MI DoT 5156 2014 free printable template

Show details

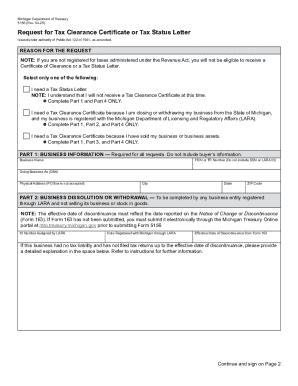

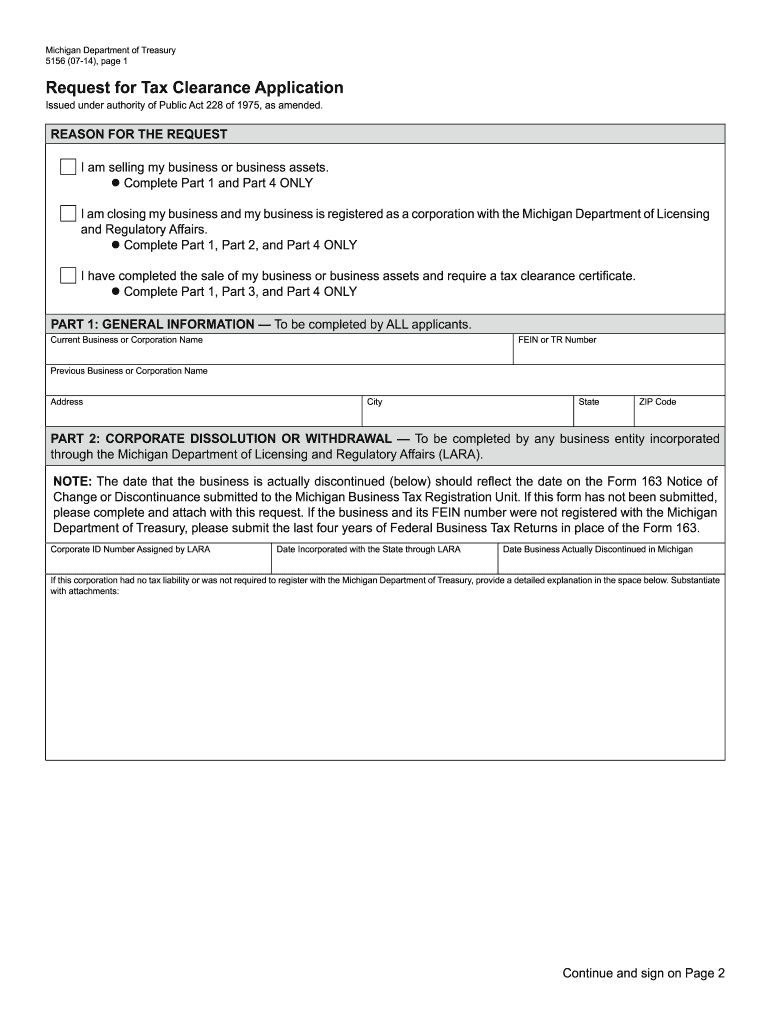

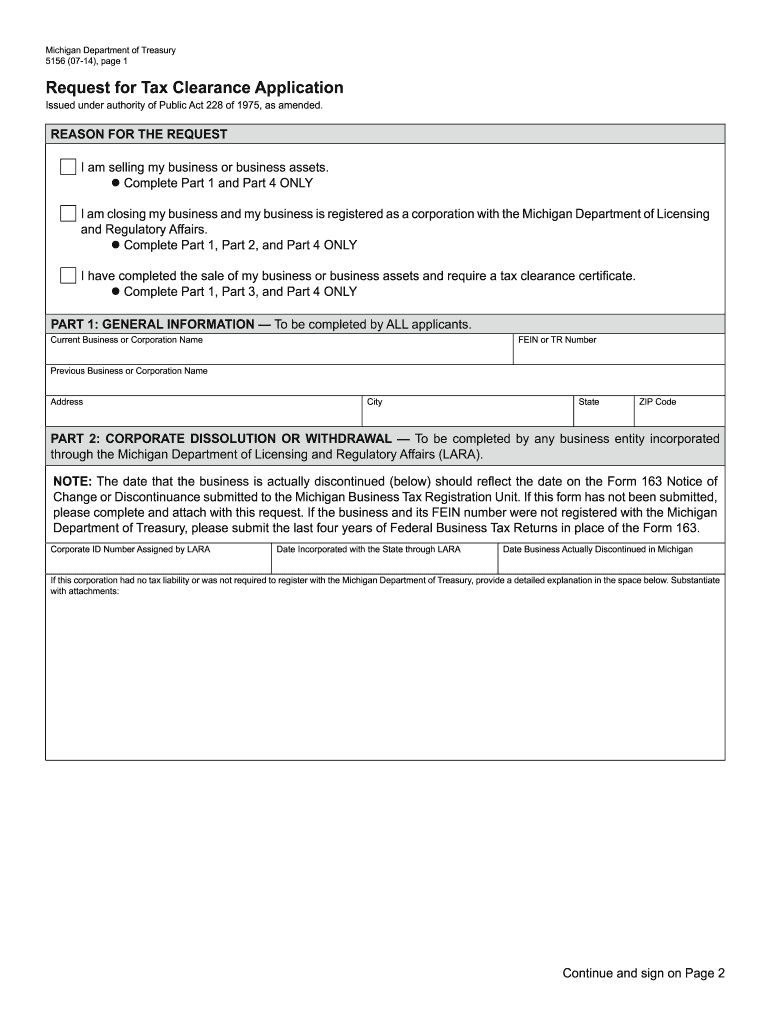

Michigan Department of Treasury 5156 (07-14), page 1 Reset Form Request for Tax Clearance Application Issued under authority of Public Act 228 of 1975, as amended. Reason for the Request I am selling

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 5156

Edit your MI DoT 5156 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 5156 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 5156 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI DoT 5156. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 5156 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 5156

How to fill out MI DoT 5156

01

Obtain the MI DoT 5156 form from the Michigan Department of Transportation website or a local office.

02

Fill in the applicant's details at the top of the form, including name, address, and contact information.

03

Provide the specific vehicle information, such as make, model, year, and VIN (Vehicle Identification Number).

04

Complete the section regarding the purpose of the application, selecting the appropriate options as they apply.

05

If applicable, attach any required supporting documents related to the application.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate MI DoT office or via the specified submission method.

Who needs MI DoT 5156?

01

Individuals applying for vehicle registration, title transfer, or other related vehicle transactions in Michigan.

02

Businesses or organizations needing to manage their vehicle fleet registration in accordance with Michigan regulations.

03

Residents who need to replace lost or damaged vehicle titles.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay Michigan business tax?

Michigan's Corporate Income Tax (CIT) is at a flat rate of 6%. The tax applies to C Corporations and any entity that elects to be taxed as a C corporation. Income is apportioned based 100% on the sales factor.

How do I close my Michigan unemployment account?

Employer Self Service (ESS) for the Unemployment account only. Online through the Agency Website. Call: 410-260-7980 or 1-800-638-2937 Provide: Name, telephone number, Federal Employer Identification Number (FEIN), Central Registration Number (CRN), reason for closing account, and closing date.

What is a tax clearance in Michigan?

A Tax Clearance Certificate for Sale of Business and/or Business Assets is granted after Treasury determines that all Sales, Use, Income Withholding, Cigarette, Motor Fuel, Single Business, Michigan Business, and Corporate Income taxes have been paid for the period of operation.

How do I request a tax clearance from the Michigan Department of Treasury?

File Form 5156, Request for Tax Clearance Application if you: Want to know your current total tax liability with the Michigan Department of Treasury.

Do I need to file a Michigan tax return as a non resident?

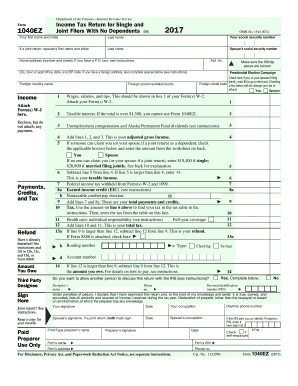

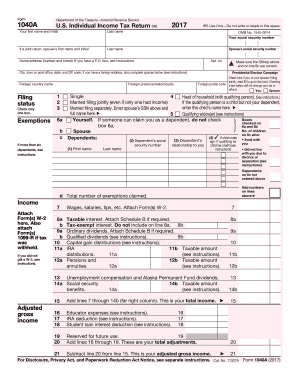

Look at the Adjusted Gross Income amount on your federal tax form. (Form 1040NR, Line 11.) If that amount is less than $5,000, you are not required to file a State of Michigan tax form. If you are required to file a State of Michigan tax form, you must file MI 1040 plus MI Schedule NR and Schedule 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI DoT 5156 to be eSigned by others?

Once your MI DoT 5156 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for signing my MI DoT 5156 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your MI DoT 5156 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete MI DoT 5156 on an Android device?

Use the pdfFiller mobile app and complete your MI DoT 5156 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MI DoT 5156?

MI DoT 5156 is a form used by the Michigan Department of Transportation for reporting certain transportation activities and compliance.

Who is required to file MI DoT 5156?

Entities involved in transportation projects or activities that fall under the jurisdiction of the Michigan Department of Transportation are required to file MI DoT 5156.

How to fill out MI DoT 5156?

To fill out MI DoT 5156, you need to gather the necessary information, complete all fields accurately, and submit the form as instructed by the Michigan Department of Transportation guidelines.

What is the purpose of MI DoT 5156?

The purpose of MI DoT 5156 is to ensure proper documentation and compliance for transportation activities regulated by the Michigan Department of Transportation.

What information must be reported on MI DoT 5156?

The information required on MI DoT 5156 typically includes details about the transportation project, involved parties, dates, compliance status, and any other relevant data specified by the Michigan Department of Transportation.

Fill out your MI DoT 5156 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 5156 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.