HI DoT N-884 2012 free printable template

Show details

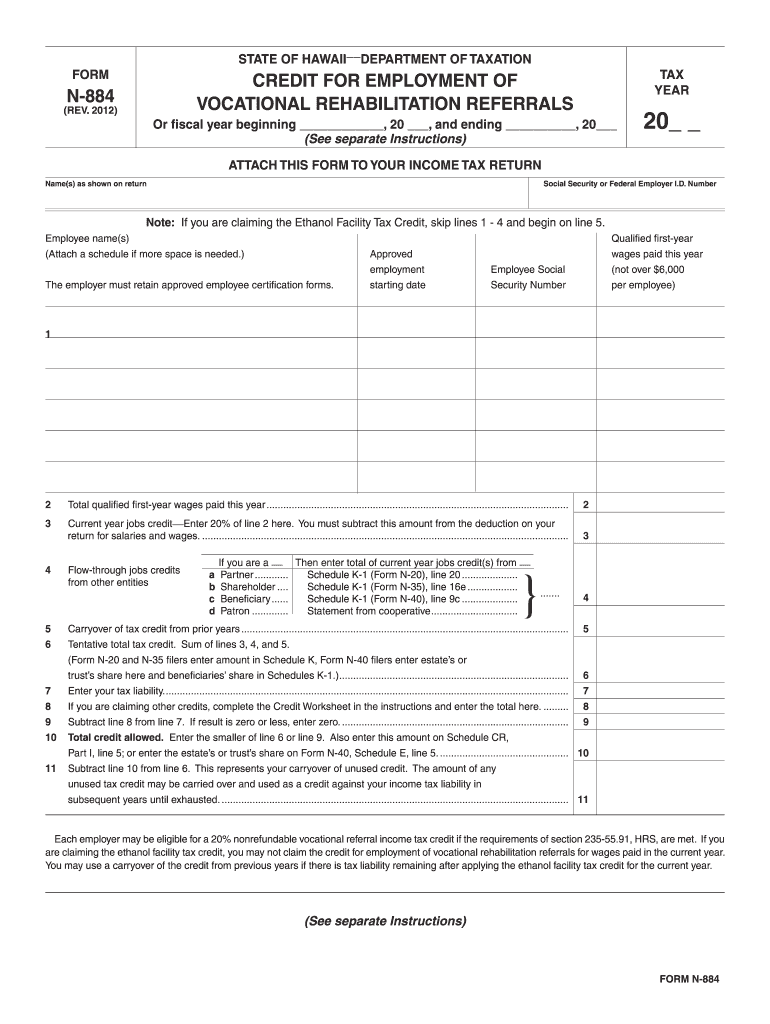

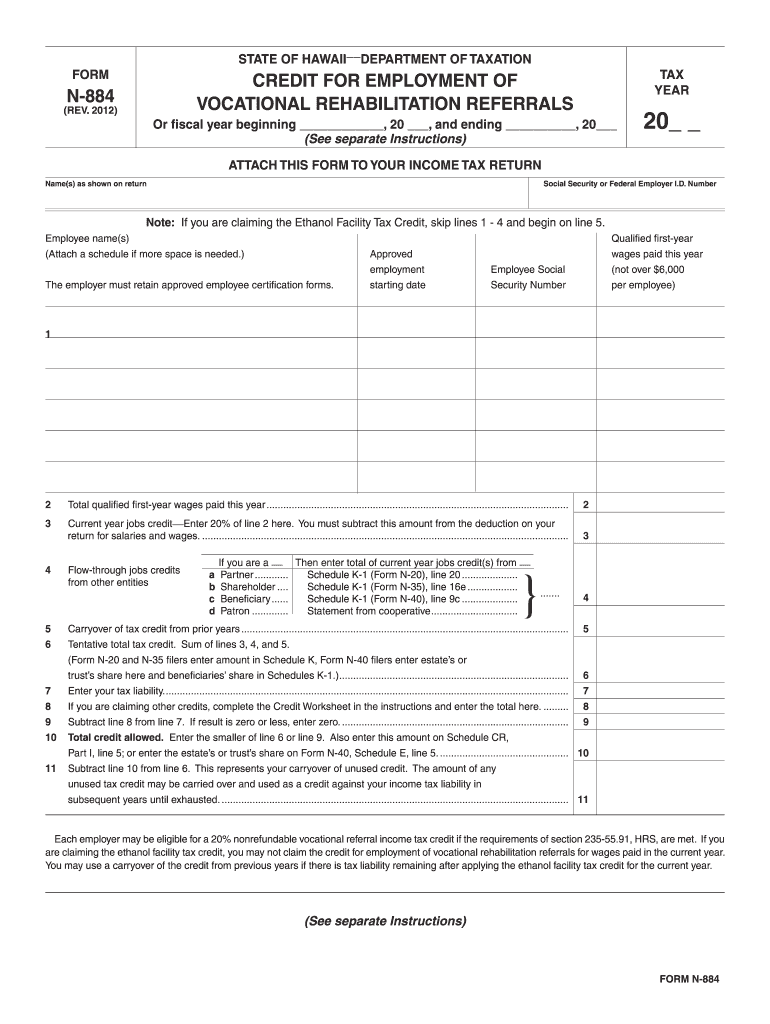

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM CREDIT FOR EMPLOYMENT OF TAX YEAR N-884 (REV. 2012) VOCATIONAL REHABILITATION REFERRALS Or fiscal year beginning, 20, and ending, 20 (See separate

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form n-884 rev 2012

Edit your form n-884 rev 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form n-884 rev 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form n-884 rev 2012 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form n-884 rev 2012. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-884 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form n-884 rev 2012

How to fill out HI DoT N-884

01

Obtain the HI DoT N-884 form from the relevant department or website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide any necessary identification numbers or account details as requested.

05

Review the specific sections that pertain to your situation, ensuring all information is accurate.

06

Attach any required documents or evidence that support your application.

07

Double-check the form for completeness and correctness before submission.

08

Submit the completed form according to the provided submission guidelines.

Who needs HI DoT N-884?

01

Individuals applying for a specific permit or license in Hawaii.

02

Persons seeking to rectify or update previous information related to their license.

03

Applicants who need to report a change in their status or personal details to the Department of Transportation.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a Hawaii tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

What is form N 163 in Hawaii?

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

What is Hawaii tax form N 15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

What is the earned income tax credit in Hawaii?

The tax credit is 20% of the federal earned income credit claimed on the taxpayer's federal income tax return. For part-year residents and nonresidents, the tax credit is multiplied by the ratio of Hawaii adjusted gross income to federal adjusted gross income.

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form n-884 rev 2012?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form n-884 rev 2012 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit form n-884 rev 2012 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign form n-884 rev 2012 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit form n-884 rev 2012 on an Android device?

You can make any changes to PDF files, such as form n-884 rev 2012, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is HI DoT N-884?

HI DoT N-884 is a form used by the Hawaii Department of Transportation for reporting various transportation-related data.

Who is required to file HI DoT N-884?

Any individual or organization engaged in transportation activities in Hawaii that meet specific criteria set by the Hawaii Department of Transportation is required to file HI DoT N-884.

How to fill out HI DoT N-884?

To fill out HI DoT N-884, follow the instructions provided on the form, ensuring that all required fields are completed accurately and any necessary supporting documentation is attached.

What is the purpose of HI DoT N-884?

The purpose of HI DoT N-884 is to collect data related to transportation activities in Hawaii to aid in planning, analysis, and policy-making by the Department of Transportation.

What information must be reported on HI DoT N-884?

Information that must be reported on HI DoT N-884 includes details about the transportation services provided, the volume of traffic, vehicle types, and any relevant operational data as required by the form.

Fill out your form n-884 rev 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form N-884 Rev 2012 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.