WI I-016a 2018 free printable template

Show details

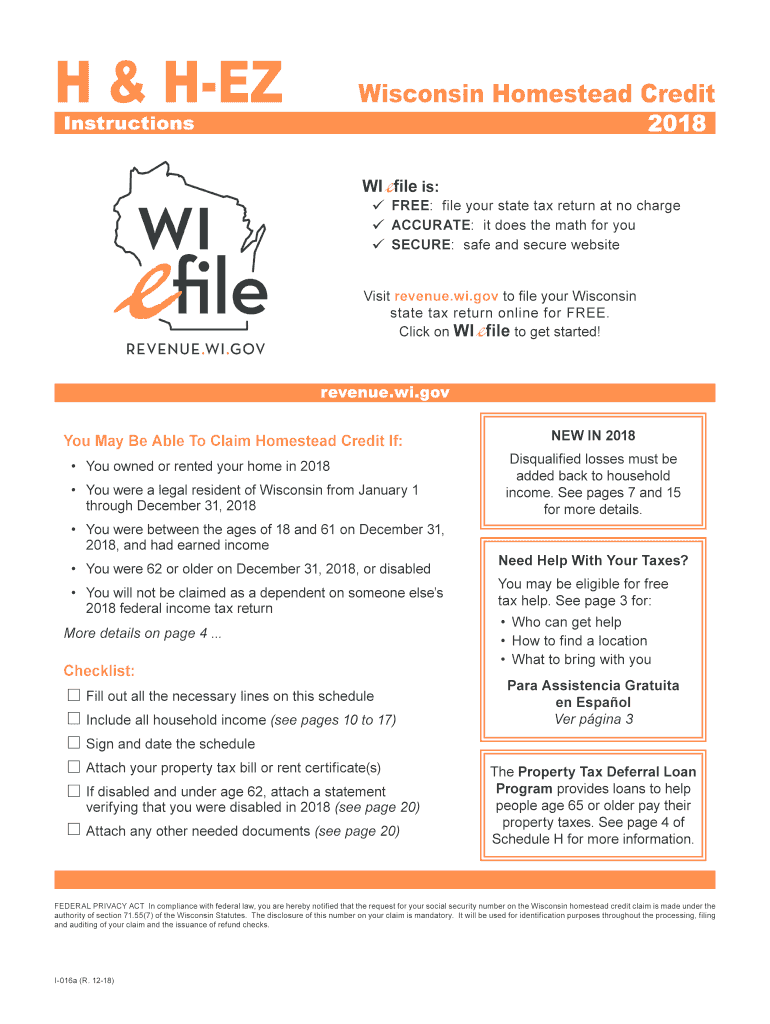

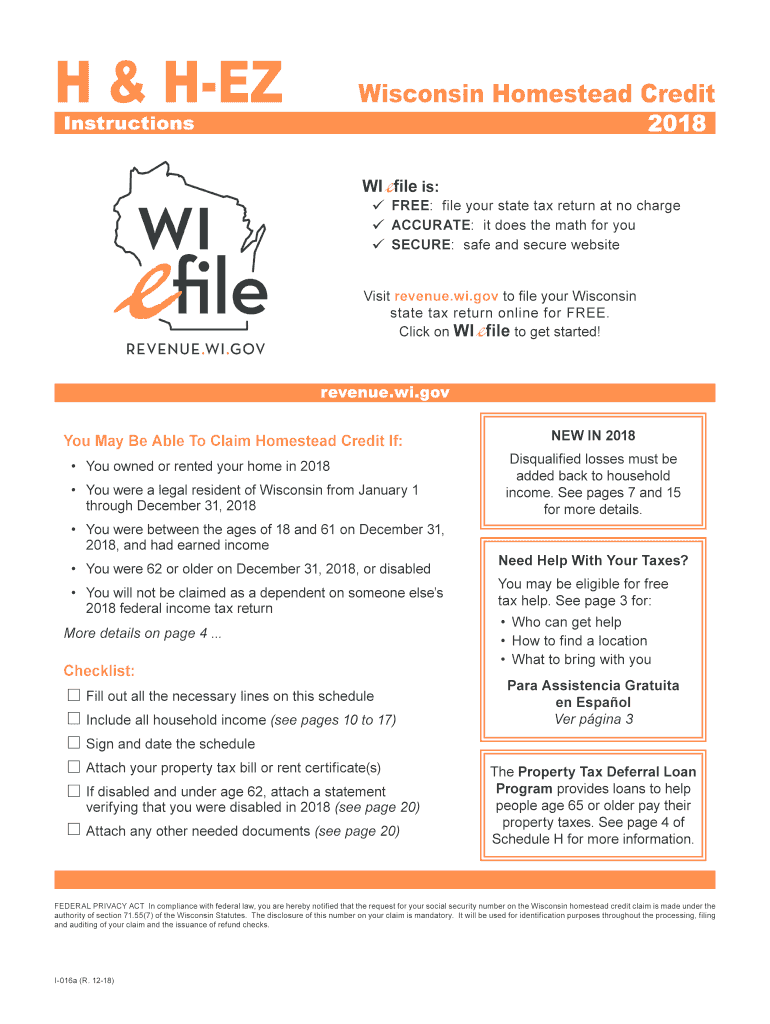

H & Wisconsin Homestead Credit 2018InstructionsWIfile is:FREE: file your state tax return at no charge ACCURATE: it does the math for you SECURE: safe and secure website Visit revenue.WI.gov to file

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI I-016a

Edit your WI I-016a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI I-016a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI I-016a online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI I-016a. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI I-016a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI I-016a

How to fill out WI I-016a

01

Obtain the WI I-016a form from the appropriate website or agency.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Provide specific details regarding the reason for filling out the form.

05

Attach any required documents or evidence that support your request.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form to the relevant agency or office as instructed.

Who needs WI I-016a?

01

Individuals who are applying for certain services or benefits that require documentation in Wisconsin.

02

Residents of Wisconsin who need to report changes in their circumstances to state agencies.

Instructions and Help about WI I-016a

Fill

form

: Try Risk Free

People Also Ask about

Does Wisconsin have a property tax refund?

This is a tax credit that can be claimed on your Wisconsin income tax return. You can get a credit for part of the rent or property taxes you paid in that tax year. It is a credit against the tax you paid and it is not refundable. This means you can't be refunded more than you paid in taxes.

Who qualifies for Wisconsin Homestead?

To qualify for homestead credit for 2022 you must meet the following requirements: You are a legal resident of Wisconsin for all of 2022, from January 1 through December 31. You are 18 years of age or older on December 31, 2022. You have less than $24,680 in household income for 2022.

What does homestead mean in Wisconsin?

Your homestead is the Wisconsin home you occupy, whether you own it or rent it, and up to one acre of land adjoining it (or up to 120 acres of land if the homestead is part of a farm). For example, it may be a house, an apartment, a rented room, a mobile home, a farm, or a nursing home room.

Who qualifies for homestead exemption in Wisconsin?

You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2021. You are a legal resident of Wisconsin for all of 2021. You are 18 years of age or older on December 31, 2021. Your household income was less than $24,680 for 2021.

What age do you stop paying property taxes in Wisconsin?

Age or Veteran Status. An applicant must be 65 years of age or older on the date of applica- tion, or a qualifying veteran of any age. Any co- owner must be at least 60 years of age on the date of application. If married, the applicant's spouse must qualify as a co-owner.

Do I qualify for homestead credit in Wisconsin?

To qualify for homestead credit for 2022 you must meet the following requirements: You are a legal resident of Wisconsin for all of 2022, from January 1 through December 31. You are 18 years of age or older on December 31, 2022. You have less than $24,680 in household income for 2022.

Is the Wisconsin Homestead Credit refundable?

If your amended Schedule H or H-EZ has increased the amount of your homestead credit, you will receive a refund for the additional amount.

What counts as a Wisconsin Homestead?

Your homestead is the Wisconsin home you occupy, whether you own it or rent it, and up to one acre of land adjoining it (or up to 120 acres of land if the homestead is part of a farm). For example, it may be a house, an apartment, a rented room, a mobile home, a farm, or a nursing home room.

How much do you get back from Homestead?

For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund. How are claims filed?

Who qualifies for Wisconsin Homestead Credit?

You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2021. You are a legal resident of Wisconsin for all of 2021. You are 18 years of age or older on December 31, 2021. Your household income was less than $24,680 for 2021.

How much is the homestead credit in Wisconsin?

The homestead credit received by eligible claimants depends on the interaction of household income and allowable property taxes. For claimants with household income of $8,000 or less, the credit is equal to 80% of property taxes or rent constituting property taxes to a maximum of $1,450 in property taxes or rent.

How much do you get back for homestead in WI?

Homestead Tax Credit Formula For claimants with household income of $8,000 or less, the credit is equal to 80% of property taxes or rent constituting property taxes to a maximum of $1,450 in property taxes or rent. The maximum credit is $1,160 (80% of $1,450 ).

How do you check homestead status in Wisconsin?

To check your return status by telephone: 1-608-266-8100 in Madison. 1-414-227-4907 in Milwaukee. Toll free at 1-866-947-7363 in other areas of Wisconsin.

What qualifies as a homestead in Wisconsin?

Your homestead is the Wisconsin home you occupy, whether you own it or rent it, and up to one acre of land adjoining it (or up to 120 acres of land if the homestead is part of a farm). For example, it may be a house, an apartment, a rented room, a mobile home, a farm, or a nursing home room.

How much is homestead exemption in Wisconsin?

The Wisconsin homestead exemption allows a debtor to exempt as much as $75,000 of equity in a homestead that the debtor occupies. If a person owns a $275,000 homestead and has a $200,000 mortgage, then $75,000 of equity in the homestead is fully exempt.

What is homestead property?

A homestead can be defined as the house and adjoining land where the owner primarily resides. Legally, what constitutes as a homestead varies state by state. Properties that qualify as homesteads may also benefit from homestead exemptions, which can offer homeowners certain financial and legal protections.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in WI I-016a?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your WI I-016a to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit WI I-016a straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing WI I-016a right away.

How do I edit WI I-016a on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign WI I-016a on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is WI I-016a?

WI I-016a is a form used for reporting specific tax-related information in the State of Wisconsin.

Who is required to file WI I-016a?

Entities and individuals who have certain income or tax obligations in Wisconsin are required to file WI I-016a.

How to fill out WI I-016a?

To fill out WI I-016a, individuals must provide required personal and financial information, ensuring accuracy and completeness based on current tax regulations.

What is the purpose of WI I-016a?

The purpose of WI I-016a is to collect information necessary for tax assessment and compliance with state tax laws.

What information must be reported on WI I-016a?

The information reported on WI I-016a includes personal identification details, income amounts, deductions, and any relevant tax credits.

Fill out your WI I-016a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI I-016a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.