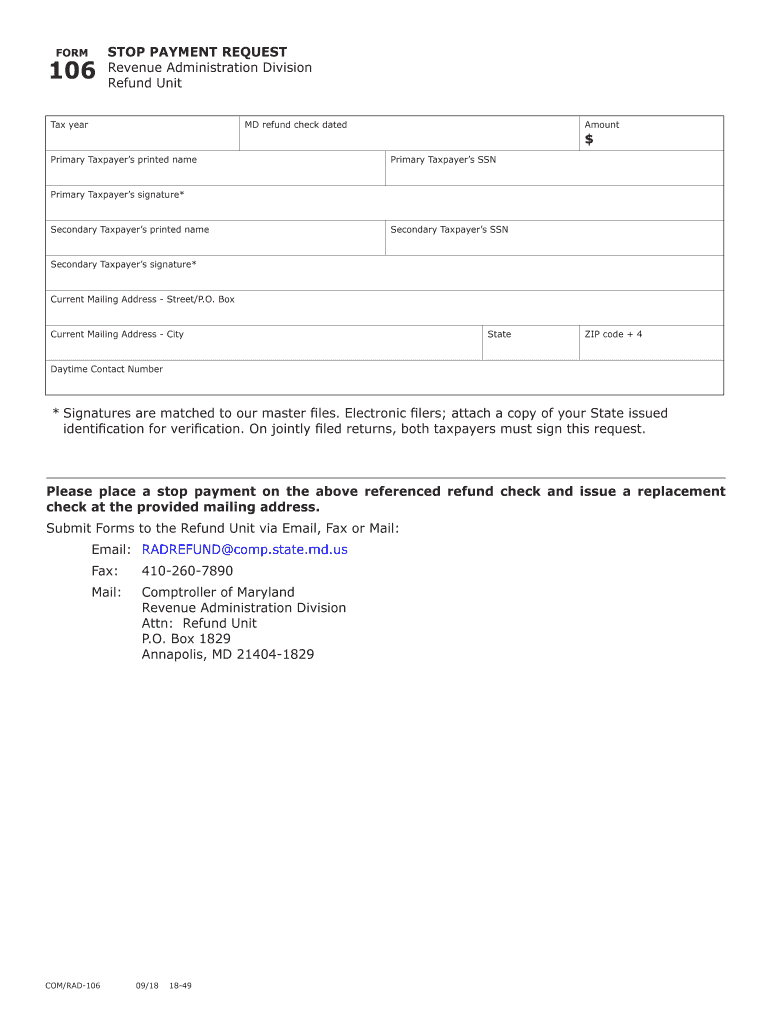

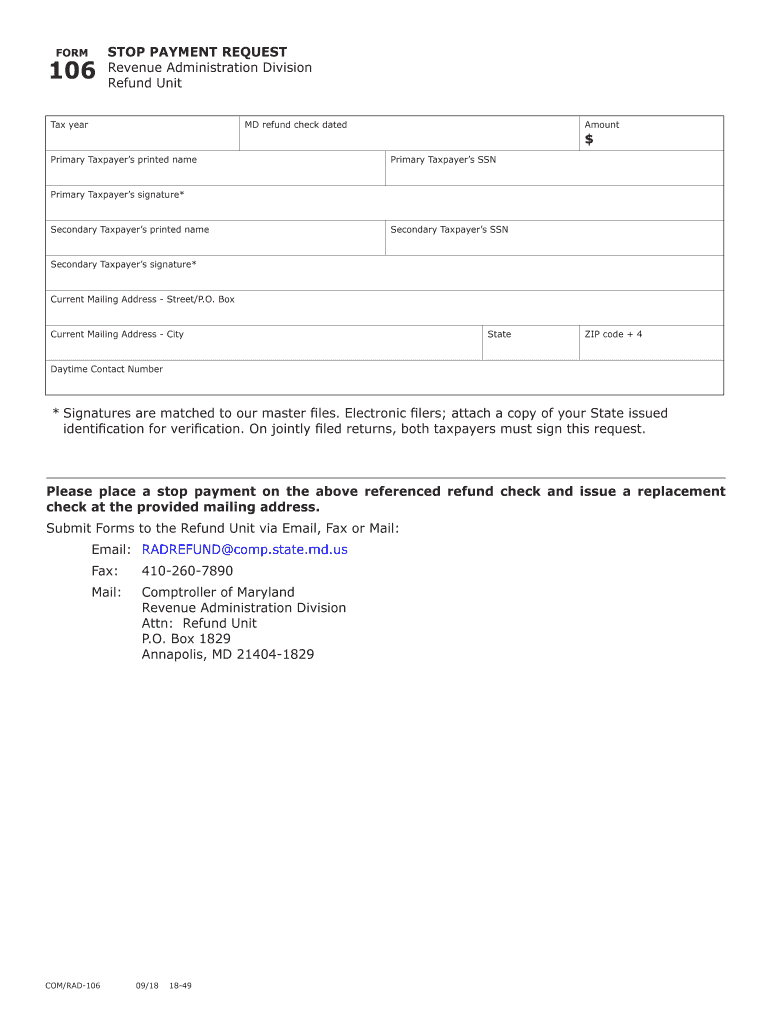

MD RAD 106 2018 free printable template

Show details

FORM106STOP PAYMENT REQUEST Revenue Administration Division Refund Unitas year MD refund check datedPrimary Taxpayers printed Paramount Primary Taxpayers signature×Secondary Taxpayers printed nameSecondary

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD RAD 106

Edit your MD RAD 106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD RAD 106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD RAD 106 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MD RAD 106. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD RAD 106 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD RAD 106

How to fill out MD RAD 106

01

Obtain the MD RAD 106 form from the relevant authority or website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information including name, address, and contact details in the designated fields.

04

Provide specific details related to the purpose of the form as required by the instructions.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form according to the guidelines provided (online, mail, or in-person).

Who needs MD RAD 106?

01

Individuals or organizations required to provide information for regulatory compliance.

02

Healthcare professionals needing to report or document activity as per guidelines.

03

Researchers collecting data for studies involving medical records.

Fill

form

: Try Risk Free

People Also Ask about

What is a Maryland Form 502?

Form 502 for full- or part-year residents. Maryland State and Local Nonresident Tax Forms and Instructions for filing nonresident personal state and local income taxes. Forms 502 and 502B for full- or part-year residents claiming dependents. Form 502CR.

Do I need to file Maryland tax return?

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

What is Maryland Form 511?

Form 511 is used by an Electing PTE to file an income tax return for a specific tax year or period and to remit Electing PTE tax paid on all members' distributive or pro rata shares of income. You must elect to remit tax on all members' shares of income in order to use this form.

What is the Maryland minimum filing requirement?

Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

What is Maryland 510D?

Purpose of Form Form 510D is used by a pass-through entity (PTE) to declare and remit estimated tax for nonresi- dents. The PTE may elect to declare and remit estimated tax on behalf of resident members.

Do I need to file a Maryland nonresident return?

You will need to file a nonresident income tax return to Maryland, using Form 505 and Form 505NR if you have income derived from: tangible property, real or personal, permanently located in Maryland; a business, trade, profession or occupation carried on in Maryland; or, gambling winnings derived from Maryland sources.

What is a MD form 515?

FORM. 515. FOR NONRESIDENTS EMPLOYED IN MARYLAND WHO. RESIDE IN JURISDICTIONS THAT IMPOSE A LOCAL. INCOME OR EARNINGS TAX ON MARYLAND RESIDENTS.

What is Maryland Schedule K 1 510?

Use Maryland Schedule K-1 (510) to report the distributive or pro rata share of the member's income, additions, subtractions, nonresident pass-through entity tax, pass-through entity election tax, and credits allocable to Maryland.

What is Maryland Form 510?

Taxability Form 510 generally is an infor mation return. The items of income or loss of the PTE are passed through to the members and subject to tax on the members' Maryland income tax return.

What is Maryland tax form 502?

You must use Form 502 if your federal adjusted gross income is $100,000 or more. All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

What is a 502 form?

More In Forms and Instructions Publication 502 explains the itemized deduction for medical and dental expenses that you claim on Schedule A (Form 1040), including: What expenses, and whose expenses, you can and cannot include in figuring the deduction.

What forms do I need to file my taxes by mail?

Attach copies of income forms W-2, 1099, and other income documents to the front of your Form 1040. The IRS address you use depends on where you live and whether you are enclosing a check or expecting a refund. You can find the right IRS mailing address to use here.

Does Maryland require a state tax form?

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay. The State of Maryland has a form that includes both the federal and state withholdings on the same form.

Who must file a MD return?

Usually Maryland requires a person to file a state tax return if that person meets these criteria: A Maryland resident or statutory resident; Who was required to file a federal tax return; and, Had a gross income exceeding the maximum income limits based on age and filing status.

What is Maryland state tax form 502?

You must use Form 502 if your federal adjusted gross income is $100,000 or more. All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

Who must file MD form 510?

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MD RAD 106 online?

The editing procedure is simple with pdfFiller. Open your MD RAD 106 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the MD RAD 106 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your MD RAD 106 in minutes.

Can I edit MD RAD 106 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign MD RAD 106 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is MD RAD 106?

MD RAD 106 is a financial reporting form used in Maryland to provide information about an individual's or entity's tax status and other relevant financial data.

Who is required to file MD RAD 106?

Individuals or entities that meet certain income thresholds or engage in specific activities requiring tax reporting in Maryland are required to file MD RAD 106.

How to fill out MD RAD 106?

To fill out MD RAD 106, individuals or entities must gather necessary financial information, complete the designated sections of the form accurately, and submit it to the appropriate tax authority by the specified deadline.

What is the purpose of MD RAD 106?

The purpose of MD RAD 106 is to ensure compliance with state tax regulations by collecting essential tax-related information from individuals and entities for assessment and review.

What information must be reported on MD RAD 106?

MD RAD 106 requires reporting of personal information, income details, deductions, tax credits, and any other relevant financial information pertaining to the individual's or entity's taxable activities.

Fill out your MD RAD 106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD RAD 106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.