Get the free PARTNER'S SHARE OF INCOME - revenue delaware

Show details

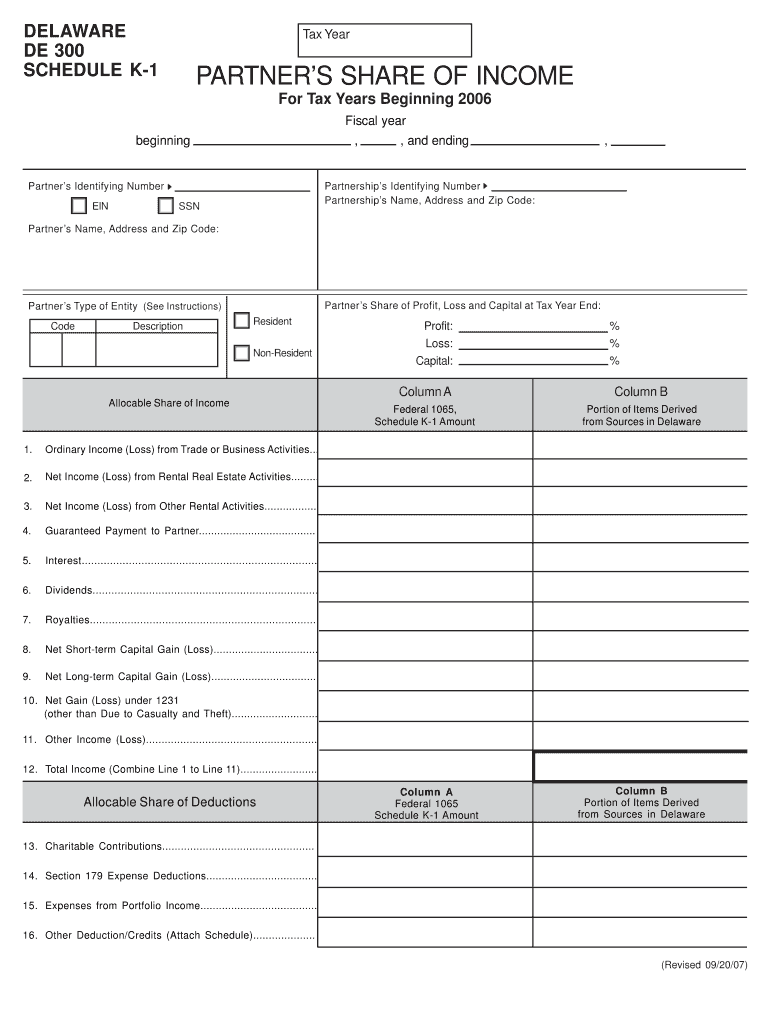

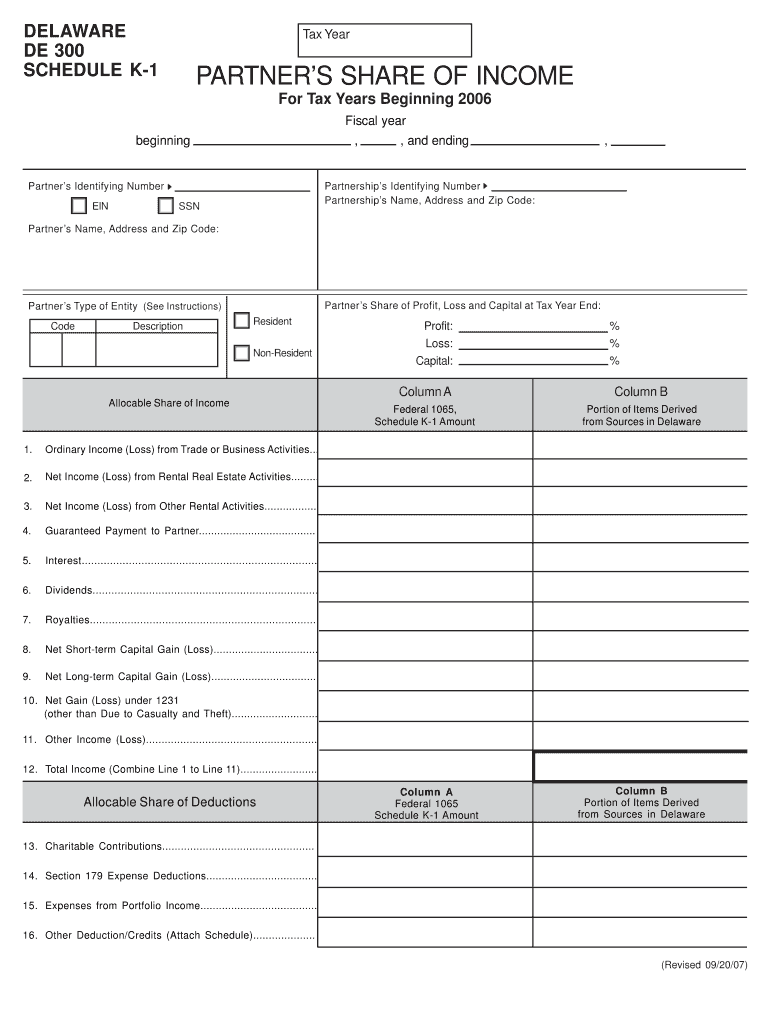

DELAWARE DE 300 SCHEDULE K-1 Reset Tax Year Print Form PARTNER S SHARE OF INCOME For Tax Years Beginning 2006 Fiscal year beginning, Partner s Identifying Number EIN, and ending, Partnership s Identifying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partner39s share of income

Edit your partner39s share of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partner39s share of income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partner39s share of income online

Follow the steps below to take advantage of the professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit partner39s share of income. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partner39s share of income

How to fill out partner's share of income:

01

Gather necessary financial information: Start by collecting all relevant financial documents, such as income statements, tax forms, and partnership agreements. It is essential to have accurate and up-to-date financial information to fill out the partner's share of income correctly.

02

Calculate the partner's share: The partner's share of income is typically determined based on the partnership agreement or ownership percentages. Calculate the share by dividing the total income of the partnership among the partners according to their respective ownership or profit-sharing ratios.

03

Include all sources of income: Ensure that you consider all sources of income when calculating the partner's share. This may include revenue from sales, services rendered, interest income, and any other income relevant to the partnership.

04

Deduct allowable deductions: Deduct any allowable expenses or deductions from the partner's share of income. This may include business expenses, depreciation, research and development costs, or any other expenses that are eligible for deduction.

05

Account for any special allocations: In some partnerships, certain partners may have special allocations of income or loss. Take into account any special allocations when filling out the partner's share of income. These special allocations may be specified in the partnership agreement or based on specific circumstances agreed upon by the partners.

Who needs partner's share of income:

01

Partners in a partnership: The partner's share of income is essential for each partner in a partnership. It helps determine their individual tax liability and provides them with information on their income from the partnership.

02

Tax authorities: The partner's share of income is crucial for tax purposes. It ensures that each partner accurately reports and pays taxes on their respective share of partnership income.

03

Financial institutions or lenders: When partners apply for loans or seek financing, financial institutions may require proof of income. Providing the partner's share of income helps support their financial standing and access to credit.

04

Internal record-keeping: Filling out the partner's share of income is vital for maintaining accurate financial records within the partnership. It helps partners track their earnings and evaluate the profitability of the partnership.

Note: It is important to consult with a tax professional or accountant for specific guidance on filling out the partner's share of income, as it may vary based on the partnership's structure and applicable tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the partner39s share of income electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your partner39s share of income in minutes.

Can I edit partner39s share of income on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share partner39s share of income from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out partner39s share of income on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your partner39s share of income, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is partner39s share of income?

Partner's share of income is the portion of income allocated to a specific partner in a partnership.

Who is required to file partner39s share of income?

Each partner in the partnership is required to report their share of income on their individual tax return.

How to fill out partner39s share of income?

Partners can typically report their share of income on Schedule K-1, which is provided by the partnership.

What is the purpose of partner39s share of income?

The purpose of reporting partner's share of income is to accurately allocate income and deductions among the partners in a partnership.

What information must be reported on partner39s share of income?

Partners must report their share of income, deductions, credits, and any other relevant tax information on their individual tax return.

Fill out your partner39s share of income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

partner39s Share Of Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.