Canada AT4930 2020 free printable template

Show details

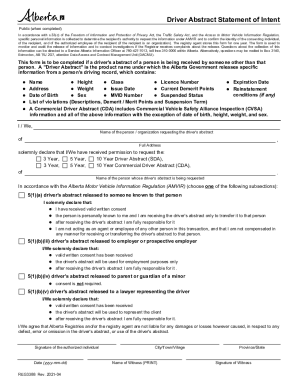

ALBERTA CONSENT FORM

Tax and Revenue Administrations form authorizes Tax and Revenue Administration to release confidential taxpayer information to a designated third party representative in

matters

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada AT4930

Edit your Canada AT4930 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada AT4930 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada AT4930 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada AT4930. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada AT4930 Form Versions

Version

Form Popularity

Fillable & printabley

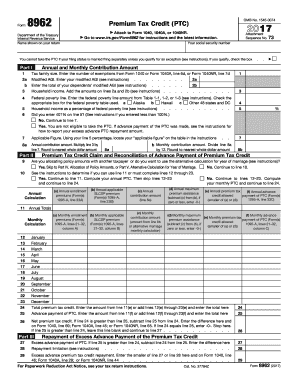

How to fill out Canada AT4930

How to fill out Canada AT4930

01

Download the Canada AT4930 form from the official Canada Revenue Agency website.

02

Read the instructions carefully before filling out the form.

03

Enter your personal information at the top of the form, including your name, address, and Social Insurance Number (SIN).

04

Complete the sections relevant to your situation, including income information and deductions.

05

Ensure all figures are accurate and supported by documentation.

06

Review the form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form to the Canada Revenue Agency by the specified deadline.

Who needs Canada AT4930?

01

Individuals or entities filing for tax adjustments.

02

Taxpayers claiming certain deductions or credits.

03

Those who require changes to previously submitted tax information.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my RBC corporate taxes online?

With CRA My Payment, payments are made securely from your bank account using RBC Online Banking and Interac‡ Online. Simply go to the CRA My Payment site and follow the on-screen directions to pay: Select the CRA remittance you wish to pay, follow the instructions and confirm transaction details.

What is Alberta corporate account number?

The account number is the nine-digit business identification number (BIN) found on your registration letter or the TEFU Application form (AT342).

How do I pay corporation tax on ROS?

A company must use Revenue Online Service (ROS) to file its return and pay any tax due under Mandatory e-Filing.Under Payment and Returns section select: tax payment/declaration. corporation tax. make a payment. the period you wish to make a payment or nil declaration for.

How much can a small business make before paying taxes in Canada?

You are not required to register for GST/HST if your business revenue over four consecutive quarters is less than $30,000 CAD.

How do I pay my Canadian corporation tax online?

You can pay your personal and business taxes to the Canada Revenue Agency (CRA) through your financial institution's online banking app or website. Most financial institutions also let you set up a payment to be made on a future date.

How much tax does a small business pay in Alberta?

Alberta's small business tax rate is 2% (see current and historical corporate income tax rates).Corporate income tax rates. General corporate income tax rateTax rateJuly 1, 201911%January 1, 202010%July 1, 20208%1 more row

What percentage does a small business pay in taxes Canada?

Provincial and Territorial Tax Rates Provinces and territories in Canada are subject to two different rates of taxable income – the lower rate and the higher rate. This is in addition to the federal tax rate of 9% for small businesses or 15% for general corporation tax.

How do you check if a company is registered in Alberta?

If you are searching for a business that is active in Alberta but that does not appear to be currently licensed, please contact the Service Alberta Contact Centre at 1-877-427-4088 for confirmation.

Do I need a business number in Alberta?

You need a business number if you incorporate or need a CRA program account. You might need a business number to interact with other federal, provincial, and municipal governments in Canada. For more information, go to Canada Revenue Agency registration and provincial or other federal programs.

Can I submit my T1 online?

Log in to My Account and select Change my return. Adjust a T1 tax return online with certified EFILE or NETFILE software.

How do I pay my government of Alberta corporate tax?

Options for making payments to TRA for Alberta corporate and commodity taxes and levies.Making payments to Tax and Revenue Administration Overview. Electronic payment. Credit card. Interac e-transfer. Cash or debit. PayPal. Cheque or money order. Wire transfer.

Can I pay my corporation tax online?

You can pay HM Revenue and Customs ( HMRC ) by Faster Payments, CHAPS or Bacs. Your 'notice to deliver your tax return' or any reminder from HMRC , will tell you which account to pay into. If you're not sure, use HMRC Cumbernauld.

How do I pay my Alberta corporate tax?

Options for making payments to TRA for Alberta corporate and commodity taxes and levies.Making payments to Tax and Revenue Administration Overview. Electronic payment. Credit card. Interac e-transfer. Cash or debit. PayPal. Cheque or money order. Wire transfer.

Where do I mail my AT1 in Alberta?

If you answer “No” to this question, a signed copy of the AT1 Schedule 10 will have to be sent to Alberta Treasury Board and Finance, Tax and Revenue Administration at the following address: 9811-109 ST, Edmonton Alberta T5K 2L5.

How much can a small business earn before paying tax?

For the 2019-20 financial year, the tax-free threshold for individuals is $18,200. If your business is structured as a company, you're required to pay tax on every dollar the company earns.

Where do I mail my AT1?

If you answer “No” to this question, a signed copy of the AT1 Schedule 10 will have to be sent to Alberta Treasury Board and Finance, Tax and Revenue Administration at the following address: 9811-109 ST, Edmonton Alberta T5K 2L5.

What percentage does a small business pay in taxes?

Small business tax rate FAQs It depends on how much the business makes and whether it's a corporation or pass-through entity. Corporations pay a flat tax of 21% on business profits, while pass-through businesses pay taxes at the owner's income-based marginal tax rate, ranging from 10% to 37%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada AT4930 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your Canada AT4930 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get Canada AT4930?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific Canada AT4930 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out Canada AT4930 using my mobile device?

Use the pdfFiller mobile app to fill out and sign Canada AT4930 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is Canada AT4930?

Canada AT4930 is a specific form used by the Canada Revenue Agency (CRA) for reporting certain types of income and deductions.

Who is required to file Canada AT4930?

Individuals and entities that meet certain criteria regarding income sources, such as foreign income or specific business activities, are required to file Canada AT4930.

How to fill out Canada AT4930?

To fill out Canada AT4930, provide accurate financial information as required, complete the relevant sections, and ensure all necessary documentation is attached before submitting it to the CRA.

What is the purpose of Canada AT4930?

The purpose of Canada AT4930 is to enable the CRA to collect relevant tax information from individuals and businesses for accurate assessment and compliance.

What information must be reported on Canada AT4930?

Canada AT4930 requires reporting information such as income types, deductions claimed, tax credits, and other financial details that pertain to the taxpayer's situation.

Fill out your Canada AT4930 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada at4930 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.