Get the free Treated as a P ri vate Foundation

Show details

Return of Private Foundation 919O-PF Form or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a P riv ate Foundation For calendar year 2005, or tax year beginning G Check all that wooly I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign treated as a p

Edit your treated as a p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your treated as a p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit treated as a p online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit treated as a p. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out treated as a p

How to fill out treated as a p:

01

Start by reading the instructions carefully. Make sure you understand the purpose and requirements of being treated as a p.

02

Gather all the necessary information and documents that may be needed to fill out the form. This could include personal information, identification numbers, or any relevant supporting documents.

03

Begin filling out the form by providing accurate and complete information in the designated fields. Double-check your entries to avoid any errors or mistakes.

04

Follow any specific guidelines or instructions provided within the form. Pay attention to any special formatting requirements or additional documents that may need to be submitted alongside the form.

05

Take your time while filling out the form and ensure that all the information provided is correct and up-to-date. Inaccurate information or missing details may result in processing delays or even rejection.

06

If you have any questions or are unsure about certain sections of the form, seek clarification from the appropriate authority or contact person. It's important to have a clear understanding of what is being asked before submitting the form.

07

Once you have completed filling out the form, review it one final time to ensure everything is accurate and complete. Make any necessary corrections or additions before finalizing the submission.

Who needs treated as a p:

01

Individuals who are part of a specific group or category and need certain accommodations or considerations in accordance with the "treated as a p" policy.

02

People who have a disability, medical condition, or unique circumstances that require additional support or adjustments within a particular setting.

03

Individuals who believe they are entitled to certain privileges, rights, or benefits based on their membership or association with a particular organization or entity.

In conclusion, filling out the form to be treated as a p requires careful attention to detail, providing accurate information, and understanding the purpose and requirements of the policy. It is important to follow the instructions, gather all necessary documents, and review the form before submission. The need for being treated as a p can arise for different reasons, such as disabilities, medical conditions, or entitlements within specific groups or organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit treated as a p from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your treated as a p into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get treated as a p?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific treated as a p and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I fill out treated as a p on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your treated as a p. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

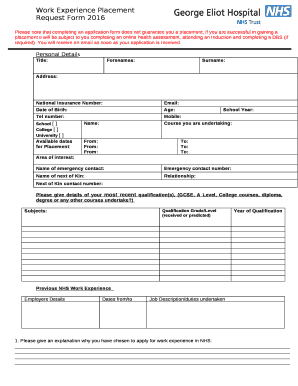

What is treated as a p?

Treated as a P is a tax form that must be filed by individuals who have received income from sources other than an employer.

Who is required to file treated as a p?

Individuals who have received income from sources other than an employer are required to file treated as a P.

How to fill out treated as a p?

Treated as a P can be filled out manually or electronically, providing details of the income received from non-employer sources.

What is the purpose of treated as a p?

The purpose of treated as a P is to report income received from sources other than an employer for tax purposes.

What information must be reported on treated as a p?

Treated as a P must include details of the income received from non-employer sources, such as income from freelance work or investments.

Fill out your treated as a p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treated As A P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.