IRS 2220 2018 free printable template

Show details

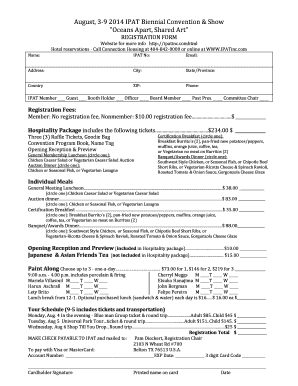

If any boxes are checked the corporation must file Form 2220 even if it does not owe a penalty. See instructions. If so enter the amount from page 2 line 38 on the estimated tax penalty line of the corporation s income tax return but do not attach Form 2220. Cat. No. 11746L Form 2220 2018 Page 2 Figuring the Penalty Enter the date of payment or the 15th day of the 4th month after the close of the tax year whichever is earlier. See instructions. Enter any other taxes for each payment period. See...instructions For each period enter the same type of credits as allowed on Form 2220 lines 1 and 2c. See instructions. Add the amounts in all preceding columns of line 38. See Enter 25 0. 25 of line 5 on page 1 of Form 2220 in each column. Note Large corporations see the instructions for line 10 for the amounts to enter. Form Department of the Treasury Internal Revenue Service OMB No. 1545-0123 Underpayment of Estimated Tax by Corporations Go Attach to the corporation s tax return. to...www.irs.gov/Form2220 for instructions and the latest information. Employer identification number Name Note Generally the corporation is not required to file Form 2220 see Part II below for exceptions because the IRS will figure any penalty owed and bill the corporation. However the corporation may still use Form 2220 to figure the penalty. Part I 2a b c d Required Annual Payment Total tax see instructions. Personal holding company tax Schedule PH Form 1120 line 26 included on line 1 Look-back...interest included on line 1 under section 460 b 2 for completed long-term contracts or section 167 g for depreciation under the income forecast method. Credit for federal tax paid on fuels see instructions. Total* Add lines 2a through 2c. Subtract line 2d from line 1. If the result is less than does not owe the penalty. do not. complete or 2b 2c file this form* The corporation 2d Enter the tax shown on the corporation s 2017 income tax return* See instructions. Caution If the tax is zero or the...tax year was for less than 12 months skip this line and enter the amount from line 3 on line 5 the amount from line 3. The corporation is using the adjusted seasonal installment method. Reasons for Filing Check the boxes below that apply. Figuring the Underpayment a Installment due dates. Enter in columns a through d the 15th day of the 4th Form 990-PF filers Use 5th month 6th 9th and 12th months of the corporation s tax year. Required installments. If the box on line 6 and/or line 7 above is...checked enter the amounts from Schedule A line 38. If the box on line 8 but not 6 or 7 is checked see instructions for the amounts to enter. If none of these boxes are checked enter 25 0. 25 of line 5 above in each column. Estimated tax paid or credited for each period. For column a only enter the amount from line 11 on line 15. See instructions. Complete lines 12 through 18 of one column before going to the next column* Enter amount if any from line 18 of the preceding column. Add lines 11 and...12. Add amounts on lines 16 and 17 of the preceding column. If the amount on line 15 is zero subtract line 13 from Otherwise enter -0-.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2220

How to edit IRS 2220

How to fill out IRS 2220

Instructions and Help about IRS 2220

How to edit IRS 2220

To edit IRS 2220, you will need a digital copy of the form. You can use pdfFiller's editing features to make necessary changes. Simply upload the form, access the editing tools, and adjust any incorrect information as needed.

How to fill out IRS 2220

Filling out IRS 2220 requires careful attention to detail to ensure compliance. Follow these steps:

01

Download IRS 2220 from the IRS website or a trusted source.

02

Gather your income information and any necessary supporting documents.

03

Fill in your personal details, including name, address, and tax identification number.

04

Provide details regarding expected tax payments for the year.

05

Review the form for accuracy before submission.

About IRS 2 previous version

What is IRS 2220?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2220?

IRS 2220 is the "Underpayment of Estimated Tax by Individuals, Estates, and Trusts" form. This form allows taxpayers to determine if they owe a penalty due to underpayment of estimated taxes throughout the tax year.

What is the purpose of this form?

The purpose of IRS 2220 is to calculate the penalty for not meeting the required tax payment thresholds. This helps ensure compliance with IRS regulations regarding estimated tax payments, which are typically due quarterly.

Who needs the form?

Taxpayers who fail to make sufficient estimated tax payments may need to complete IRS 2220. This includes individuals, estates, and trusts that anticipate owing more than a specified amount for the tax year after subtracting withheld amounts and refundable credits.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 2220 if you owe less than $1,000 in tax after subtracting your withholding and refundable credits. Additionally, taxpayers who had no tax liability in the previous year and were a U.S. citizen or resident for the entire year may not need to file this form.

Components of the form

IRS 2220 comprises several sections, including the taxpayer's identifying information, a calculation of estimated tax payments, and a penalty computation section. The form also includes worksheets that guide taxpayers in making accurate calculations.

Due date

The due date for submitting IRS 2220 typically coincides with your annual tax return deadline, which is generally April 15. However, if you are unable to file by this date, you may be eligible for an extension, but remember that any taxes owed are still due by this date to avoid penalties.

What payments and purchases are reported?

IRS 2220 reports estimated tax payments made during the year, which includes payments for self-employment income of individuals, income from estates, and capital gains. It does not report other types of payments or deductions that are not directly related to the tax calculation.

How many copies of the form should I complete?

Generally, you only need to submit one copy of IRS 2220 with your tax return. However, it is advisable to retain a copy for your personal records in case of future audits or queries from the IRS.

What are the penalties for not issuing the form?

Failing to file IRS 2220 when required may lead to penalties calculated as a percentage of the unpaid tax. The IRS may impose additional interest on any unpaid balances, resulting in a higher tax liability.

What information do you need when you file the form?

When filing IRS 2220, you will need your Social Security number or Employer Identification Number, details about your total tax liability, information regarding payments made during the year, and, if applicable, any tax credits claimed. This information will help you complete the calculations accurately.

Is the form accompanied by other forms?

IRS 2220 is often filed alongside your main tax form, such as Form 1040 or Form 1041, along with any other necessary schedules showing income and deductions. It is crucial to check the current filing requirements to ensure all forms are submitted together.

Where do I send the form?

The completed IRS 2220 form should be sent to the address specified in the instructions of the form. Typically, this address varies depending on your location and whether you are enclosing a payment. Always review the latest IRS guidelines for accurate submission locations.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.