Get the free Inheritance & Estate Tax Forms and Instructions Packet - Kentucky ... - revenue ky

Show details

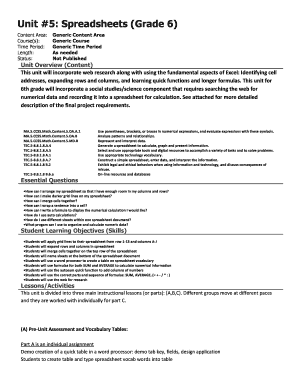

Kentucky Inheritance and Estate Tax Forms and Instructions COMMONWEALTH OF KENTUCKY DEPARTMENT OF REVENUE For Dates of Death on or After January 1, 2005 (Revised for Website July 2014) Kentucky Department

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inheritance amp estate tax

Edit your inheritance amp estate tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inheritance amp estate tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing inheritance amp estate tax online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit inheritance amp estate tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out inheritance amp estate tax

How to Fill Out Inheritance & Estate Tax:

01

Gather all necessary documents: Start by gathering documents such as the deceased's will, trust documents, and any other relevant paperwork. This will help you understand the assets and liabilities involved in the inheritance and estate.

02

Determine if you need to file: Not everyone is required to file an inheritance or estate tax return. Check the laws in your jurisdiction to determine if you meet the filing requirements. Typically, you will need to file if the value of the estate exceeds a certain threshold.

03

Understand the tax laws: Familiarize yourself with the specific tax laws related to inheritance and estate tax in your country or state. This will help ensure you fill out the forms accurately and properly calculate any taxes owed.

04

Fill out the necessary forms: Depending on your jurisdiction, you may need to fill out specific forms to report and pay the inheritance and estate tax. These forms generally require information about the deceased, their assets and liabilities, and any beneficiaries.

05

Determine if you need professional help: Filling out inheritance and estate tax forms can be complex, especially if the estate is large or involves complex assets. Consider consulting with a tax professional or estate attorney to ensure accuracy and compliance with tax laws.

Who Needs Inheritance & Estate Tax:

01

Beneficiaries of an estate: If you are a beneficiary or heir of an estate, you may need to pay the inheritance tax. This tax is typically based on the value of the assets you receive.

02

Executors or administrators of an estate: The executor or administrator of an estate is responsible for filing the necessary tax forms and paying any estate taxes owed. This role includes ensuring compliance with inheritance and estate tax laws.

03

Individuals with substantial assets: In some jurisdictions, individuals with substantial assets may be subject to an estate tax upon their death. This tax is based on the value of the entire estate and is separate from the inheritance tax.

Note: The specific requirements and laws surrounding inheritance and estate tax vary by jurisdiction. It's essential to consult with a tax professional or estate attorney to understand the specific rules and obligations that apply to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is inheritance amp estate tax?

Inheritance and estate tax is a tax imposed on the transfer of assets from a deceased person to their heirs.

Who is required to file inheritance amp estate tax?

The executor or administrator of the deceased person's estate is usually required to file the inheritance and estate tax.

How to fill out inheritance amp estate tax?

To fill out inheritance and estate tax, the executor or administrator must gather information about the deceased person's assets, debts, and beneficiaries, and submit the necessary forms to the appropriate tax authorities.

What is the purpose of inheritance amp estate tax?

The purpose of inheritance and estate tax is to generate revenue for the government and to prevent the accumulation of wealth in a few families.

What information must be reported on inheritance amp estate tax?

Information such as the value of the deceased person's assets, debts, and beneficiaries must be reported on inheritance and estate tax forms.

How can I get inheritance amp estate tax?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific inheritance amp estate tax and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit inheritance amp estate tax in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your inheritance amp estate tax, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit inheritance amp estate tax on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing inheritance amp estate tax.

Fill out your inheritance amp estate tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inheritance Amp Estate Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.