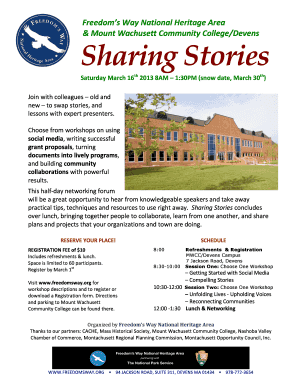

Get the free Non-Probate of Filed Will - Marathon County

Show details

STATE OF WISCONSIN In the Matter of the Will of: CIRCUIT COURT, Deceased MARATHON COUNTY NONPROFIT OF FILED WILL Class Code No. 50111 Case No. WE TO THE CIRCUIT COURT FOR MARATHON COUNTY, WISCONSIN:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-probate of filed will

Edit your non-probate of filed will form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-probate of filed will form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-probate of filed will online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-probate of filed will. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-probate of filed will

How to fill out a non-probate of filed will:

01

Gather all necessary documents: Begin by collecting all legal documents related to the deceased individual, including the will, death certificate, and any other supporting paperwork.

02

Identify the assets: Determine the assets that need to be included in the non-probate process. Non-probate assets typically include jointly owned property, life insurance policies with designated beneficiaries, retirement accounts with beneficiary designations, and assets held in a living trust.

03

Consult with an attorney: It is advisable to seek legal guidance from an experienced attorney specialized in estate planning and probate matters. They can guide you through the process and ensure that all legal requirements and procedures are followed.

04

Obtain necessary forms: Obtain the required forms for filing a non-probate will from the appropriate court or probate office. These forms may vary depending on your jurisdiction, so it is essential to use the correct ones.

05

Complete the forms: Carefully fill out the necessary forms, ensuring that all information is accurate and up to date. Provide details about the deceased, the will, and the non-probate assets being claimed. Take your time to ensure accuracy and thoroughness.

06

Attach supporting documents: Include all relevant supporting documentation, such as the death certificate, asset ownership documents, or proof of beneficiary designations. Make copies of all submitted documents for your records.

07

Review and sign: Double-check all the information provided on the forms and make any necessary revisions. Once satisfied, sign the documents as required by your jurisdiction's procedures. It may be necessary to have witnesses or a notary public present for the signing.

08

Submit the forms: File the completed forms and all supporting documents with the appropriate court or probate office. Pay any required filing fees and retain copies of all submitted materials.

09

Follow up: Stay in contact with the court or probate office to ensure your non-probate application is being processed. Address any additional requirements or requests for information promptly.

10

Seek professional guidance: Throughout the process, consult with your attorney or other qualified professionals to ensure that you are fulfilling all legal obligations and properly documenting any assets.

Who needs a non-probate of filed will?

01

Individuals with significant non-probate assets: Those who possess assets that do not require probate, such as jointly owned property, designated beneficiaries on life insurance policies, retirement accounts with beneficiaries, and assets held in living trusts.

02

People seeking a faster distribution of assets: Non-probate assets can be distributed relatively quickly compared to those that go through the probate process, which can take months or even years.

03

Individuals who desire privacy: The probate process is a matter of public record, potentially allowing personal and financial information to become accessible to anyone. Those seeking confidentiality may opt for a non-probate filing.

04

Those looking to minimize costs: Probate proceedings often involve various fees and expenses. By utilizing non-probate procedures, individuals can potentially reduce costs associated with the administration of the estate.

05

Individuals with specific wishes for asset distribution: Non-probate assets typically provide more options for directing asset distribution, allowing individuals to specify beneficiaries or designate specific assets for distribution.

It is crucial to consult with a legal professional to determine if a non-probate filing is appropriate for your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute non-probate of filed will online?

With pdfFiller, you may easily complete and sign non-probate of filed will online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit non-probate of filed will in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing non-probate of filed will and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the non-probate of filed will electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your non-probate of filed will in minutes.

What is non-probate of filed will?

A non-probate of filed will is a legal document that outlines how a person's assets should be distributed after their death, and it bypasses the probate process.

Who is required to file non-probate of filed will?

The executor or personal representative of the deceased person's estate is required to file a non-probate of filed will.

How to fill out non-probate of filed will?

To fill out a non-probate of filed will, you will need to gather information about the deceased person's assets, debts, and beneficiaries. You may also need to consult with a lawyer to ensure that the document is properly prepared.

What is the purpose of non-probate of filed will?

The purpose of a non-probate of filed will is to ensure that the deceased person's assets are distributed according to their wishes in a timely manner.

What information must be reported on non-probate of filed will?

The non-probate of filed will must include information about the deceased person's assets, debts, beneficiaries, and any specific instructions for the distribution of assets.

Fill out your non-probate of filed will online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Probate Of Filed Will is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.