MA LCTL-ANS-CS 2013-2025 free printable template

Show details

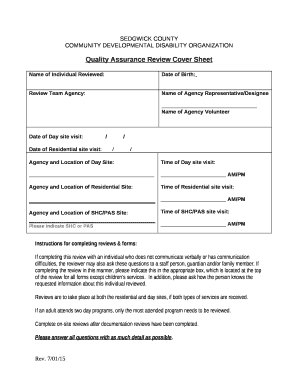

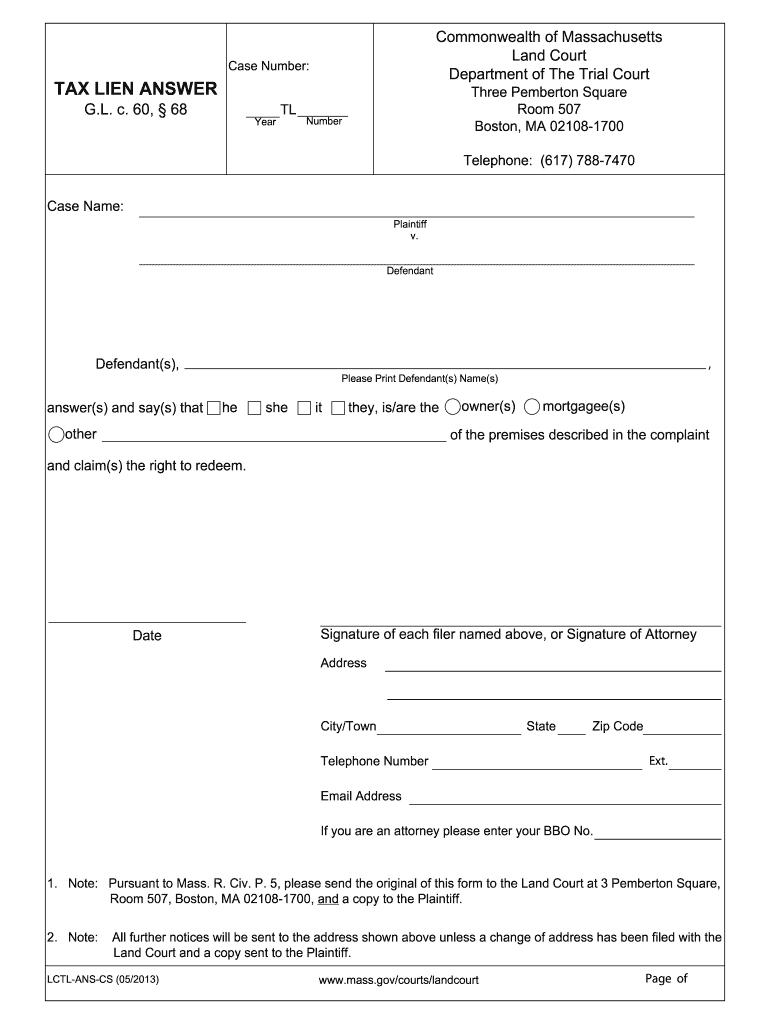

Commonwealth of Massachusetts Land Court Department of The Trial Court Case Number: TAX LIEN ANSWER G.L. c. 60, 68 Year TL Three Pemberton Square Room 507 Boston, MA 02108-1700 Number Telephone: (617)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax lien answer form

Edit your ma lctl cs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts tax lien answer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts tax lien answer online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit massachusetts tax lien answer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massachusetts tax lien answer

How to fill out MA LCTL-ANS-CS

01

Obtain the MA LCTL-ANS-CS form from the appropriate authority or website.

02

Read the instructions carefully to understand the requirements for the form.

03

Fill out your personal information in the designated fields, including your name, contact details, and relevant identifiers.

04

Provide the necessary language proficiency information, including the languages you are proficient in and the levels of proficiency.

05

Attach any required documentation that supports your language skills, such as transcripts or certificates.

06

Review the completed form to ensure all sections are filled out correctly and that there are no errors.

07

Submit the form to the specified department or organization by the deadline.

Who needs MA LCTL-ANS-CS?

01

Individuals applying for a language certification program.

02

Students seeking to demonstrate their competencies in Less Commonly Taught Languages (LCTL).

03

Language instructors looking to validate their teaching qualifications.

04

Employers seeking to assess the language skills of potential employees.

Fill

form

: Try Risk Free

People Also Ask about

Is Massachusetts a tax lien or tax deed state?

Real property in Massachusetts, including time-shares, is subject to a lien for estate taxes upon the death of anyone who has a legal interest in the property.

What is a notice of Massachusetts tax lien?

To protect the Commonwealth's interests, the collector will file a "Notice of Massachusetts Tax Lien." The tax lien is a public record and attaches to all of the taxpayer's real and personal property and may prevent the sale or transfer of the property attached.

What is a Massachusetts tax lien?

A tax lien allows a city, town, or sometimes a third party to get the tax title (see below) to the property, and after proper proceedings, to get full ownership of the property to enforce the collection of real estate taxes or water/sewer bills.

What is a release of Massachusetts tax lien?

The standard method of obtaining a release of estate tax lien is to file an estate tax return with the Massachusetts Department of Revenue (DOR) and obtain from the DOR a Release of Estate Tax Lien, known as an M-792 certificate. This is the required method when dealing with estates that are worth $1,000,000 or more.

Does Massachusetts sell tax lien certificates?

60. Under M.G.L. c. 60 § 52, municipalities may sell tax obligations to third-party investors at several points in the tax foreclosure process (as receivables, liens or tax titles) to raise immediate revenue.

What IRS form do I need to release a tax lien?

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the massachusetts tax lien answer in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your massachusetts tax lien answer in minutes.

How can I edit massachusetts tax lien answer on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing massachusetts tax lien answer.

Can I edit massachusetts tax lien answer on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign massachusetts tax lien answer right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is MA LCTL-ANS-CS?

MA LCTL-ANS-CS is a form used in Massachusetts for reporting specific information related to licenses held by certain entities or individuals.

Who is required to file MA LCTL-ANS-CS?

Entities or individuals who hold certain types of licenses in Massachusetts are required to file the MA LCTL-ANS-CS form.

How to fill out MA LCTL-ANS-CS?

To fill out MA LCTL-ANS-CS, you need to provide accurate details as required on the form, including your personal or business information, license details, and any other mandated information.

What is the purpose of MA LCTL-ANS-CS?

The purpose of MA LCTL-ANS-CS is to ensure compliance with state regulations and to keep track of licensed activities in Massachusetts.

What information must be reported on MA LCTL-ANS-CS?

The information that must be reported on MA LCTL-ANS-CS includes license identification numbers, personal identifiers, and any specific transactions or activities associated with the license.

Fill out your massachusetts tax lien answer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Tax Lien Answer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.