Get the free ig sacco loan form

Show details

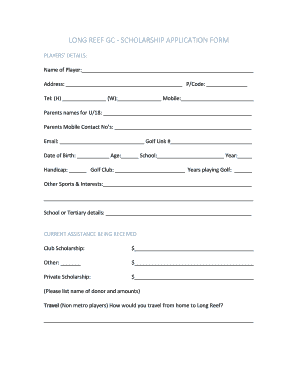

This document is an application form for loans offered by IG Sacco Society Ltd, detailing personal information, loan types, application and repayment terms, and security requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ig account activation form

Edit your ig sacco account activation form online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ig sacco website form via URL. You can also download, print, or export forms to your preferred cloud storage service.

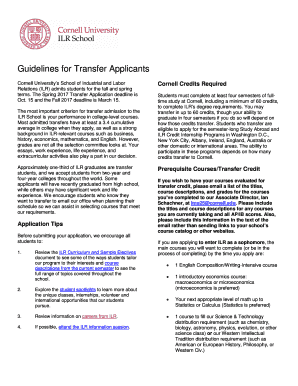

Editing invest and grow sacco app online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ig sacco account activation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ig sacco loan form

How to fill out ig sacco loan form

01

Gather all necessary documentation, including identification and financial statements.

02

Obtain the IG SACCO loan form from the designated location or website.

03

Fill out personal information accurately including your name, contact details, and membership number.

04

Provide information regarding your employment and income details.

05

Specify the loan amount you are applying for and its purpose.

06

Attach required supporting documents such as payslips or bank statements.

07

Review the completed form for any errors or omissions.

08

Submit the form along with the supporting documents to the designated office.

Who needs ig sacco loan form?

01

Members of the IG SACCO who are in need of financial assistance.

02

Individuals looking to finance specific projects or personal expenses through a loan.

03

Those who meet the eligibility criteria set by the IG SACCO.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out the loan form?

Home loan application form Check and gather everything from the list of documents required for the home loan. Log on to the official lender website and apply for a home loan by filling up the form with the following details. Personal information, i.e. name, address, date of birth. PIN code. Employment details. Monthly income.

What are the requirements for IG Sacco loan?

Qualifications: 60 Months Subject to ability to Repay. Documents: Latest Payslip, Duly filled and signed Loan Application Form. Security: Non-withdrawable Deposits, Salary, Savings, Guarantors and Sacco acceptable tangible securities. Multiplier: 5 times your Non-withdrawable Deposits.

What are the requirements for a secured loan?

Secured loans require collateral, like a car or home, while unsecured loans do not. Lenders may offer lower interest rates and larger borrowing limits on secured loans. Common examples of secured loans are auto loans, mortgages and business financing.

How do you qualify for a Centenary Sacco loan?

Salary Loans Loan is eligible to sacco members whose salaries have been channeled through centenary sacco for atleast 1 month. Maximum loan granted is 9 times of 2/3 net pay. The maximum repayment period of 12 months. Attach copies of original stamped payslips and must be endorsed by the employer.

How to withdraw money from IG sacco?

To withdraw your funds, please log in to My IG, go to the 'live accounts' tab, and select 'withdraw funds'. You're able to withdraw funds as a bank transfer (assuming all anti-money laundering regulations have been met), or back to a card account as a refund.

What are the conditions for getting a loan?

Lenders look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a personal loan. Different lenders have different requirements for approving personal loans. Some lenders may be willing to work with applicants who have lower credit scores.

How do I qualify for a sacco loan?

Be an active member of the Sacco with regular deposits contributions. Must have paid (or is paying) the minimum share capital requirement by the Sacco. Must have been a member of the Sacco for at least three months. Must have a regular source of income to support loan repayment (salary, business, farming etc.)

What is a loan request form?

These forms typically gather data such as applicant details, employment and income information, loan amount requested, purpose of the loan, collateral offered, and consent for credit checks. Loan application forms streamline the process of evaluating eligibility, assessing risk, and making informed lending decisions.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ig sacco loan form?

The IG SACCO loan form is a document used by members of a Savings and Credit Cooperative Organization (SACCO) to apply for a loan.

Who is required to file ig sacco loan form?

All members of the SACCO who wish to apply for a loan are required to fill out and file the IG SACCO loan form.

How to fill out ig sacco loan form?

To fill out the IG SACCO loan form, members should provide personal information, loan details, and any required documentation as specified by the SACCO.

What is the purpose of ig sacco loan form?

The purpose of the IG SACCO loan form is to standardize the application process for loans and to collect necessary information for loan approval.

What information must be reported on ig sacco loan form?

The IG SACCO loan form typically requires personal identification details, the amount of loan requested, purpose of the loan, and repayment terms.

Fill out your ig sacco loan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ig Sacco Account Activation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.