NC DoR NC-478G 2018 free printable template

Show details

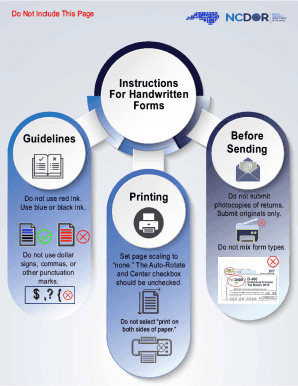

C Do not mix form types. NC-478G 2018 Tax Credit for Investing in Renewable Energy Property Web 7-18 Legal Name First 10 Characters SSN or FEIN Part 1 through 3. m u. - - Do Not Include This Page RI NC D i NORTH CAROLINA DEPARTMENT OF REVENUE Instructions For Handwritten Forms Before Sending Guidelines Do not use red ink. Use blue or black ink. Printing 8 Do not use dollar signs commas or other punctuation marks. 1 t I ocopies of returns. Submit originals only. Set page scaling to none. The...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR NC-478G

Edit your NC DoR NC-478G form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR NC-478G form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC DoR NC-478G online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NC DoR NC-478G. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR NC-478G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR NC-478G

How to fill out NC DoR NC-478G

01

Obtain the NC DoR NC-478G form from the North Carolina Department of Revenue website or local office.

02

Fill in your personal information, including your name, Social Security number, and address in the designated fields.

03

Indicate the tax year for which you are filing the form.

04

If applicable, provide details of income adjustments, deductions, or credits pertinent to the current tax year.

05

Complete all required sections accurately, being careful to follow the instructions for each part.

06

Double-check your entries for any errors or omissions.

07

Sign and date the form to certify its accuracy.

08

If required, submit the form electronically or send it to the specified address along with any necessary documentation.

Who needs NC DoR NC-478G?

01

Any individual or entity in North Carolina who is required to report certain tax information or adjustments related to income for a specific tax year.

02

Taxpayers who are claiming credits or deductions for which the NC DoR NC-478G is applicable.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax rate for an S Corp in NC?

The minimum franchise tax is $200. For S-Corporations: The tax rate for an S-Corporation is $200 for the first one million dollars ($1,000,000) of the corporation's tax base and $1.50 per $1,000 of its tax base that exceeds one million dollars ($1,000,000).

Does a LLC file tax return in NC?

If an LLC is treated as a C Corporation for federal tax purposes and a corporate member has activities in this State in addition to its ownership interest in the LLC, the corporate member(s) is required to file a corporate income and franchise tax return.

What is the best tax form for LLC?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

What is the tax form for an LLC in NC?

To choose corporate tax treatment for your LLC, file IRS Form 2553. This requires the LLC to file a separate federal income tax return each year. Corporations are also taxed by North Carolina at a rate of 5 percent of annual income and must pay a franchise tax each year. File Form CD-405 with the Department of Revenue.

Does a LLC use Form 1040?

What Kind of Tax Return Do I File? If the only member of the LLC is an individual, the LLC income and expenses are reported on Form 1040, Schedule C, E, or F. If the only member of the LLC is a corporation, the LLC income and expenses are reported on the corporation's return, usually Form 1120 or Form 1120S.

How are LLCs taxed in North Carolina?

By default, North Carolina LLCs are taxed as pass-through entities. This means that the LLC itself does not pay federal taxes. Instead, the company's revenue is “passed through” to its members, who then report it as income on their personal taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NC DoR NC-478G directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NC DoR NC-478G and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit NC DoR NC-478G on an Android device?

You can make any changes to PDF files, such as NC DoR NC-478G, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out NC DoR NC-478G on an Android device?

Use the pdfFiller Android app to finish your NC DoR NC-478G and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NC DoR NC-478G?

NC DoR NC-478G is a state form used in North Carolina for the reporting of certain tax information related to income and deductions.

Who is required to file NC DoR NC-478G?

Individuals and entities in North Carolina that meet specific criteria regarding their income and deductions are required to file NC DoR NC-478G.

How to fill out NC DoR NC-478G?

To fill out NC DoR NC-478G, individuals should collect the necessary income and deduction information, follow the instructions on the form, and ensure all required sections are completed accurately.

What is the purpose of NC DoR NC-478G?

The purpose of NC DoR NC-478G is to provide the North Carolina Department of Revenue with a comprehensive overview of income and deductions for tax assessment purposes.

What information must be reported on NC DoR NC-478G?

The NC DoR NC-478G must report information such as total income, deductions, credits, and any other relevant tax-related information specified by the form instructions.

Fill out your NC DoR NC-478G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR NC-478g is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.