Get the free Fair Credit Reporting Act Background Check Disclosure & Notice Statement

Show details

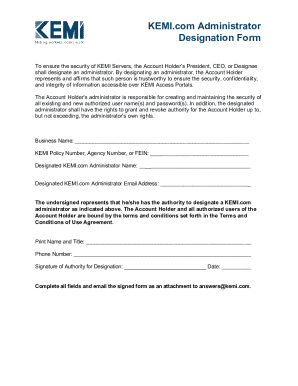

Borough of Franklin Lakes Volunteer Background Check Request Fair Credit Reporting Act Background Check Disclosure & Notice Statement In connection with your volunteer application and for other volunteer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair credit reporting act

Edit your fair credit reporting act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair credit reporting act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fair credit reporting act online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fair credit reporting act. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair credit reporting act

How to fill out fair credit reporting act

01

To fill out the Fair Credit Reporting Act (FCRA), follow these steps:

02

Obtain a copy of the FCRA form from the Federal Trade Commission (FTC) website or other reliable sources.

03

Read the instructions and familiarize yourself with the requirements and obligations outlined in the FCRA.

04

Provide the requested personal information accurately, including your full name, social security number, date of birth, and current address.

05

Review and understand your rights and the protections offered by the FCRA, such as the right to access your credit report and dispute any inaccurate information.

06

If applicable, provide information about the specific issue or dispute you are addressing, such as a fraudulent account or incorrect personal details.

07

Submit the completed FCRA form to the designated authority or institution, which could be a credit reporting agency, a lender, or a specific organization responsible for handling FCRA-related matters.

08

Keep a copy of the filled-out form and any supporting documents for your records.

09

Monitor your credit report regularly to ensure its accuracy and report any discrepancies or unauthorized activities to the relevant authorities.

10

Stay informed about updates or amendments to the FCRA to maintain compliance with any new requirements or changes.

Who needs fair credit reporting act?

01

Various individuals and entities can benefit from the Fair Credit Reporting Act (FCRA), including:

02

- Consumers: The FCRA provides consumers with rights and protections regarding their credit reports, ensuring its accuracy, and allowing them to dispute any errors or fraudulent activities.

03

- Lenders and Creditors: The FCRA imposes certain obligations on lenders and creditors, such as providing accurate and fair credit information to consumers and obtaining their consent before accessing their credit reports.

04

- Employers: The FCRA regulates how employers can use an individual's credit report during the hiring process, protecting applicants and employees from discriminatory practices.

05

- Credit Reporting Agencies: The FCRA sets standards and guidelines for credit reporting agencies, ensuring they handle consumer information responsibly, securely, and accurately.

06

- Government Agencies: Government agencies may utilize the FCRA to conduct background checks, verify identities, and prevent fraud.

07

- Legal Professionals: Attorneys and legal professionals may need to understand the FCRA to advise clients on related legal matters or handle disputes involving credit reporting issues.

08

- Financial Institutions: Banks, credit unions, and other financial institutions may use the FCRA to determine an individual's creditworthiness, assess risks, and make informed lending decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fair credit reporting act online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your fair credit reporting act to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the fair credit reporting act electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out fair credit reporting act on an Android device?

Use the pdfFiller app for Android to finish your fair credit reporting act. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is fair credit reporting act?

The Fair Credit Reporting Act is a federal law that regulates the collection, dissemination, and use of consumer credit information.

Who is required to file fair credit reporting act?

Credit reporting agencies, lenders, and other entities that collect and distribute consumer credit information are required to comply with the Fair Credit Reporting Act.

How to fill out fair credit reporting act?

To comply with the Fair Credit Reporting Act, entities must ensure that they accurately report consumer credit information, provide consumers with access to their credit reports, and take steps to correct any inaccuracies.

What is the purpose of fair credit reporting act?

The purpose of the Fair Credit Reporting Act is to protect consumers from inaccurate credit reporting and ensure that they have access to their credit information.

What information must be reported on fair credit reporting act?

Credit reporting agencies are required to report information such as a consumer's credit history, current debts, and payment history.

Fill out your fair credit reporting act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Credit Reporting Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.