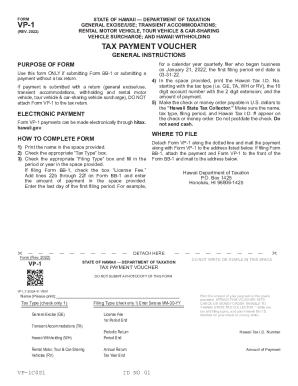

HI VP-1 2018 free printable template

Get, Create, Make and Sign HI VP-1

Editing HI VP-1 online

Uncompromising security for your PDF editing and eSignature needs

HI VP-1 Form Versions

How to fill out HI VP-1

How to fill out HI VP-1

Who needs HI VP-1?

Instructions and Help about HI VP-1

Hello I'd like to extend to you a very warm welcome to this help out video my name is Tim I'm a US service coordinator here to walk you through the form requirements for completing the Nita HS 7 declaration form now this is for this one is in regard to ones for importing of motor vehicles and motor vehicle equipment if we look at the top of the declaration the first box there is port of entry if you are aware of the port of entry at time that you're completing this you can put that there that's going to be you know you just won't put the sea bless city and state for the customers part that you will be entering or if you know the port code you can put that there oh I'm sorry that's the next box over the territory and next thing will be the customs entry number for this if you do not know the entry at time of completing the stack we can actually put it in there for you, so that's not necessary anything with the entry date we can enter that information as well it's the next couple boxes that you will need to be completing which will be included the make of the vehicle the model in the year and also the vehicle identification number now a lot of this information can either be inside the door there should be a label there that has a lot of this information below that we're going to go down to the registered importer name, and it's a registration number now if this is a non-conforming vehicle meaning it doesn't conform to the federal motor vehicle safety standards of the US then you need to find a registered importer to assist you in bringing this vehicle in and making sure it conforms with US standards, but that's where you would put that information if it is conforming then you can leave that blank as same with a vehicle eligibility number that can be left blank as well under that you put your description mm-hmm of the motor vehicle or equipment below that we have a choice of program coral codes that we do have an additional list exclaims ease, but it will either be MV f OE i o FF REI t PE next to that there will be a corresponding category code that you will have to enter as well scrolling down these are numerous choices of which box you need to select will be your responsibility to review these and of course we can assist as well as to what box is the appropriate one to checks once we're complete with that we'll get down to the bottom and this is where whoever is completing the stock that they'll be considered the importer record will be importer, so you'll put the name of importer which will be the company's name be the company's address, but the Cabin is who's completing this a certifying individual the clearance email address your capacity and telephone number meaning your title and then your signature the next box you have to pay attention to if the program code those chosen is MV Sour REI then the additional information is required where you'll have the potential complete name of the manufacturer and their complete address thank you for...

People Also Ask about

Do I have to file an extension for Hawaii state taxes?

What is Hawaii form n11?

Does Hawaii have an extension form?

What is a refund tracer request?

What is the current GE tax for Hawaii?

How do I get Hawaii tax forms?

What is Hawaii form N 2?

What is Hawaii tax form G 49?

What is a GE tax license in Hawaii?

Can I download tax forms online?

Can I file my Hawaii state taxes online?

What is the Hawaii extension form number?

Where can I get hard copies of tax forms?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my HI VP-1 in Gmail?

Can I create an electronic signature for the HI VP-1 in Chrome?

How do I fill out HI VP-1 on an Android device?

What is HI VP-1?

Who is required to file HI VP-1?

How to fill out HI VP-1?

What is the purpose of HI VP-1?

What information must be reported on HI VP-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.