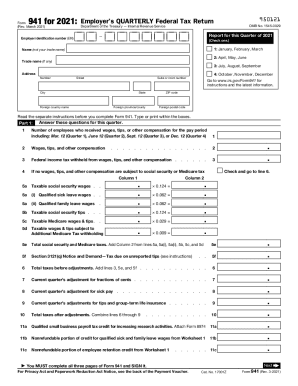

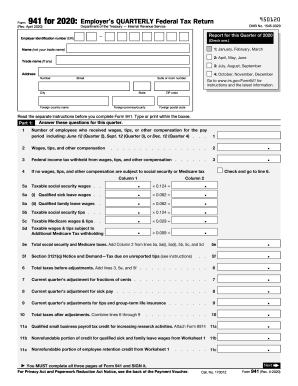

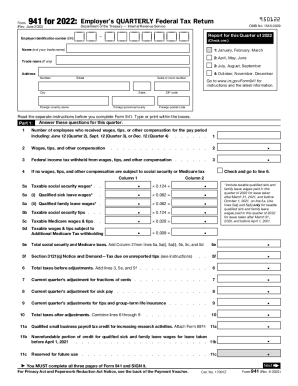

IRS 941 2019 free printable template

Instructions and Help about IRS 941

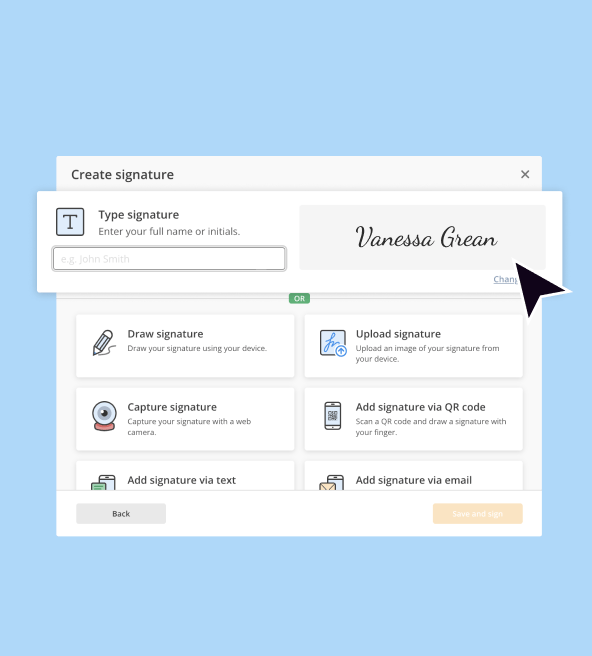

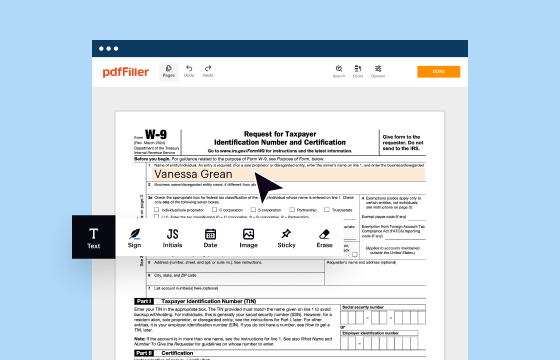

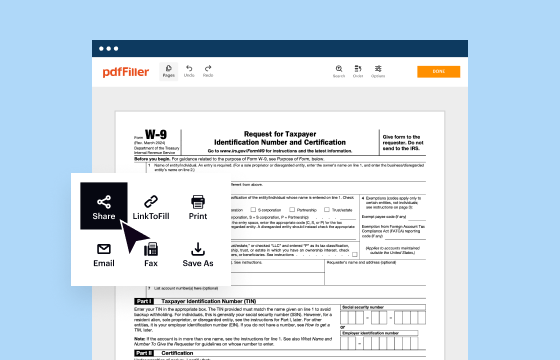

How to edit IRS 941

How to fill out IRS 941

About IRS previous version

What is IRS 941?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

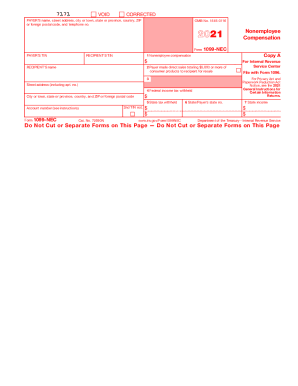

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 941

How can I correct mistakes on an already filed IRS 941?

To correct mistakes on an IRS 941 that has already been filed, you will need to submit Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund. This form allows you to amend your original filing and address specific errors such as miscalculations of tax liability or incorrect employee counts. Make sure to carefully follow the instructions for Form 941-X to ensure accurate processing.

How can I check the status of my IRS 941 submission?

To verify the status of your IRS 941 submission, you can call the IRS Business & Specialty Tax Line. They can provide you with information on whether your form has been received and if there are any issues. Additionally, if you e-filed, you might receive immediate confirmation from the e-filing system, which can help you track the processing status.

What should I do if I receive a notice from the IRS regarding my 941?

If you receive a notice from the IRS about your IRS 941, it's essential to read it thoroughly to understand the issue. Follow the instructions provided in the notice, which may require additional documentation or a response. Prepare any necessary paperwork and respond promptly to avoid further penalties, and keep a copy of all correspondence for your records.

What are some common errors that happen while filing IRS 941?

Common errors while filing IRS 941 include misreporting employee wages, claiming incorrect tax credits, or failing to sign the form. Double-checking figures and using tax preparation software can help avoid these mistakes. If you notice an error after filing, taking prompt action to amend the return with Form 941-X is crucial to mitigate potential penalties.

See what our users say