KY TC 95-616 2013 free printable template

Show details

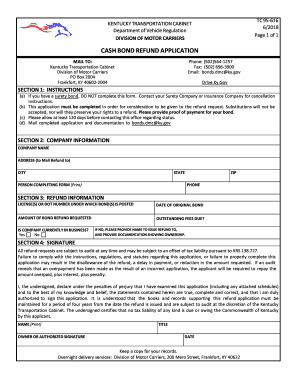

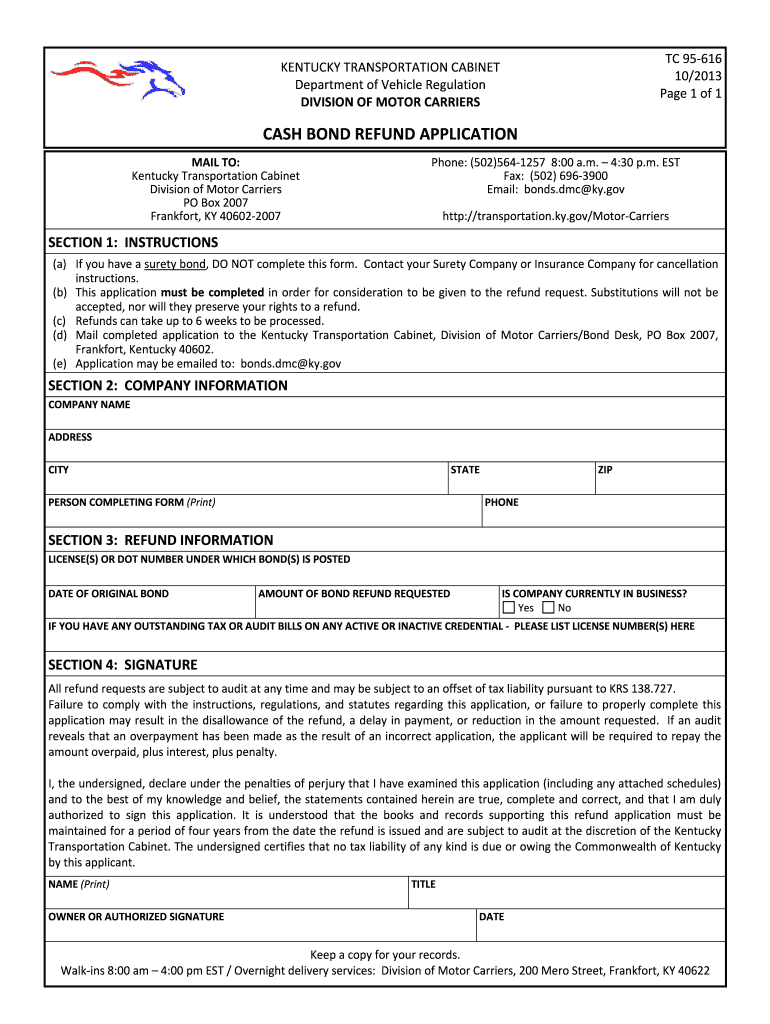

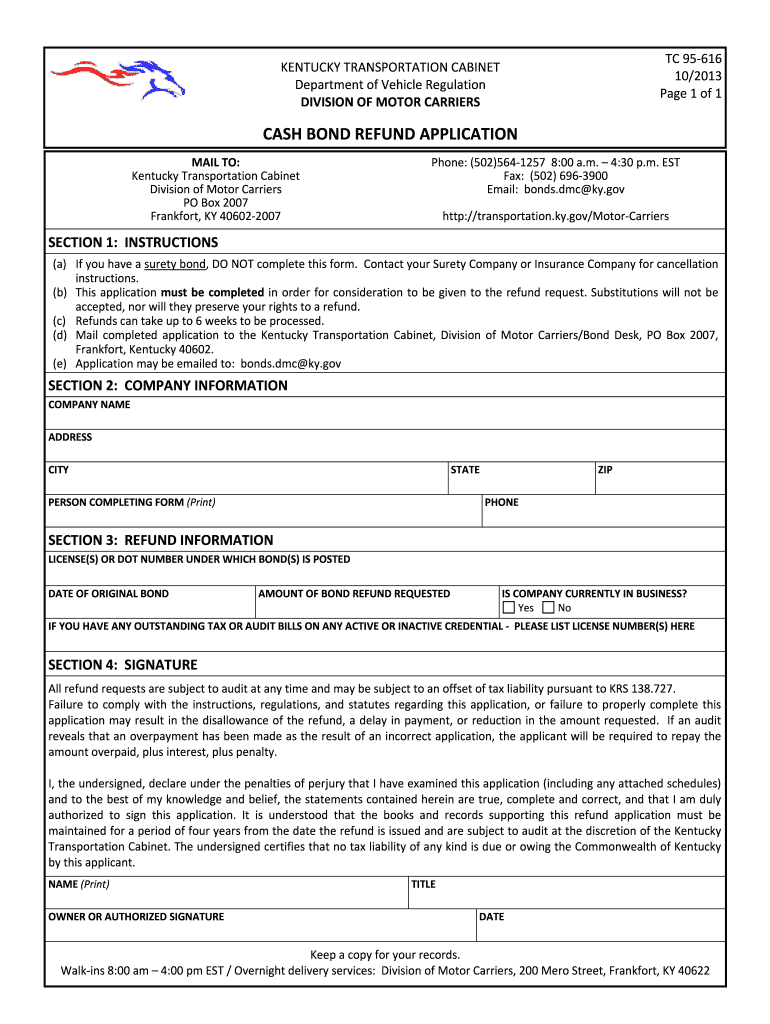

TC 95?616 10/2013-Page 1 of 1 KENTUCKY TRANSPORTATION CABINET Department of Vehicle Regulation DIVISION OF MOTOR CARRIERS CASH BOND REFUND APPLICATION Phone: (502)564?1257 8:00 a.m. 4:30 p.m. EST

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY TC 95-616

Edit your KY TC 95-616 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY TC 95-616 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY TC 95-616 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY TC 95-616. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY TC 95-616 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY TC 95-616

How to fill out KY TC 95-616

01

Obtain the KY TC 95-616 form from the Kentucky Department of Revenue website or a local office.

02

Fill in the 'Taxpayer Information' section, including your name, address, and Tax Identification Number.

03

Complete the 'Income Information' section, providing details on all income sources.

04

Enter any deductions or credits you are eligible for in the relevant sections provided.

05

Calculate your total tax liability or refund based on the provided instructions.

06

Sign and date the form at the designated area.

07

Submit the completed form to the appropriate address specified in the form instructions.

Who needs KY TC 95-616?

01

Individuals filing their income tax in Kentucky who need to report specific income types or claim deductions.

02

Tax professionals assisting clients with their Kentucky state tax filings.

03

Businesses required to report certain tax information to the Kentucky Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Do you get back the money from bond?

Cash bonds are only released upon order of a judge or dismissal of the charges. The bond can only be returned to the person who posted the bond.

How long does it take to get I bond money back?

3. How Long Does It Take to Get Your Bond Money Back? Your bail refund is processed and mailed to you within 30 business days after you have made your court appearances, or the charges have been dropped.

How do I post a bond in Kentucky?

To post a bond with cash you must do the following: Go to the District Court Clerk's Office located at 330 York St. Newport, KY 41071 and post the bond. Bring your receipt to the Campbell County Detention Center located at 601 Central Ave.

Can you revoke a bond in Kentucky?

If a defendant "jumps bail" or fails to appear at a scheduled court hearing, bail can be revoked.

How do I get my bond money back in KY?

Bonds are only refunded via a check made payable to the Surety listed on the bond sheet, unless a notarized bond assignment is on file with the Circuit Clerk's office. A Photo ID of the surety is required to pick up the bond.

How does bond work in KY?

In Kentucky, a judge ultimately has the final say on the exact dollar amount of a set bail. When a person is arrested, a judge immediately reviews the case file, taking into consideration the charges, citation narrative and the person's criminal history. They then determine the initial bail amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KY TC 95-616 online?

With pdfFiller, the editing process is straightforward. Open your KY TC 95-616 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in KY TC 95-616 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your KY TC 95-616, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete KY TC 95-616 on an Android device?

Use the pdfFiller Android app to finish your KY TC 95-616 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is KY TC 95-616?

KY TC 95-616 is a tax form used in the state of Kentucky for reporting certain tax-related information to the Kentucky Department of Revenue.

Who is required to file KY TC 95-616?

Individuals or businesses that meet specific tax obligations as determined by Kentucky state law are required to file KY TC 95-616.

How to fill out KY TC 95-616?

To fill out KY TC 95-616, individuals or businesses must provide accurate personal and financial information according to the instructions provided on the form.

What is the purpose of KY TC 95-616?

The purpose of KY TC 95-616 is to collect information necessary for the Kentucky Department of Revenue to assess and ensure compliance with state tax laws.

What information must be reported on KY TC 95-616?

KY TC 95-616 requires reporting of various tax-related information including, but not limited to, income, deductions, and other financial details as per the guidelines.

Fill out your KY TC 95-616 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY TC 95-616 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.