Get the free transunion fraud alert removal letter

Get, Create, Make and Sign transunion fraud alert removal

How to edit transunion fraud alert removal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transunion fraud alert removal

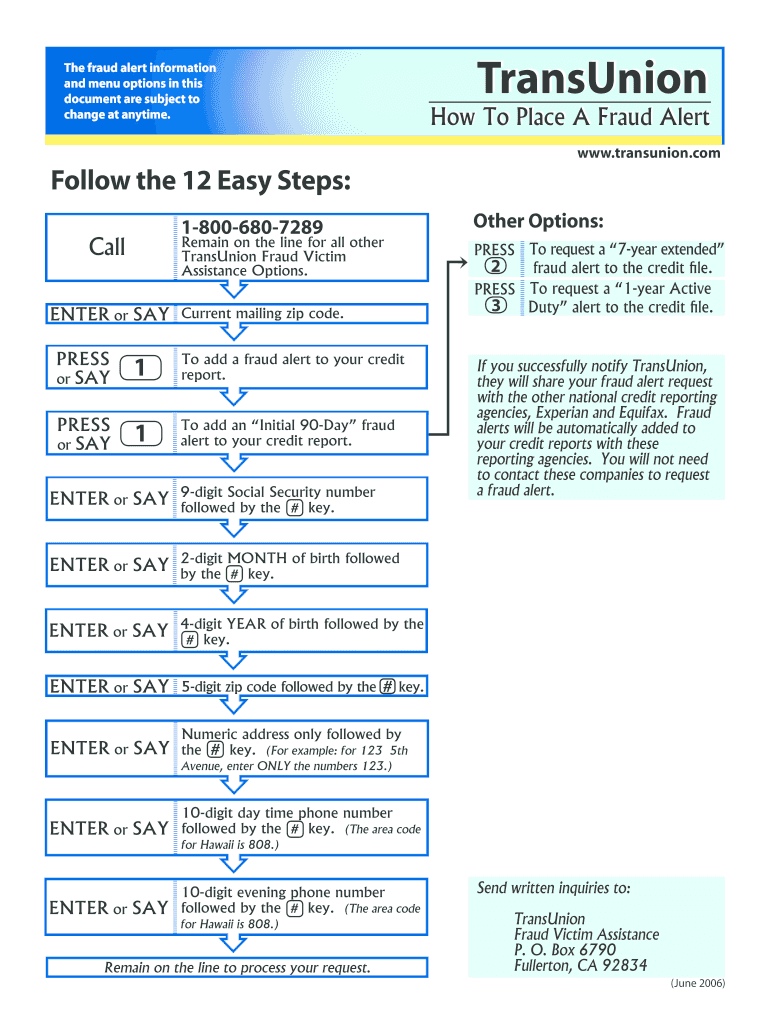

To fill out a TransUnion fraud alert removal, you can follow these steps:

Who needs TransUnion fraud alert removal?

Instructions and Help about transunion fraud alert removal

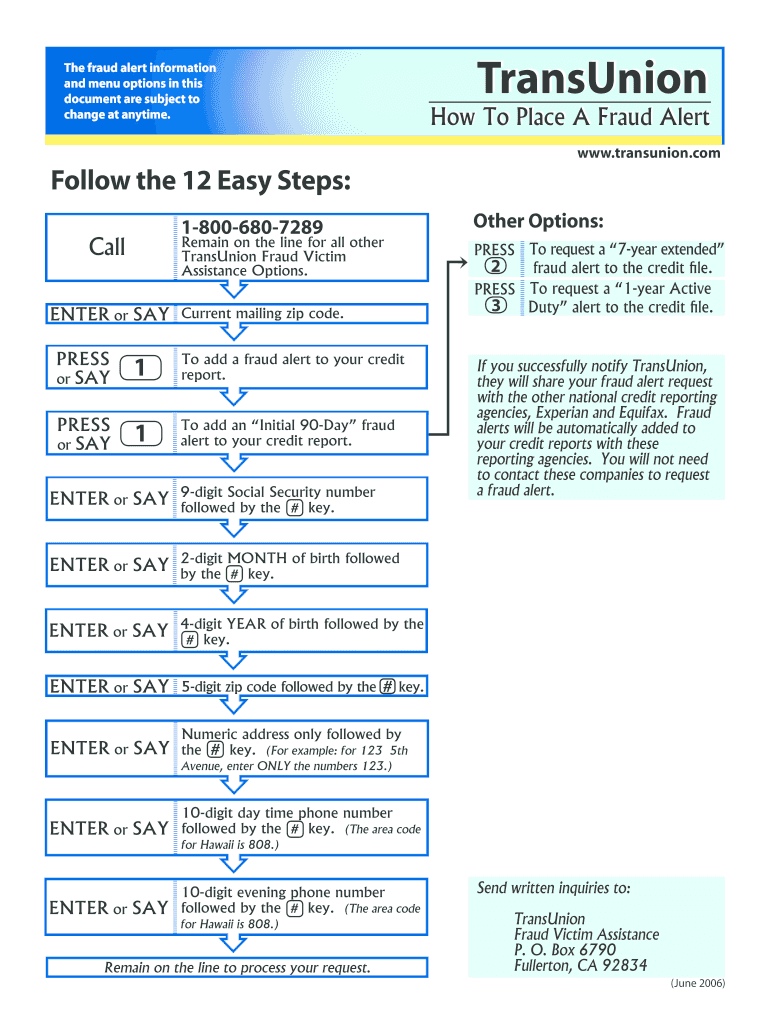

If someone has misused your personal financial information or if you think you are at greater risk for fraud or identity theft a fraud alert may be right for you Hi I'm Amanda Christensen financial expert with Utah State University Extension Sadly it's not a matter of if anymore it's probably a matter of when your personal information is compromised The aftermath of a data breach that potentially affected millions of people may have you asking what can I do to protect my credit One way is to put a fraud alert on your accounts What does a fraud alert do Putting a fraud alert on your credit file means businesses must try to verify your identity before extending any new credit For example they may call you to verify thatyoure the one soliciting credit from a particular business This can make it harder for an identity thief to open an account in your name How long does a fraud alert last An initial fraud alert lasts 90 days You can renew it, but it will expire if you do nothing An extended fraud alert lasts 7 years bandits recommended for those who are victims of fraud or identity theft An active duty military alert lasts one yea rand its meant for those who are in the military who want to minimize their risks while they're deployed How much does it cost Its free How do I place a fraud alert Contact one of the 3 major credit reporting agencies by phone or online Ask the company to put a fraud alert on your credit file Confirm that the company you contacted will call the other 2 reporting bureaus They are required to, but you'll want to check to be sure the credit reporting company has your current contact information, so they can get in touch with you Mark your calendar to renew this fraud alert after 90 days Remember you don't have to be a victim of identity theft to use a fraud alert A fraud alert can make it harder for an identity thief to open an account in your name The alert lasts 90 days, but you can renew it When you call one of the credit reporting agencies and ask them for a fraud alert they must tell the other 2 companies Check the description box below for links to each of the 3 credit reporting agencies and more resources about fraud alerts Like this video give it a thumbs up leave comment Let me know what financial question godlike to have answered Also check out our website financeusuedufor links to great financial resources Thanks for stopping by I'm Amanda Christensen with Utah State UniversityExtension Well see you again soon bye

People Also Ask about

How do I write a fraud alert letter?

How do I remove a fraud alert from my TransUnion letter?

Do credit bureaus share fraud alerts?

Do you have to remove credit freeze from all three bureaus?

What documents do I need to remove fraud alert from Experian?

Do I need to remove fraud alert from all three credit bureaus?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find transunion fraud alert removal?

How do I execute transunion fraud alert removal online?

How can I fill out transunion fraud alert removal on an iOS device?

What is transunion fraud alert removal?

Who is required to file transunion fraud alert removal?

How to fill out transunion fraud alert removal?

What is the purpose of transunion fraud alert removal?

What information must be reported on transunion fraud alert removal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.