Get the free 2014 Williamson County Homestead Exemption Form - Keep Austin ...

Show details

Application for Residence Homestead Exemption P r o p e r t y Ta x Form 50-114 WILLIAMSON CENTRAL APPRAISAL DISTRICT (512) 930-3787 Appraisal District s Name Phone (area code and number) 625 FM 1460,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2014 williamson county homestead

Edit your 2014 williamson county homestead form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 williamson county homestead form via URL. You can also download, print, or export forms to your preferred cloud storage service.

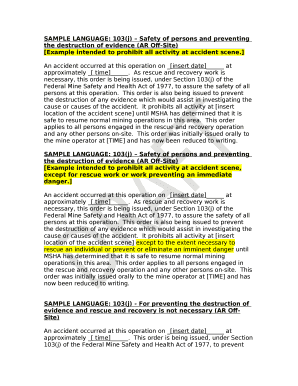

Editing 2014 williamson county homestead online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2014 williamson county homestead. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2014 williamson county homestead

How to fill out 2014 Williamson County homestead:

01

Obtain the necessary forms: Begin by obtaining the 2014 Williamson County homestead application form from the county's official website or by requesting it from the county's tax office.

02

Review the eligibility requirements: Read through the eligibility requirements carefully to ensure that you meet all the criteria necessary to qualify for the homestead exemption. These criteria may include ownership of the property, residency, and other specific requirements set by the county.

03

Gather required documentation: Collect all the necessary documents needed to support your application, such as proof of ownership, proof of residency, and any additional documents required by the county. It is essential to have these documents ready before proceeding with the application process.

04

Complete the application form: Fill out the application form accurately and legibly, ensuring that all required fields are properly filled in. Be sure to double-check all the information provided to avoid any mistakes or omissions.

05

Attach supporting documents: Attach all the required supporting documents to your application. These may include copies of property documents, identification cards, or any other documentation specified by the county.

06

Submit the application: Once you have filled out the form and attached all required documents, submit your completed application to the Williamson County tax office. Be mindful of any deadlines specified by the county and consider submitting your application well in advance to allow sufficient processing time.

07

Follow up: It's always a good idea to follow up with the Williamson County tax office to ensure that your application has been received and is being processed. This will help you stay informed about the status of your homestead exemption and address any potential issues promptly.

Who needs 2014 Williamson County homestead:

01

Homeowners: Homeowners in Williamson County who meet the eligibility requirements for the homestead exemption may benefit from applying for the 2014 Williamson County homestead. This exemption can potentially reduce property taxes, resulting in cost savings for homeowners.

02

Residents of Williamson County: Individuals who reside in Williamson County and own property may need the 2014 Williamson County homestead to avail themselves of the homestead exemption benefits provided by the county tax office. It is beneficial for residents to explore this exemption option to potentially lower their property tax obligations.

03

Property owners in Williamson County: Any property owner within Williamson County who fulfills the eligibility criteria can apply for the 2014 Williamson County homestead. This includes individuals who own residential homes, as well as owners of other types of eligible properties outlined by the county's tax office.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is williamson county homestead exemption?

The Williamson County homestead exemption is a property tax relief program that reduces the taxable value of a homeowner's primary residence.

Who is required to file Williamson County homestead exemption?

Homeowners in Williamson County who use their property as their primary residence are eligible to file for the homestead exemption.

How to fill out Williamson County homestead exemption?

To fill out the Williamson County homestead exemption, homeowners need to complete the application form provided by the county assessor's office and submit it along with required documentation.

What is the purpose of Williamson County homestead exemption?

The purpose of the Williamson County homestead exemption is to provide property tax relief to homeowners by reducing the taxable value of their primary residence.

What information must be reported on Williamson County homestead exemption?

Homeowners must report their name, address, Social Security number, and other property ownership details on the Williamson County homestead exemption application.

How can I send 2014 williamson county homestead for eSignature?

To distribute your 2014 williamson county homestead, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the 2014 williamson county homestead in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 2014 williamson county homestead in seconds.

Can I create an eSignature for the 2014 williamson county homestead in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2014 williamson county homestead directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your 2014 williamson county homestead online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2014 Williamson County Homestead is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.