Get the free gst 06

Show details

Government of India

And

Government of GujaratForm GST REG06

Registration Certificate

Registration Number :24AABCB6825A3Z7

1. Legal Name TGB BANQUETS AND HOTELS LIMITED2. Trade Name, if any TGB BANQUETS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reg 06 gst form

Edit your reg 06 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst reg 06 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

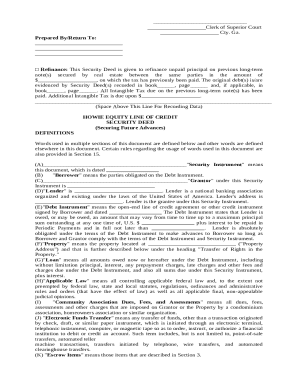

How to edit gst form 06 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form gst reg 06. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

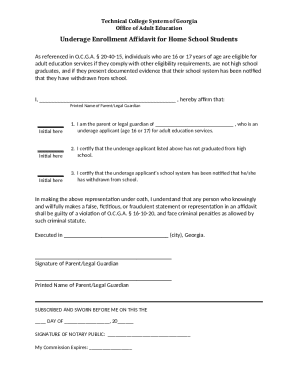

How to fill out form gst reg 06 registration certificate

How to fill out gst reg 06:

01

Obtain a copy of the gst reg 06 form from the relevant tax authority or download it from their website.

02

Fill in your personal information, such as your name, address, and contact details, in the designated fields.

03

Provide your GST registration number, if applicable, and any other relevant identification numbers.

04

Indicate the period for which you are filing the gst reg 06 form, typically a financial year or a specific reporting period.

05

Fill in the details of your taxable supplies, including the value of taxable items or services provided.

06

Specify the input tax credits you are claiming, if any, by providing the relevant details and supporting documentation.

07

Calculate the amount of tax payable, if applicable, based on the information provided and any applicable tax rates.

08

Sign and date the gst reg 06 form, certifying that the information provided is accurate and complete.

09

Submit the completed form to the tax authority by the specified deadline, either electronically or by mail.

Who needs gst reg 06:

01

Individuals or businesses registered for GST are typically required to fill out gst reg 06 forms.

02

GST reg 06 is used for reporting taxable supplies and input tax credits, making it necessary for those engaged in taxable activities.

03

Non-GST registered entities who want to claim input tax credits may also need to complete gst reg 06 forms to support their claims.

04

The exact requirements for gst reg 06 may vary by jurisdiction, so it is important to consult the specific guidelines provided by the relevant tax authority.

Fill

form

: Try Risk Free

People Also Ask about

What is 06 in GST?

GST State Code List STATE NAMESTATE CODEHARYANA06DELHI07RAJASTHAN08UTTAR PRADESH0935 more rows • 15 Mar 2023

What is my Gstin number in India?

GSTIN of a person can be identified based on their Permanent Account Number (PAN). Goods & Service Tax Identification Number (GSTIN) is a state-specific unique number based on PAN. GSTIN is a 15 digits registration number consisting of state code, PAN, entity code, and the check digit.

What is Gstin for Gujarat?

The State code of Gujarat is 24. The GST number in Gujarat starts with 24. If you observe any number starting with 24 that means this GST number applies to the state of Gujarat.

How can I get GST number for freelancer in India?

The freelancer must apply for GST registration online on the GST Portal. The freelancer will be required to furnish proof of identity, proof of address, and proof of bank account. The freelancer will be assigned a GSTIN as soon as the registration process is complete.

What is the Gstin number?

GSTIN, short for Goods and Services Tax Identification Number, is a unique 15 digit identification number assigned to every taxpayer (primarily dealer or supplier or any business entity) registered under the GST regime. Obtaining GSTIN and registering for GST is absolutely free of cost.

How do I get a GST certificate in Singapore?

Applicants for GST registration will have to submit their applications online via myTax Portal using their CorpPass with supporting documents such as your Accounting and Corporate Regulatory Authority (ACRA) Business Profile, or Certificate of Incorporation in English (if your business is incorporated overseas).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gst 06 form for eSignature?

Once your gst 06 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit gst 06 form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing gst 06 form, you can start right away.

How do I fill out gst 06 form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your gst 06 form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is gst reg 06?

GST REG-06 is a form used for the application of a GST registration in India, specifically for businesses that are required to obtain Goods and Services Tax registration.

Who is required to file gst reg 06?

Any business or individual who is liable to pay GST and who exceeds the prescribed threshold limit or engages in inter-state supply of goods and services is required to file GST REG-06.

How to fill out gst reg 06?

GST REG-06 can be filled out online through the GST portal by providing details such as the applicant's name, business address, type of business, and other relevant information as prompted in the form.

What is the purpose of gst reg 06?

The purpose of GST REG-06 is to formally apply for GST registration, thereby allowing businesses to legally collect and remit GST on their sales and ensure compliance with tax regulations.

What information must be reported on gst reg 06?

The information that must be reported on GST REG-06 includes the applicant's PAN, business details, address of the place of business, type of business entity, contact information, and bank account details.

Fill out your gst 06 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst 06 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.