AZ 32-6901 2005 free printable template

Show details

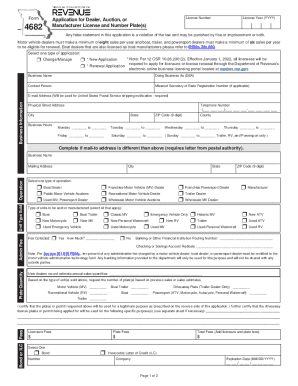

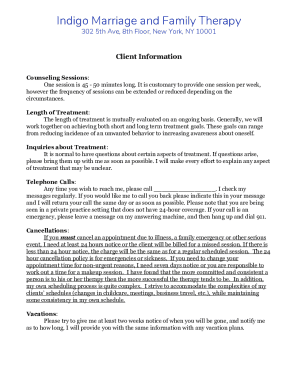

NON-PROBATE AFFIDAVIT for Obtaining Title to the Vehicle of an Arizona Decedent 32-6901 R10/05 www.azdot.gov Clear Owner Name (first, middle, last, suffix) Date of Death Place of Death County: State:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ 32-6901

Edit your AZ 32-6901 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ 32-6901 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ 32-6901 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AZ 32-6901. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ 32-6901 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ 32-6901

How to fill out AZ 32-6901

01

Obtain the AZ 32-6901 form from the appropriate government website or office.

02

Read the instructions provided with the form carefully.

03

Fill out your personal information in the designated fields, such as name, address, and contact number.

04

Provide any relevant identification numbers, such as your Social Security Number or tax identification number.

05

Complete the sections regarding your employment or income details.

06

Answer any questions related to your eligibility or specific circumstances.

07

Review the form for accuracy and completeness.

08

Sign and date the form where required.

09

Submit the completed form as per the instructions, either electronically or via mail.

Who needs AZ 32-6901?

01

Individuals applying for specific benefits or programs that require the AZ 32-6901 form.

02

Residents of Arizona seeking assistance with financial aid or social services.

03

People who need to verify their eligibility for state-funded programs.

Fill

form

: Try Risk Free

People Also Ask about

How do you prove you are an heir?

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

Who can be an affiant affidavit of heirship?

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the “AFFIANT”.

How do I get a small estate affidavit in Arizona?

Filing the affidavit is a two step process. First, the affidavit is filed in the probate court in the county where the property is located, along with a certified copy of the death certificate, and the original will if there is one. Second, a certified copy of the affidavit must be recorded in the same county.

How do I file a small estate affidavit in AZ?

Filing the affidavit is a two step process. First, the affidavit is filed in the probate court in the county where the property is located, along with a certified copy of the death certificate, and the original will if there is one. Second, a certified copy of the affidavit must be recorded in the same county.

What qualifies as a small estate in Arizona?

Under current Arizona law, small estates are defined as those in which the deceased owned less than $100,000 in real estate equity or less than $75,000 worth of personal property. For estates over this size, probate is typically required, and those estates will not be eligible for the small estate affidavit process.

What is an affidavit of heirship form in Arizona?

The Arizona Affidavit of Heirship for Real Estate allows successors to transfer real estate, finances, cars, and other “property” after the owner has died, without the need for a will or probate court.

What is a small estate affidavit for bank account Arizona?

An Arizona small estate affidavit is a legal document that can be used to transfer assets from the estate of the decedent without going through the probate process.

Does a small estate affidavit need to be filed with the court in Arizona?

If seeking personal property, it is not necessary to file the small estate affidavit with the court. Instead, give the completed, signed, notarized form to the person or entity holding the asset to be transferred.

What is heirship?

Heirship simply means you are the legal heir of someone who has died without a will. Heirs are different from beneficiaries. Beneficiaries are the people named in a will who inherit from someone who has died. When there is no will, heirship is created.

What is an affidavit of heirship in Arizona?

The Arizona Affidavit of Heirship for Real Estate allows successors to transfer real estate, finances, cars, and other “property” after the owner has died, without the need for a will or probate court.

How does a small estate affidavit work in Arizona?

The state of Arizona uses the Small Estate Affidavit process to transfer assets from the deceased to their heirs without going through probate. This process is in place to provide for easier transfer of small estates to the deceased to their heirs, lowering costs and providing a greater degree of simplicity.

How does a small estate affidavit work in Arizona?

Once signed and notarized, the affidavits must be filed with the probate court in the county where the property is physically located. A certified copy of the death certificate and a copy of the will, if any, must be attached to each affidavit, along with title documents for real estate and other large assets.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in AZ 32-6901?

With pdfFiller, the editing process is straightforward. Open your AZ 32-6901 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the AZ 32-6901 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign AZ 32-6901 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete AZ 32-6901 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your AZ 32-6901. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is AZ 32-6901?

AZ 32-6901 is a tax form used for reporting transaction privilege tax (TPT) in the state of Arizona.

Who is required to file AZ 32-6901?

Businesses and individuals engaged in activities that generate taxable transactions in Arizona are required to file AZ 32-6901.

How to fill out AZ 32-6901?

To fill out AZ 32-6901, gather your business information, report your gross income, calculate the applicable tax, and ensure you include all necessary signatures and dates.

What is the purpose of AZ 32-6901?

The purpose of AZ 32-6901 is to collect and report transaction privilege tax owed to the state by businesses conducting taxable activities.

What information must be reported on AZ 32-6901?

The information that must be reported includes the taxpayer's business name, address, gross income from sales, deductions, and the total tax due.

Fill out your AZ 32-6901 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ 32-6901 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.