Get the free transunion fraud alert removal letter

Show details

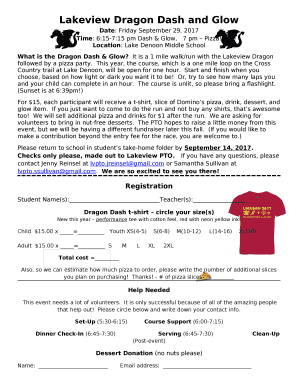

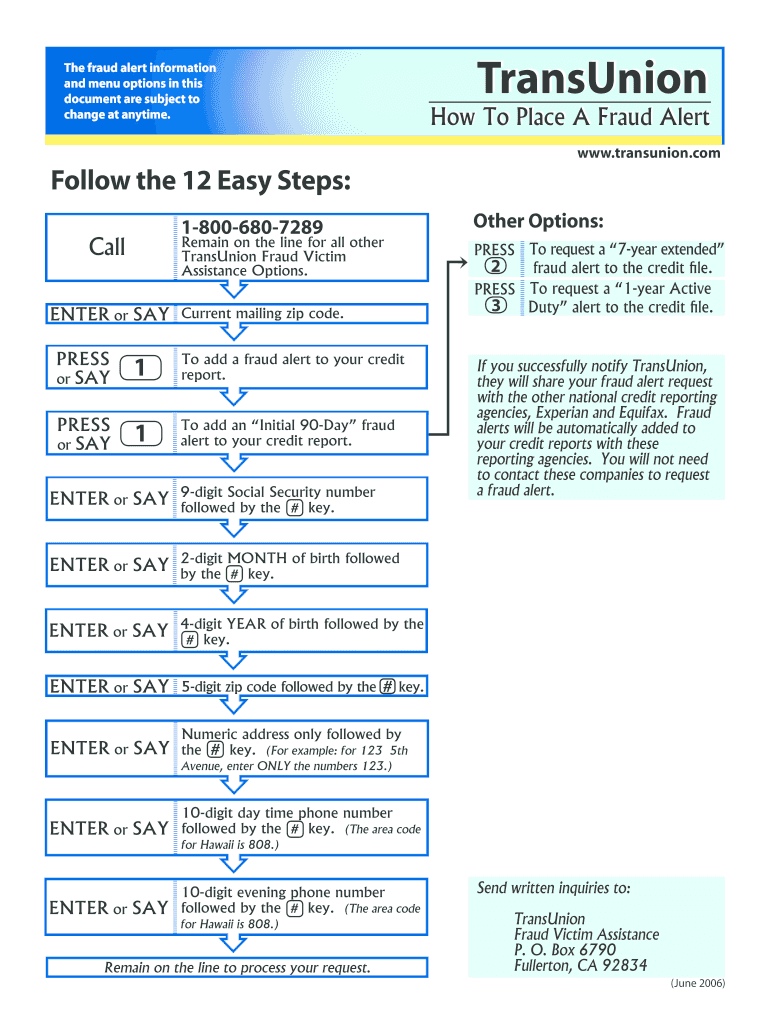

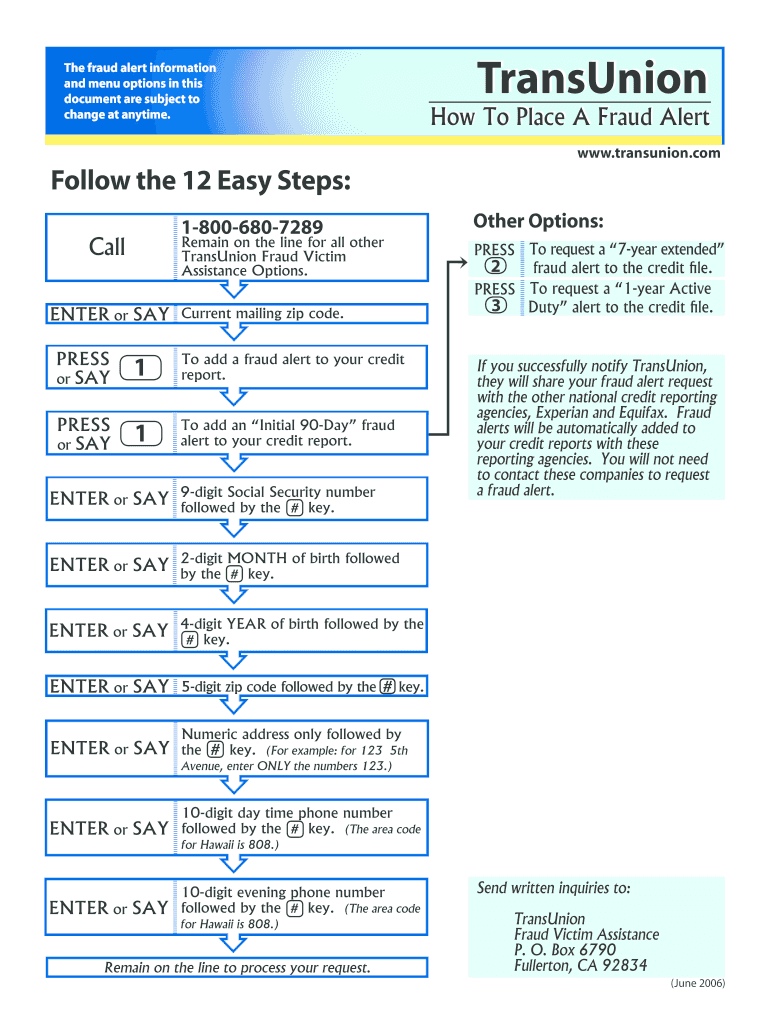

The fraud alert information and menu options in this document are subject to change at anytime. TransUnion How To Place A Fraud Alert www. Duty alert to the credit le. If you successfully notify TransUnion they will share your fraud alert request with the other national credit reporting agencies Experian and Equifax. Transunion.com Follow the 12 Easy Steps 1-800-680-7289 Call Remain on the line for all other TransUnion Fraud Victim Assistance Options. ENTER or SAY Current mailing zip code....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transunion fraud alert removal

Edit your transunion fraud alert removal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transunion fraud alert removal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transunion fraud alert removal online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit transunion fraud alert removal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transunion fraud alert removal

To fill out a TransUnion fraud alert removal, you can follow these steps:

01

Access the TransUnion website or contact their customer service. You may need to create an account or provide some personal information to proceed.

02

Locate the option or section related to fraud alerts. It is often found under the "Credit Monitoring" or "Identity Theft" category.

03

Click on the option to remove or cancel the fraud alert. TransUnion may require you to provide additional information, such as the date the fraud alert was placed or a security question to verify your identity.

04

Follow the instructions provided by TransUnion to complete the fraud alert removal process. This may involve filling out an online form, submitting a written request, or providing additional documentation.

Who needs TransUnion fraud alert removal?

Anyone who has previously placed a fraud alert with TransUnion and no longer needs it should consider removing it. Reasons for removal could include resolving the identity theft issue, concluding a credit monitoring service, or updating personal information. It is important to evaluate your specific circumstances and assess if the fraud alert is still necessary for your financial security.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a fraud alert letter?

Dear Sir or Madam: It appears I have been a victim of identity theft and am writing to request that an initial fraud alert be immediately placed in my credit file so that no new credit will be approved or issued until my identity is first verified by the lender. My Social Security number is .

How do I remove a fraud alert from my TransUnion letter?

If you want to remove your fraud alert, the fastest way to do so if through the TransUnion Service Center. You can also remove your fraud alert over the phone by calling TransUnion at 800-916-8800.

Do credit bureaus share fraud alerts?

You can contact any of the three nationwide credit bureaus to request a fraud alert. Once you have placed a fraud alert on your credit report with one of the bureaus, that bureau will send a request to the other two bureaus to do the same, so you do not have to contact all three.

Do you have to remove credit freeze from all three bureaus?

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

What documents do I need to remove fraud alert from Experian?

To remove the alert by mail, send your written request to Experian along with copies of documentation verifying your identity. You can find a form to use for this request in Experian's Fraud Alert Center. Be sure to send copies (not original documents) of: A government-issued identification card.

Do I need to remove fraud alert from all three credit bureaus?

You can remove a fraud alert from your credit reports by contacting all three credit bureaus directly or by letting the fraud alert expire on its own. Depending on what kind of fraud alert you selected, the alert will be automatically removed after one year (initial fraud alert) or seven years (extended fraud alert).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find transunion fraud alert removal?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the transunion fraud alert removal in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute transunion fraud alert removal online?

pdfFiller has made it simple to fill out and eSign transunion fraud alert removal. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I fill out transunion fraud alert removal on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your transunion fraud alert removal. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is transunion fraud alert removal?

TransUnion fraud alert removal refers to the process of officially canceling a fraud alert that has been placed on a consumer's credit report. A fraud alert is a notice to creditors that they should take extra steps to verify the identity of the person applying for credit, usually due to suspected identity theft.

Who is required to file transunion fraud alert removal?

Typically, the individual who placed the fraud alert is required to file for its removal. This is usually a consumer who no longer believes they are at risk of identity theft and wants to resume regular access to credit.

How to fill out transunion fraud alert removal?

To fill out a TransUnion fraud alert removal, consumers can submit a request online through TransUnion's website, call their customer service, or send a written request via mail. They need to provide identification and any relevant information related to the original fraud alert.

What is the purpose of transunion fraud alert removal?

The purpose of removing a TransUnion fraud alert is to inform creditors that the individual is no longer concerned about identity theft. This allows for easier credit transactions without the additional verification steps that come with a fraud alert.

What information must be reported on transunion fraud alert removal?

The information that must be reported when removing a TransUnion fraud alert typically includes the consumer's personal information (name, address, Social Security number), the details of the original fraud alert, and any identification supporting the request for removal.

Fill out your transunion fraud alert removal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transunion Fraud Alert Removal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.