MD BCPS Employee Combined Withholding Allowance Certificate 2019 free printable template

Show details

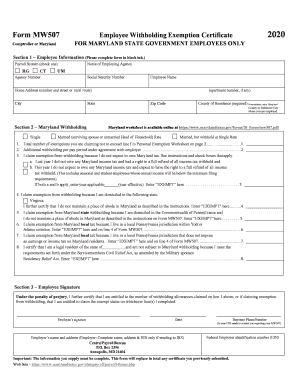

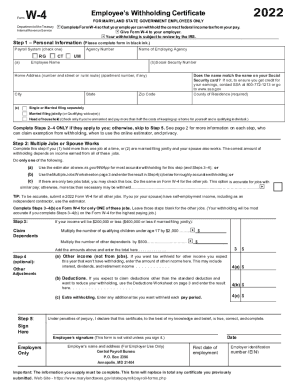

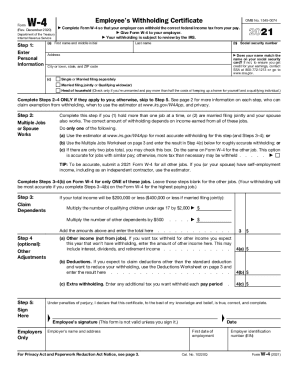

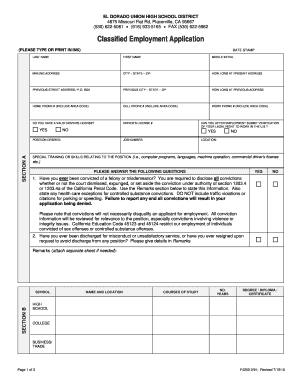

Employee Withholding Allowance Certificate FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY2019Form W4 Department of the Treasury Internal Revenue ServiceNow MW 507 Comptroller of MarylandPlease complete

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD BCPS Employee Combined Withholding Allowance

Edit your MD BCPS Employee Combined Withholding Allowance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD BCPS Employee Combined Withholding Allowance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD BCPS Employee Combined Withholding Allowance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MD BCPS Employee Combined Withholding Allowance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD BCPS Employee Combined Withholding Allowance Certificate Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD BCPS Employee Combined Withholding Allowance

How to fill out MD BCPS Employee Combined Withholding Allowance Certificate

01

Obtain the MD BCPS Employee Combined Withholding Allowance Certificate form from the HR department or online.

02

Fill in your personal information, including your name, address, Social Security number, and filing status.

03

Indicate the number of allowances you are claiming based on your tax situation.

04

Complete the additional sections regarding other income or deductions if applicable.

05

Review your entries for accuracy.

06

Sign and date the form.

07

Submit the completed form to your HR or payroll department.

Who needs MD BCPS Employee Combined Withholding Allowance Certificate?

01

Employees of Maryland Baltimore County Public Schools (BCPS) who wish to adjust their tax withholding allowances.

Fill

form

: Try Risk Free

People Also Ask about

What is Maryland Form 506?

The 7.75 percent tax must be paid to the Comptroller of Maryland with Form MW506 (Employer's Return of Income Tax Withheld). If the payor of the distribution is not currently registered with the Comptroller and has not established a withholding account, the payor can register online.

What is MD form 502?

You must use Form 502 if your federal adjusted gross income is $100,000 or more. All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

What is Maryland form MW506NRS?

Form MW506NRS is designed to assure the regular and timely collection of Maryland income tax due from nonresident sellers of real property located within the State.

What is Maryland withholding tax for non residents?

A nonresident entity must make an 8.25% payment. See Withholding Requirements for Sales of Real Property by Nonresidents.

What is a md101 form?

What is the md101 form? MD-101: Managing Modern Desktop certification is a great way to get started in your Microsoft 365 Career ! This certification validates your ability to manage and support modern desktop environments, including Windows 10 and Office 365.

What is a MD form 515?

FORM. 515. FOR NONRESIDENTS EMPLOYED IN MARYLAND WHO. RESIDE IN JURISDICTIONS THAT IMPOSE A LOCAL. INCOME OR EARNINGS TAX ON MARYLAND RESIDENTS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MD BCPS Employee Combined Withholding Allowance to be eSigned by others?

MD BCPS Employee Combined Withholding Allowance is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the MD BCPS Employee Combined Withholding Allowance electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your MD BCPS Employee Combined Withholding Allowance in seconds.

How can I fill out MD BCPS Employee Combined Withholding Allowance on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your MD BCPS Employee Combined Withholding Allowance, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is MD BCPS Employee Combined Withholding Allowance Certificate?

The MD BCPS Employee Combined Withholding Allowance Certificate is a form used by employees in Maryland to declare their withholding allowances for state and local income taxes.

Who is required to file MD BCPS Employee Combined Withholding Allowance Certificate?

Employees who work in Maryland and have taxes withheld from their paycheck are required to file the MD BCPS Employee Combined Withholding Allowance Certificate.

How to fill out MD BCPS Employee Combined Withholding Allowance Certificate?

To fill out the MD BCPS Employee Combined Withholding Allowance Certificate, employees should provide their personal information, claim the appropriate number of allowances, and sign the form.

What is the purpose of MD BCPS Employee Combined Withholding Allowance Certificate?

The purpose of the MD BCPS Employee Combined Withholding Allowance Certificate is to inform employers about the number of allowances employees wish to claim for tax withholding purposes.

What information must be reported on MD BCPS Employee Combined Withholding Allowance Certificate?

The information that must be reported includes the employee's name, social security number, address, marital status, and the number of withholding allowances claimed.

Fill out your MD BCPS Employee Combined Withholding Allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD BCPS Employee Combined Withholding Allowance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.