Canada A008MF 2017-2025 free printable template

Show details

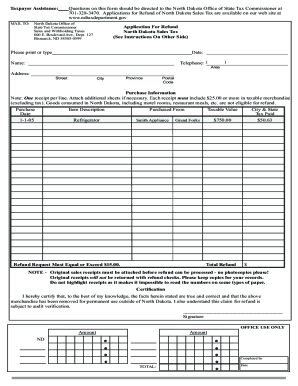

Refund Request Form

PLEASE COMPLETE IN FULL AND ATTACH ALL REQUIRED DOCUMENTS*

A separate form must be completed for each policy

(* Incomplete request form and/or insufficient documents may cause

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2017 refund form

Edit your allianz refund request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request a008mf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing refund a008mf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2017 refund a008mf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request form a008mf

How to fill out Canada A008MF

01

Obtain the Canada A008MF form from the official government website or local office.

02

Read the instructions carefully to understand the purpose of the form.

03

Begin with filling out your personal information such as name, address, and contact details.

04

Provide details of your immigration status or application number as required.

05

Complete the sections relevant to the purpose of the form, ensuring accuracy in your responses.

06

Attach any necessary supporting documents as specified in the instructions.

07

Review the completed form for any errors or omissions.

08

Sign and date the form where required.

09

Submit the form through the specified method (online, by mail, or in-person) as indicated in the instructions.

Who needs Canada A008MF?

01

Individuals applying for immigration or temporary resident status in Canada.

02

Applicants seeking specific government services related to immigration.

Fill

baggage cancellation

: Try Risk Free

People Also Ask about 2017 form a008mf

How long does it take to get a refund from GIC?

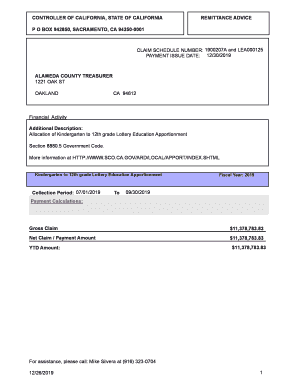

Charges DescriptionChargesProcessing Time7-10 daysWire Transfer FeesNILCancellation FeeCAD 150 + CAD 25 (Wire Transfer fees)Refund Fee4 Weeks3 more rows

What is a NR7-R form?

To get a refund of excess or incorrectly withheld Part XIII tax, a non-resident has to fill out Form NR7-R, Application for Refund of Part XIII Tax Withheld. The CRA has to receive this form no later than two years from the end of the calendar year in which the tax was sent to the CRA .

How do I get a refund from Canadian immigration?

How to request a refund if you have not been automatically refunded Sign in in to the account you created with our payment service. Go to “My receipts” and find the correct receipt in the list. Select “Get receipt” to view it. Select “Request a refund”.

How do I get a tax refund in Canada?

Direct deposit is the fastest way to get your refund and other payments from the CRA. The CRA will deposit your payments securely into your account at a Canadian financial institution. If you are not signed up for direct deposit, the only other way to get your CRA payments is by cheque.

How to get money back from immigration?

Getting the bond money back involves sending Form I-391 and your original immigration bond receipt, known as Form I-305, to the Debt Management Center. If you have Form I-352, which is the original copy of the bond contract, you should include it in your mailing.

How do I request a refund?

What to Include in Your Refund Request Letter Include details about the transaction. Explain why you are seeking a refund, but make sure that your reason falls within the refund policy. Include your contact information so that the business can reach you in case they would like to accept your refund request.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form a008mf ca?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the refund request form canada. Open it immediately and start altering it with sophisticated capabilities.

How do I complete refund request form canada online?

pdfFiller has made it easy to fill out and sign refund request form canada. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete refund request form canada on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your refund request form canada, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is Canada A008MF?

Canada A008MF is a specific form used by the Canada Revenue Agency (CRA) for reporting and assessing certain financial information for individuals or entities in Canada.

Who is required to file Canada A008MF?

Individuals or entities who meet specific criteria set forth by the Canada Revenue Agency, particularly related to income thresholds, types of income, or resident status are required to file Canada A008MF.

How to fill out Canada A008MF?

To fill out Canada A008MF, individuals need to provide accurate financial information as required in the form sections, ensuring to reference the accompanying instructions for guidance on specific entries.

What is the purpose of Canada A008MF?

The purpose of Canada A008MF is to collect detailed financial information to assess tax liabilities, compliance with Canadian tax laws, and to support the CRA's ability to administer tax policies effectively.

What information must be reported on Canada A008MF?

On Canada A008MF, individuals must report various types of income, deductions, credits, and any other financial information that the CRA specifically requires, such as personal identification and tax residency details.

Fill out your refund request form canada online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund Request Form Canada is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.