Get the free Mortgage LoansHome LoansU.S. Bank

Show details

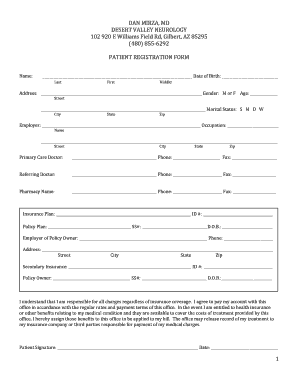

As you can see I am currently paying monthly on this loan in which I still have a little over $4,000 to pay. Below you will notice loan US Bank Loan information that illus tares the loans I have taken

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loanshome loansus bank

Edit your mortgage loanshome loansus bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loanshome loansus bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loanshome loansus bank online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage loanshome loansus bank. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loanshome loansus bank

How to fill out mortgage loanshome loansus bank

01

To fill out mortgage loans/home loans from US Bank, follow these steps:

1. Gather all the required documents, which may include proof of income, tax returns, bank statements, and identification.

02

Research and compare different mortgage loan options offered by US Bank to find the one that suits your needs. Consider factors such as interest rates, loan terms, and any additional fees associated with the loan.

03

Contact a loan officer at US Bank or visit their website to start the application process.

04

Complete the application form accurately and provide all the necessary information. Be prepared to disclose your financial situation, employment history, and any other relevant details.

05

Submit the completed application along with the required documents to US Bank for review.

06

Await a response from US Bank regarding the status of your application. This may take some time as they evaluate your eligibility and conduct a thorough assessment of your financial situation.

07

If your application is approved, review the loan terms and conditions provided by US Bank.

08

Sign the loan agreement and fulfill any remaining requirements as specified by US Bank.

09

Arrange for the payment of any upfront costs or fees associated with the mortgage loan.

10

Fulfill any post-approval requirements, such as providing additional documentation if requested by US Bank.

11

Once all the necessary steps are completed, US Bank will disburse the loan amount as agreed upon.

12

Repay the mortgage loan according to the terms and conditions outlined by US Bank.

Who needs mortgage loanshome loansus bank?

01

Mortgage loans/home loans offered by US Bank are typically needed by individuals or families who wish to purchase a home but do not have sufficient funds to make the purchase outright.

02

These loans are also needed by those who want to refinance their existing mortgage loans to take advantage of lower interest rates, obtain better loan terms, or access the equity built in their homes for other financial needs.

03

Additionally, mortgage loans may be necessary for individuals looking to invest in real estate by purchasing properties for rental income or as a means of building long-term wealth.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortgage loanshome loansus bank online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your mortgage loanshome loansus bank to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out mortgage loanshome loansus bank using my mobile device?

Use the pdfFiller mobile app to fill out and sign mortgage loanshome loansus bank on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete mortgage loanshome loansus bank on an Android device?

Use the pdfFiller mobile app to complete your mortgage loanshome loansus bank on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is mortgage loanshome loansus bank?

Mortgage loans are loans provided by US banks for the purpose of purchasing a home.

Who is required to file mortgage loanshome loansus bank?

Individuals or couples who are applying for a mortgage loan from a US bank are required to file the necessary paperwork.

How to fill out mortgage loanshome loansus bank?

To fill out a mortgage loan application from a US bank, you will need to provide personal and financial information, including income, assets, debts, and credit history.

What is the purpose of mortgage loanshome loansus bank?

The purpose of mortgage loans from US banks is to help individuals or couples purchase a home by providing them with the necessary funds.

What information must be reported on mortgage loanshome loansus bank?

Information such as personal details, employment history, income, assets, debts, and credit history must be reported on mortgage loan applications from US banks.

Fill out your mortgage loanshome loansus bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loanshome Loansus Bank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.