AZ Form 140X 2018 free printable template

Show details

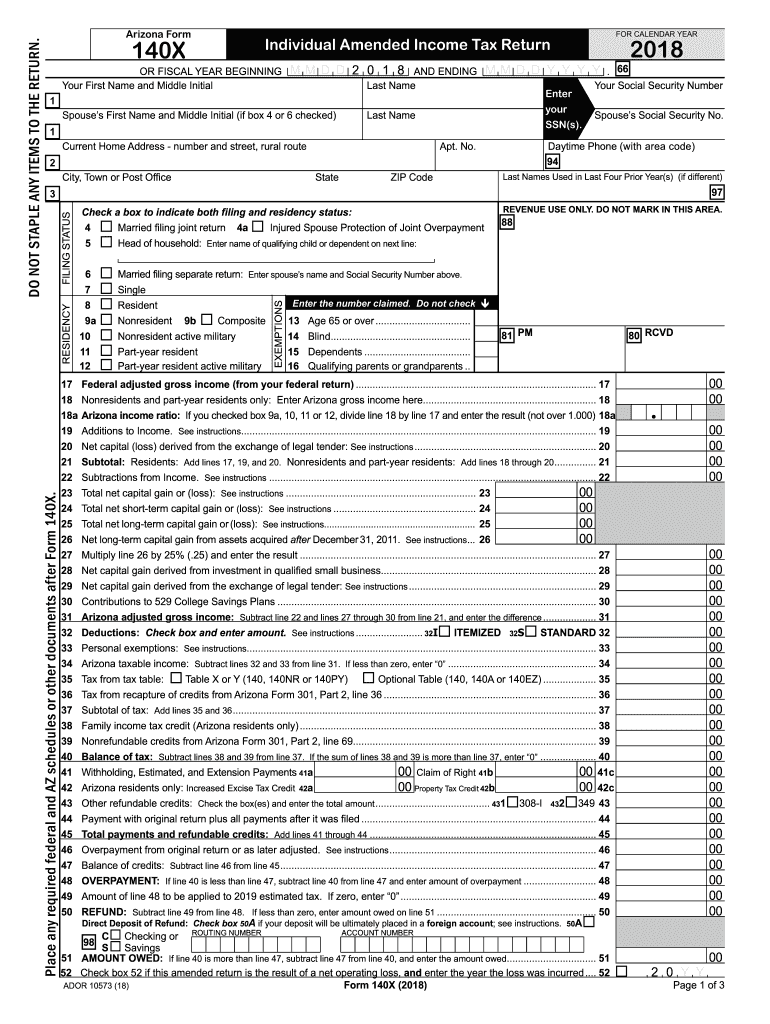

140XFOR CALENDAR YEARIndividual Amended Income Tax Returner FISCAL YEAR BEGINNING Your First Name and Middle Initial MM D 2 0 1 8AND ENDING Last Name MM D Y Y Y Y Enter your SSN(s).1 Spouses First

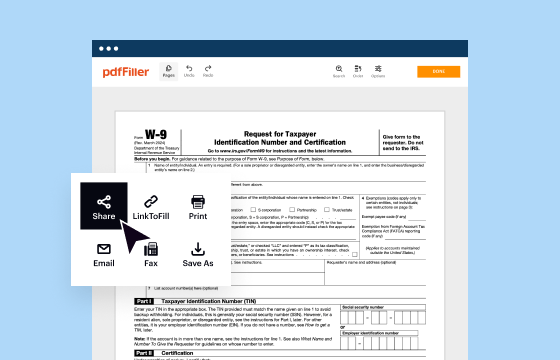

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ Form 140X

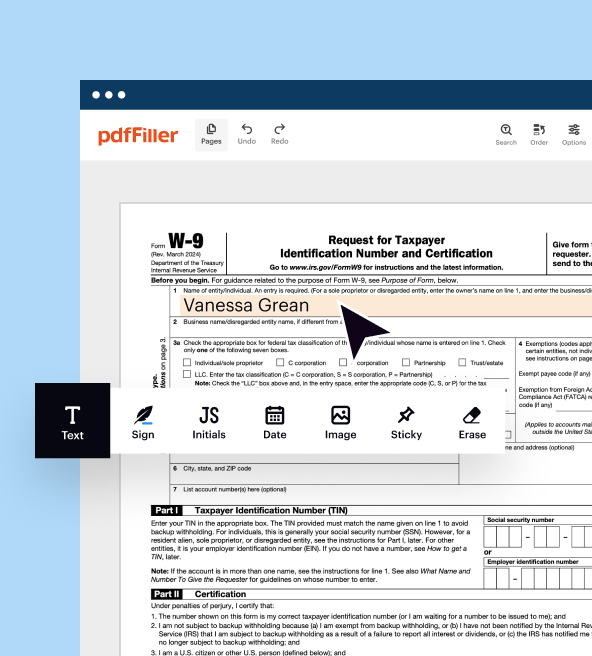

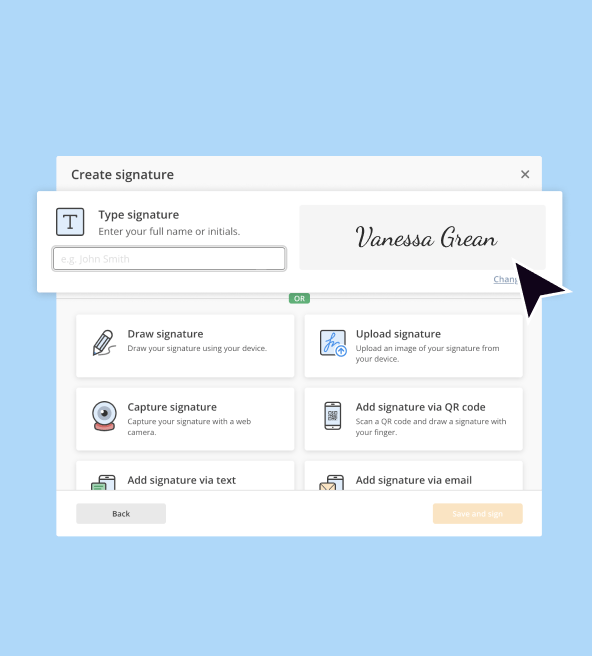

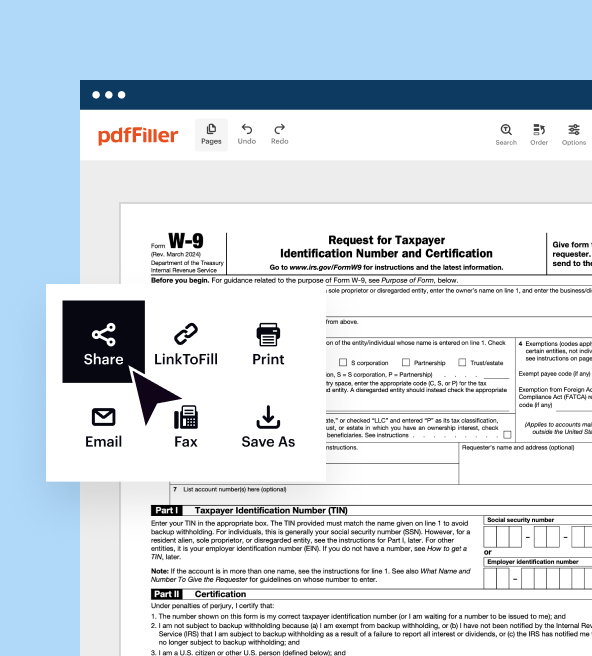

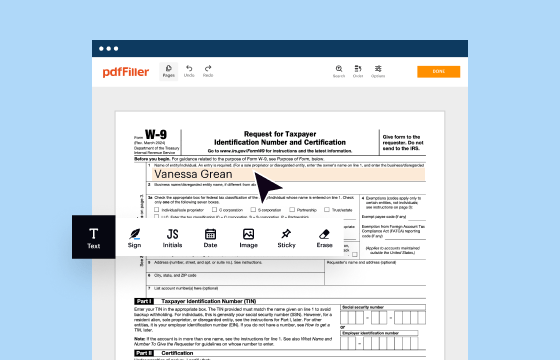

How to edit AZ Form 140X

How to fill out AZ Form 140X

Instructions and Help about AZ Form 140X

How to edit AZ Form 140X

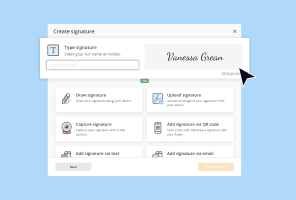

To edit AZ Form 140X, utilize a reliable PDF editor like pdfFiller. Begin by uploading the form into the editor. Once uploaded, you can modify text fields, add signatures, or insert any necessary notes before saving the updated document. Ensure that all changes comply with IRS requirements.

How to fill out AZ Form 140X

Filling out AZ Form 140X requires careful attention to detail. Start by entering your personal information at the top of the form, including your name, address, and Social Security number. Next, follow the form's sections, ensuring that you accurately report any changes to income or deductions. It is essential to review all entries for accuracy before submission to avoid potential penalties. For a smoother process, consider using pdfFiller to fill out the form electronically.

About AZ Form 140X 2018 previous version

What is AZ Form 140X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ Form 140X 2018 previous version

What is AZ Form 140X?

AZ Form 140X is the Arizona Individual Income Tax Amendment form. This form allows taxpayers to amend their previously filed Arizona tax returns. By submitting this form, you can correct errors or change information from your original return.

What is the purpose of this form?

The purpose of AZ Form 140X is to formally update information on a prior Arizona tax return. Taxpayers may need to amend their returns for various reasons, including unreported income, claiming additional deductions, or correcting mistakes. Filing this form ensures that the Arizona Department of Revenue has accurate and complete information.

Who needs the form?

Taxpayers who discover errors or omissions in their previously filed Arizona tax returns need to complete AZ Form 140X. This includes individuals who need to report additional income, claim missed deductions, or correct filing status changes. It's important for any taxpayer seeking an adjustment to previous tax return data to use this form.

When am I exempt from filling out this form?

You are exempt from filling out AZ Form 140X if you did not file a prior Arizona income tax return or if your original return was accepted without any errors. Additionally, if you are filing an original return rather than amending a previous one, this form does not apply to you.

Components of the form

AZ Form 140X contains several components designed to capture the necessary changes. It begins with the taxpayer's identification information, followed by sections that document the original amounts reported and the corrected amounts. Detailed instructions are provided to guide taxpayers through each section, ensuring that all required data is submitted.

What are the penalties for not issuing the form?

Failing to issue AZ Form 140X when required may lead to penalties from the Arizona Department of Revenue. Potential consequences include fines and interest on any unpaid tax amounts resulting from the errors. It is crucial to submit the amended form to avoid complications with tax compliance.

What information do you need when you file the form?

When filing AZ Form 140X, you will need your personal identification details, such as Social Security number and filing status. You should also have a copy of your original tax return, details of the changes being made, and any documentation supporting the adjustments, such as W-2s or 1099s.

Is the form accompanied by other forms?

AZ Form 140X may need to be accompanied by supporting documentation that explains or justifies the changes being made. If, for example, additional deductions are claimed, corresponding forms or evidence that supports the claims should also be submitted to facilitate the amendment process.

Where do I send the form?

After completing AZ Form 140X, send the form to the Arizona Department of Revenue. The mailing address can typically be found in the instructions section of the form or on the Arizona Department of Revenue's website. Verify the mailing address based on the type of amendment or if there are specific instructions for electronic submissions.

See what our users say