Get the free Chapter 13 Proceeding

Show details

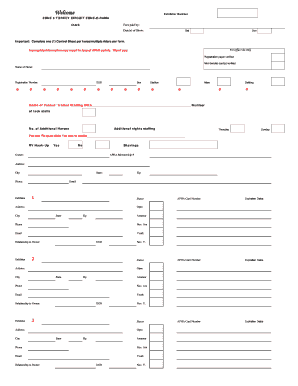

IN THE UNITED STATES BANKRUPTCY COURT FOR THE WESTERN DISTRICT OF TEXAS AUSTIN DIVISION IN RE: Debtor(s) CASE NO. Chapter 13 Proceeding DEBTOR(S) CHAPTER 13 PLAN AMENDED AND MOTIONS FOR VALUATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 proceeding

Edit your chapter 13 proceeding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 proceeding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 13 proceeding online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chapter 13 proceeding. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 proceeding

How to fill out Chapter 13 proceeding:

01

Gather necessary documents: Before filling out Chapter 13 proceeding forms, make sure you have all the required documents handy. This includes your financial records, tax returns, pay stubs, and a detailed list of your debts and assets.

02

Complete the necessary forms: Begin by completing the official Chapter 13 bankruptcy forms, which may vary depending on your jurisdiction. These forms typically include a petition, schedules, a means test, a proposed repayment plan, and other supporting documents.

03

Provide accurate and detailed information: It is crucial to provide accurate and detailed information when filling out the forms. Ensure that all your income, expenses, debts, and assets are accurately disclosed. Any inaccurate or incomplete information can jeopardize your bankruptcy case.

04

Determine your proposed repayment plan: Chapter 13 bankruptcy requires a repayment plan to be submitted along with the other forms. Create a workable plan that considers your income, necessary expenses, and scheduled payments to creditors. The plan should outline how you intend to repay your debts over a specified period, usually three to five years.

05

Seek professional advice if necessary: Filling out Chapter 13 proceeding forms can be complex, so if you are unsure or need assistance, it is advisable to consult with an experienced bankruptcy attorney. They can guide you through the process, ensure accuracy, and help maximize the benefits of your bankruptcy case.

Who needs Chapter 13 proceeding:

01

Individuals with regular income: Chapter 13 bankruptcy is specifically designed for individuals with regular income who have the ability to repay a portion or all of their debts over time. If you have a stable income but are struggling with excessive debt, Chapter 13 may be a suitable option.

02

Those facing foreclosure: Chapter 13 bankruptcy can help individuals facing foreclosure by providing an opportunity to catch up on missed mortgage payments through the repayment plan. It allows you to keep your property while restructuring your debt.

03

People with non-exempt assets they wish to keep: Chapter 13 provides a means to protect non-exempt assets by incorporating a repayment plan that satisfies creditors over a specific period. This can allow individuals to retain valuable assets like a home or a car.

04

Debtors who do not qualify for Chapter 7: If you do not meet the eligibility criteria for Chapter 7 bankruptcy, such as passing the means test or having significant non-exempt assets, Chapter 13 might be a viable alternative to address your debts.

05

Those seeking a fresh start: Chapter 13 bankruptcy provides individuals the opportunity for a fresh financial start. By reorganizing their debts and establishing a repayment plan, debtors can gradually pay off their obligations and work towards a debt-free future.

Remember to consult with a bankruptcy attorney or financial advisor for personalized advice based on your specific financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is chapter 13 proceeding?

Chapter 13 proceeding is a type of bankruptcy proceeding that allows individuals with regular income to develop a plan to repay all or part of their debts.

Who is required to file chapter 13 proceeding?

Individuals with regular income who have unsecured debts that are less than $419,275 and secured debts that are less than $1,262,975 are required to file chapter 13 proceeding.

How to fill out chapter 13 proceeding?

To fill out chapter 13 proceeding, individuals need to gather all financial documents, complete the necessary forms, create a repayment plan, and file the paperwork with the bankruptcy court.

What is the purpose of chapter 13 proceeding?

The purpose of chapter 13 proceeding is to create a repayment plan that allows individuals to pay off their debts over a period of time, typically three to five years.

What information must be reported on chapter 13 proceeding?

Information such as income, expenses, assets, debts, and a proposed repayment plan must be reported on chapter 13 proceeding.

How do I edit chapter 13 proceeding in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your chapter 13 proceeding, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit chapter 13 proceeding on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign chapter 13 proceeding right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out chapter 13 proceeding on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your chapter 13 proceeding. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your chapter 13 proceeding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Proceeding is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.