Get the free Restricted Stock awarded to Mr

Show details

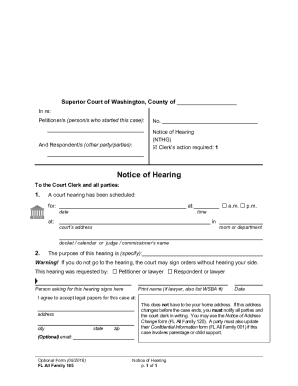

SEC Form 4FORM 4UNITED STATES SECURITIES AND EXCHANGE COMMISSIONCheck this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).OMB Number: hours

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign restricted stock awarded to

Edit your restricted stock awarded to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your restricted stock awarded to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing restricted stock awarded to online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit restricted stock awarded to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out restricted stock awarded to

How to fill out restricted stock awarded to

01

To fill out restricted stock awarded to, follow these steps:

02

Begin by reviewing the terms and conditions of the restricted stock award. Make sure you understand the vesting schedule, restrictions, and any other requirements.

03

Obtain the necessary forms or documentation from the company or institution that granted the restricted stock award. This may include stock award agreements, tax forms, and other relevant documents.

04

Carefully read and complete the required forms, providing accurate and up-to-date information. Pay attention to details such as your personal information, the number of awarded shares, and any required signatures.

05

Consult with a financial advisor or tax professional if needed, especially if there are tax implications or specific strategies for handling the restricted stock award.

06

Submit the completed forms and any supporting documentation to the appropriate party according to the instructions provided. Ensure that you meet any stated deadlines or submission requirements.

07

Keep copies of all the submitted paperwork and maintain organized records for future reference or potential audits.

08

Monitor the progress of your restricted stock award, particularly in relation to vesting. Stay informed about any changes in restrictions or additional requirements that may arise.

09

Once the restricted stock award has fully vested or met the required conditions, consider your options for managing or selling the awarded shares. Seek professional advice if necessary to make informed decisions.

10

Remember, the process of filling out restricted stock awarded to may vary depending on the specific circumstances and instructions provided by the granting entity. It is important to carefully review all relevant materials and seek professional help when needed.

Who needs restricted stock awarded to?

01

Restricted stock awards are typically granted to specific individuals, often as part of an employment or compensation package. The recipients of restricted stock awards can include:

02

- Employees of a company as an incentive or reward for their contributions and performance.

03

- Executives, directors, or other key personnel to align their interests with the company's long-term success.

04

- Consultants or contractors who have made significant contributions to a project or initiative.

05

- Advisors or board members who provide guidance and expertise to the organization.

06

In general, restricted stock awards are used to motivate and retain individuals with a vested interest in the company's performance and growth. The specific criteria for eligibility and selection may vary depending on the policies and practices of the granting entity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send restricted stock awarded to to be eSigned by others?

When you're ready to share your restricted stock awarded to, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in restricted stock awarded to without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit restricted stock awarded to and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit restricted stock awarded to on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign restricted stock awarded to. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is restricted stock awarded to?

Restricted stock is typically awarded to employees as part of their compensation package.

Who is required to file restricted stock awarded to?

The employer is required to report the restricted stock awarded to employees.

How to fill out restricted stock awarded to?

Restricted stock awards are typically reported on IRS Form 3921 or Form 3922.

What is the purpose of restricted stock awarded to?

The purpose of awarding restricted stock is to incentivize employees to stay with the company and perform well.

What information must be reported on restricted stock awarded to?

Information such as the number of shares, grant date, fair market value, and vesting schedule must be reported.

Fill out your restricted stock awarded to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Restricted Stock Awarded To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.