Get the free Non-Probate vs

Show details

17ChapterNonProbate vs. Probate Assets Why You Should Care Susan McCain (Richmond, Virginia)When you die, like most other people, you will probably leave assets that need to be transferred to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-probate vs

Edit your non-probate vs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-probate vs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-probate vs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-probate vs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-probate vs

How to fill out non-probate vs:

01

Gather all necessary information and documents related to the estate: Before starting, make sure you have all the required documents and information, including the deceased person's will, death certificate, financial records, and property ownership documents.

02

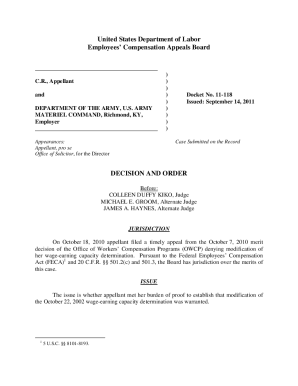

Determine if the assets qualify for non-probate transfer: Non-probate assets typically include assets held in joint tenancy with rights of survivorship, assets with designated beneficiaries (such as retirement accounts or life insurance policies), and assets held in a living trust. These assets can bypass the probate process.

03

Verify the eligibility for non-probate transfer: Review the applicable state laws to ensure that the assets meet the requirements for non-probate transfer. These laws may have specific criteria or limitations depending on the jurisdiction.

04

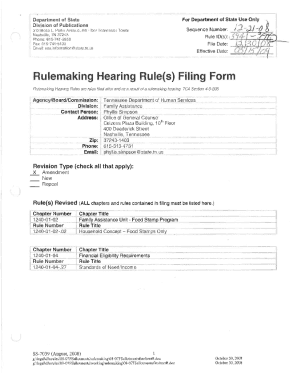

Complete the necessary forms: Fill out the required forms for non-probate transfer, such as transfer on death (TOD) forms, beneficiary designation forms, or quitclaim deeds. These forms usually require information about the deceased person, the designated beneficiary, and the specific assets involved.

05

Follow state-specific instructions: Each state may have its own specific instructions and requirements for completing non-probate transfer forms. Make sure to carefully read and follow these instructions to avoid any potential delays or complications.

Who needs non-probate vs:

01

Individuals with estates that have non-probate assets: If the deceased person owned assets that qualify for non-probate transfer, utilizing this option can help streamline the distribution process and avoid the time and expense of probate court.

02

Families or beneficiaries seeking a quicker distribution of assets: Non-probate transfer can often be completed more swiftly compared to the probate process, allowing beneficiaries to receive their inheritance sooner.

03

Individuals who wish to maintain privacy: Probate proceedings are typically public records, whereas non-probate transfers may help maintain privacy since they are often not publicly recorded.

04

Those looking to minimize legal costs: Probate can involve substantial legal fees, whereas non-probate transfer may be a more cost-effective option for transferring certain assets.

It is essential to consult with an attorney or estate planning professional to understand the specific laws and procedures related to non-probate transfer in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non-probate vs?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific non-probate vs and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit non-probate vs online?

The editing procedure is simple with pdfFiller. Open your non-probate vs in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete non-probate vs on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your non-probate vs. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is non-probate vs?

Non-probate vs is a document that transfers assets outside of the probate process.

Who is required to file non-probate vs?

Beneficiaries or heirs of the deceased individual are typically required to file non-probate vs.

How to fill out non-probate vs?

Non-probate vs can be filled out by providing information about the deceased individual, the assets being transferred, and the beneficiaries.

What is the purpose of non-probate vs?

The purpose of non-probate vs is to ensure the smooth transfer of assets to beneficiaries without going through the probate process.

What information must be reported on non-probate vs?

Information such as the name of the deceased individual, a description of the assets being transferred, and the names of the beneficiaries must be reported on non-probate vs.

Fill out your non-probate vs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Probate Vs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.