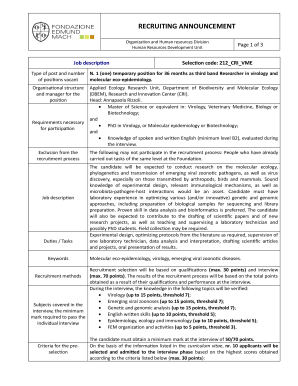

Get the free Sales Tax Definition - What is Sales Tax - Shopify

Show details

2016 Exhibitor Catering Menu 22% Service Charge and 10% Food Sales Tax & 5.75% Nonfood Sales Tax will be charged on all orders. All orders are subject to a ×65 Delivery Fee per delivery service.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales tax definition

Edit your sales tax definition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax definition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales tax definition online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sales tax definition. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax definition

How to fill out sales tax definition

01

To fill out a sales tax definition, follow these steps:

02

Begin by gathering all relevant information about the business you are defining the sales tax for. This includes the type of products or services the business offers, the jurisdiction(s) it operates in, and any applicable tax rates.

03

Determine the specific criteria for sales tax liability in the jurisdiction(s) where the business operates. This may include thresholds for sales volume, types of products/services, or other factors that trigger the requirement to collect and pay sales tax.

04

Consult with a tax advisor or research the specific laws and regulations governing sales tax in the relevant jurisdiction(s). It's important to understand the legal requirements and obligations related to sales tax.

05

Analyze the business transactions and determine which sales are subject to sales tax based on the defined criteria. This may involve reviewing invoices, receipts, and other transaction records.

06

Calculate the sales tax owed for each applicable transaction. This typically involves multiplying the sales amount by the applicable tax rate.

07

Keep accurate records of all sales tax collected and paid. This includes tracking sales amounts, tax rates, and any exemptions or deductions that apply.

08

Prepare and file the necessary sales tax returns with the appropriate tax authority. This usually involves submitting a report of sales and tax collected within a specified period, along with any tax payments owed.

09

Regularly review and update the sales tax definition as needed to account for changes in tax laws or business circumstances.

10

Note: It is important to consult with a tax professional or advisor to ensure compliance with all applicable laws and regulations.

Who needs sales tax definition?

01

Various individuals and entities may need a sales tax definition, including:

02

- Business owners who sell products or services and are required by law to collect and remit sales tax.

03

- Accountants or financial professionals responsible for managing tax compliance and reporting for businesses.

04

- Tax authorities or government agencies that enforce sales tax regulations and require businesses to provide clear definitions and documentation.

05

- Legal professionals who provide guidance and advice on sales tax matters.

06

- Individuals or organizations conducting research or analysis on sales tax policies and practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sales tax definition online?

With pdfFiller, the editing process is straightforward. Open your sales tax definition in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the sales tax definition in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your sales tax definition right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit sales tax definition on an iOS device?

Create, modify, and share sales tax definition using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is sales tax definition?

Sales tax definition refers to the tax imposed on the sale of goods and services that are provided by the government.

Who is required to file sales tax definition?

Businesses that sell goods or services are required to file sales tax definition.

How to fill out sales tax definition?

Sales tax definition can be filled out by reporting the total sales made during a specific period and calculating the tax owed based on the applicable tax rate.

What is the purpose of sales tax definition?

The purpose of sales tax definition is to generate revenue for the government and fund public services and programs.

What information must be reported on sales tax definition?

Information such as total sales, taxable sales, exempt sales, and tax owed must be reported on sales tax definition.

Fill out your sales tax definition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales Tax Definition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.