Get the free Probate Law 2012 - The Florida Bar - floridabar

Show details

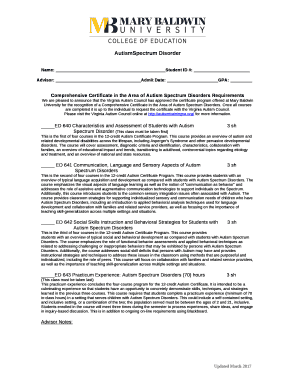

The Florida Bar Continuing Legal Education Committee and The Real Property, Probate and Trust Law Section present Probate Law 2012 Live Webcast Audio CD Video DVD COURSE CLASSIFICATION: INTERMEDIATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign probate law 2012

Edit your probate law 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your probate law 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing probate law 2012 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit probate law 2012. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out probate law 2012

How to Fill Out Probate Law 2012:

01

Understand the purpose of probate law 2012: Probate law 2012 deals specifically with the legal process of administering a deceased person's estate. It involves proving the validity of the will, identifying and distributing assets, paying debts and taxes, and resolving any disputes that may arise.

02

Gather legal documents: Start by collecting all relevant legal documents, including the deceased person's will, any trusts, bank statements, property deeds, and insurance policies. These documents will be necessary for completing the probate process.

03

Identify the executor: The executor is responsible for managing the probate process. If the deceased person named an executor in their will, that person is typically appointed. If no executor was named, the court will appoint one based on state laws.

04

File the probate petition: Begin the probate process by filing a petition with the appropriate court in the jurisdiction where the deceased person lived. This document formally requests the court to open probate and name the executor.

05

Notify interested parties: Notify all interested parties about the probate proceedings, including beneficiaries named in the will, creditors, and other potential heirs. This ensures that all parties have the opportunity to participate in the process.

06

Take inventory of assets and debts: Create a comprehensive list of the deceased person's assets, such as bank accounts, real estate, vehicles, personal property, investments, and debts. This inventory will be used to determine the value of the estate and to distribute assets to beneficiaries.

07

Pay outstanding debts and taxes: Before distributing assets to beneficiaries, it is crucial to settle any outstanding debts and taxes. This may involve notifying creditors, filing tax returns, paying taxes owed, and obtaining tax clearances.

08

Distribute assets to beneficiaries: Once debts and taxes are settled, the remaining assets can be distributed to the beneficiaries as outlined in the will or as determined by state laws if there is no valid will. This process may require obtaining court approval.

Who Needs Probate Law 2012:

01

Executors: Executors need to understand probate law 2012 to properly navigate the legal responsibilities and obligations associated with administering an estate.

02

Beneficiaries and Heirs: Beneficiaries and potential heirs should have a basic understanding of probate law 2012 to ensure their rights are protected throughout the probate process and to understand the timeline for receiving their inheritances.

03

Attorneys and Legal Professionals: Attorneys and legal professionals who specialize in estate planning, wills, and probate law need to stay updated on probate law 2012 to effectively advise and represent their clients.

04

Creditors: Creditors should familiarize themselves with probate law 2012 to understand how to properly file claims against the estate and protect their interests in recovering any owed debts.

05

Executors named in outdated wills: Executors who have been named in wills created before 2012 may particularly benefit from understanding probate law 2012, as it may have introduced changes or updates that affect their responsibilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my probate law 2012 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your probate law 2012 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute probate law 2012 online?

pdfFiller has made it simple to fill out and eSign probate law 2012. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out probate law 2012 using my mobile device?

Use the pdfFiller mobile app to fill out and sign probate law 2012. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is probate law - form?

Probate law form is a legal document used to administer the estate of a deceased person.

Who is required to file probate law - form?

The executor or administrator of the deceased person's estate is required to file probate law form.

How to fill out probate law - form?

Probate law form must be filled out with accurate information regarding the deceased person's assets, debts, and beneficiaries.

What is the purpose of probate law - form?

The purpose of probate law form is to ensure the proper distribution of the deceased person's assets according to their will or state law.

What information must be reported on probate law - form?

Information such as the deceased person's assets, debts, beneficiaries, and any other relevant details must be reported on probate law form.

Fill out your probate law 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Probate Law 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.