be deemed a gift to determine the value of your services you may consider your salary what others are paid for the same service or other factors and issues that you think are applicable you should be prepared to explain how you valued your services if you are audited or investigated by the FNPC as with other types of gifts travel payment gifts from a single source are generally subject to the annual gift limit noted on this slide however if the travel payment is income there is no limit on the amount that the official may accept from a single source non-elected officials who are filing assuming office statements are not subject to the gift limit for the time before they assumed office, but they must disclose all reportable travel payments received in the 12 months prior to assuming office once officials assume office however they should remember the gift limit and track payments from all sources, so they do not exceed the limit annual statements covered travel payments received during the last calendar year while leaving off the statements covered travel payments received since the last annual statement if after watching this video you are unsure if you should accept a travel payment or if you were unsure if you should report it please see the instructions on the form 700 many filers also find our gift and travel fact sheet very...

People Also Ask about

Who has to file a California Form 700?

What is California Form 700 for?

What is the assuming office date for Form 700?

Is Form 700 public record?

Who is required to fill out Form 700?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form700 fppc ca gov from Google Drive?

How can I get form700 fppc ca gov?

How do I complete form700 fppc ca gov online?

What is CA FPPC 700?

Who is required to file CA FPPC 700?

How to fill out CA FPPC 700?

What is the purpose of CA FPPC 700?

What information must be reported on CA FPPC 700?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.