DE DoR 200-01-X-I 2018 free printable template

Show details

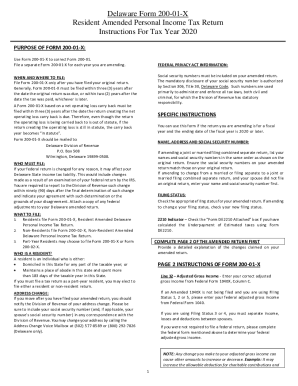

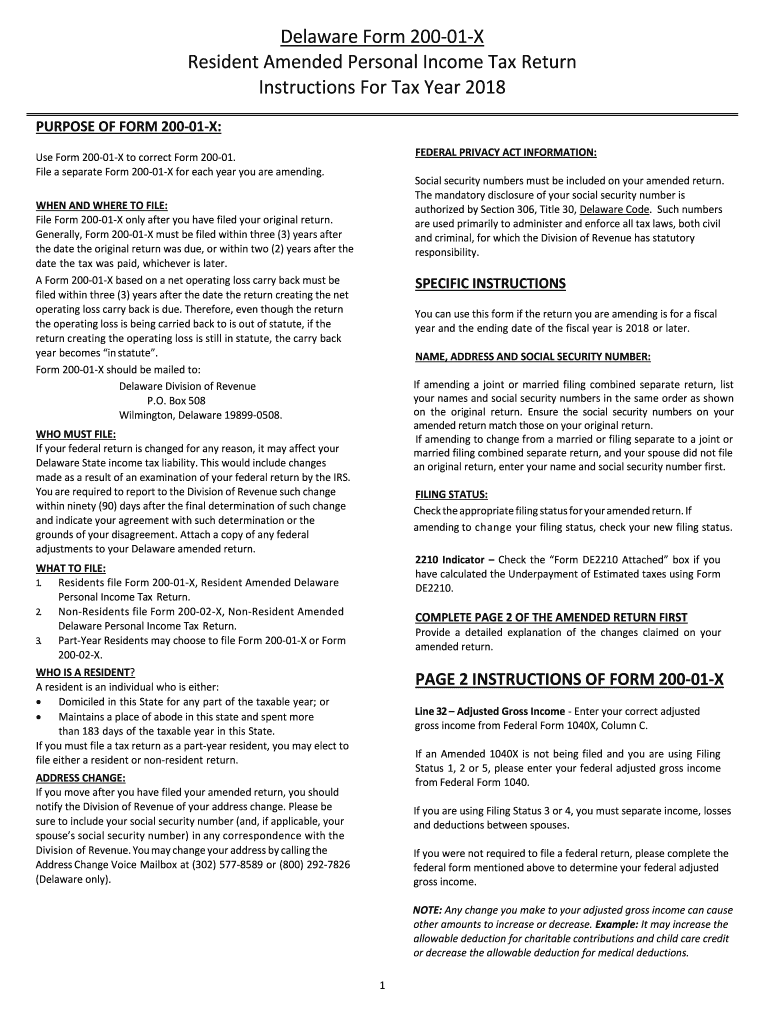

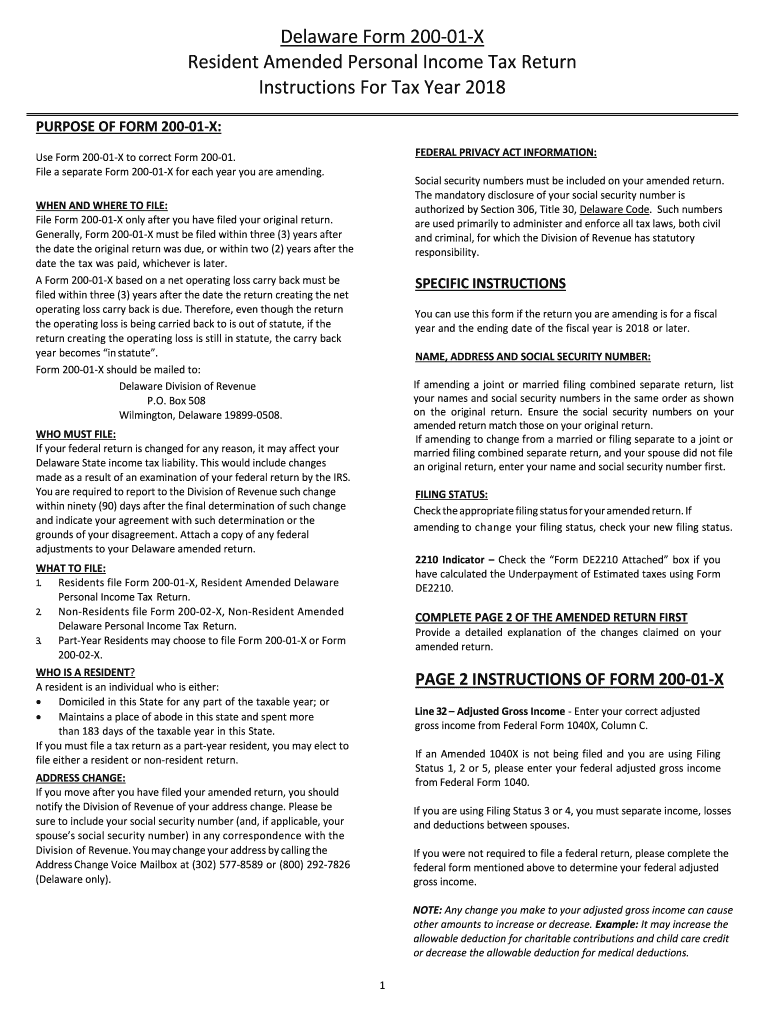

Delaware Form 20001X

Resident Amended Personal Income Tax Return

Instructions For Tax Year 2018

PURPOSE OF FORM 20001X:

FEDERAL PRIVACY ACT INFORMATION:Use Form 20001X to correct Form 20001.

File

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE DoR 200-01-X-I

Edit your DE DoR 200-01-X-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE DoR 200-01-X-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DE DoR 200-01-X-I online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit DE DoR 200-01-X-I. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE DoR 200-01-X-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE DoR 200-01-X-I

How to fill out DE DoR 200-01-X-I

01

Obtain the DE DoR 200-01-X-I form from the relevant authority's website or office.

02

Fill in the applicant's personal information in the designated sections, including name, address, and contact details.

03

Provide the specific details requested in the form, such as the nature of the request and any relevant dates.

04

Attach any supporting documentation required to substantiate the request.

05

Review the completed form for accuracy and completeness.

06

Submit the form according to the instructions, either in person, by mail, or electronically as specified.

Who needs DE DoR 200-01-X-I?

01

Individuals or organizations seeking to formally request documentation or information related to a specific matter covered under DE regulations.

Instructions and Help about DE DoR 200-01-X-I

Fill

form

: Try Risk Free

People Also Ask about

What is the form for Delaware tax power of attorney?

A Delaware tax power of attorney (Form 2848) is a paper submission that can be used to designate an agent to represent the principal in front of the Delaware Division of Revenue.

Where do I get Delaware tax forms?

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Where can I get Delaware tax forms?

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Does Delaware have an efile form?

State Only Return Requirements – The Delaware e-file program: Supports federal/state (piggyback) filing and state-only filing through the Federal/State Electronic Filing Program (Modernized e-File System). Allows electronic filing of part-year and nonresident returns.

Do I need to file a Delaware state tax return?

File a tax return if you have any gross income from sources in Delaware during the tax year. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

How long does it take to get a refund from the state of Delaware?

The average processing time to date for returns without any agency review has been eight days. More complex returns average 34 calendar days. Overall, the division's automated systems indicate that it can take 10 to 12 weeks for review, ing to the Division of Revenue.

How fast can I expect my tax refund?

We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return. Where's My Refund?

Does Delaware have an eFile form?

State Only Return Requirements – The Delaware e-file program: Supports federal/state (piggyback) filing and state-only filing through the Federal/State Electronic Filing Program (Modernized e-File System). Allows electronic filing of part-year and nonresident returns.

How long does it take to get Delaware state tax refund?

Refunds from Delaware tax returns generally take four to 12 weeks to process. For more specific status updates, visit the state's Refund Inquiry (Individual Income Tax Return) page. You will need to enter your SSN and your refund amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get DE DoR 200-01-X-I?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the DE DoR 200-01-X-I in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in DE DoR 200-01-X-I without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your DE DoR 200-01-X-I, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out DE DoR 200-01-X-I on an Android device?

On an Android device, use the pdfFiller mobile app to finish your DE DoR 200-01-X-I. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is DE DoR 200-01-X-I?

DE DoR 200-01-X-I is a document or form used for reporting specific data to the Department of Revenue.

Who is required to file DE DoR 200-01-X-I?

Individuals and businesses that meet certain criteria set by the Department of Revenue must file DE DoR 200-01-X-I.

How to fill out DE DoR 200-01-X-I?

To fill out DE DoR 200-01-X-I, gather the necessary information, complete each section of the form accurately, and follow the provided instructions.

What is the purpose of DE DoR 200-01-X-I?

The purpose of DE DoR 200-01-X-I is to collect and report financial data as required by the Department of Revenue for tax purposes.

What information must be reported on DE DoR 200-01-X-I?

The information that must be reported on DE DoR 200-01-X-I includes income, expenses, and any other relevant financial details as specified in the form instructions.

Fill out your DE DoR 200-01-X-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE DoR 200-01-X-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.