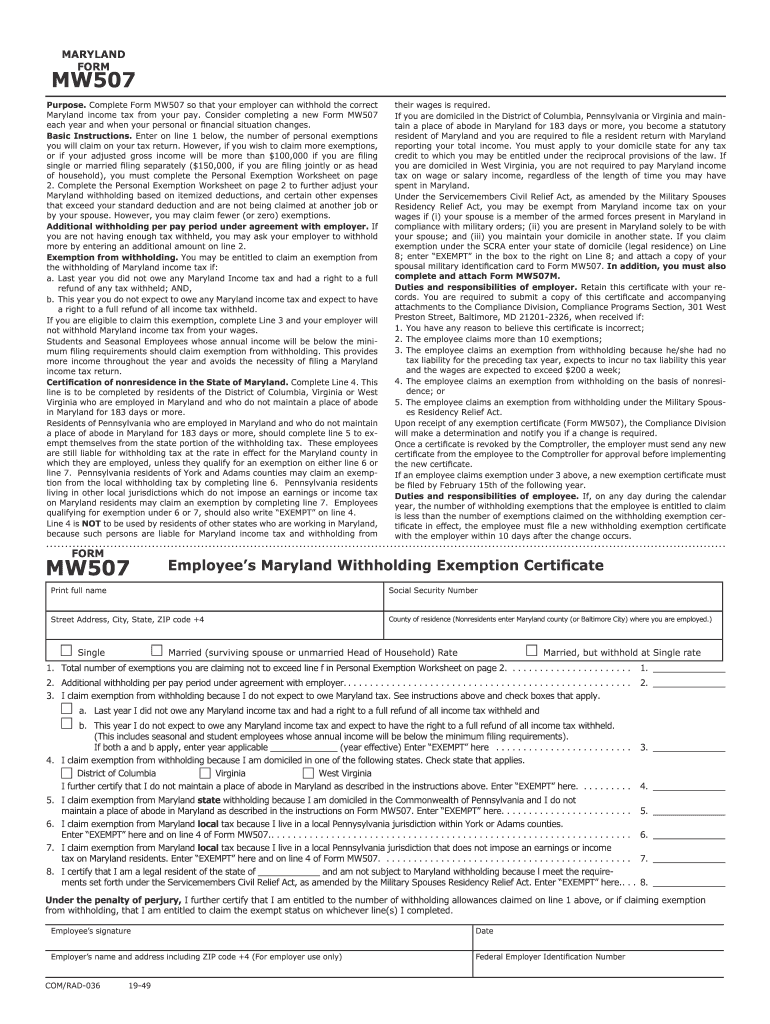

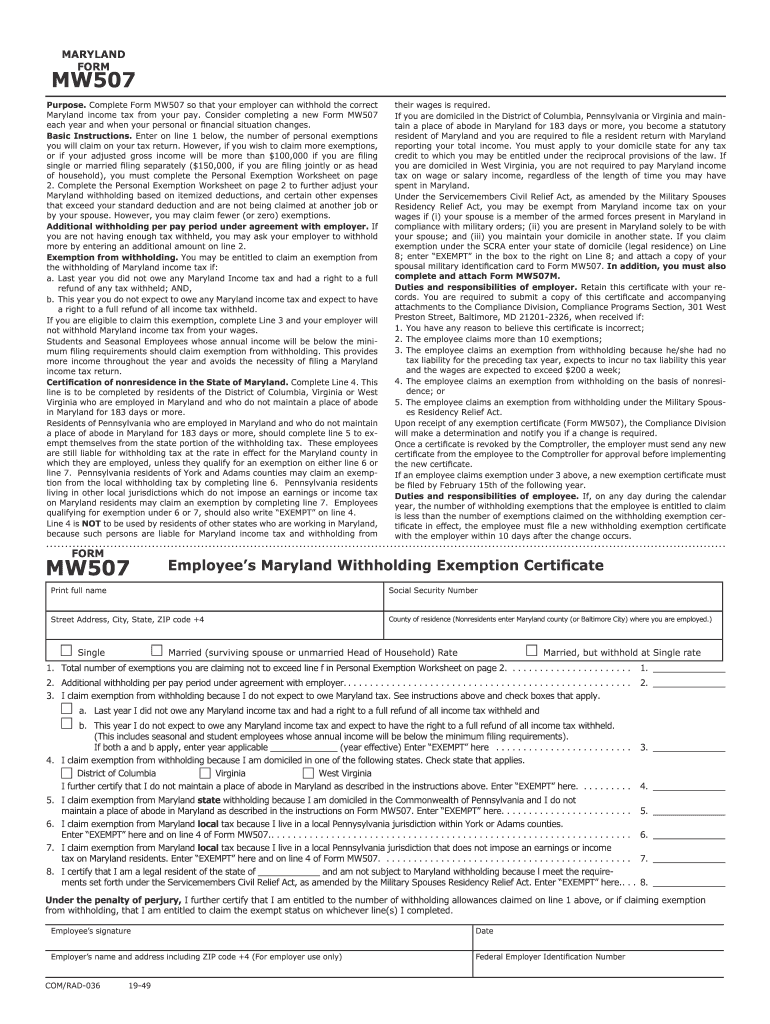

MD Comptroller MW 507 2019 free printable template

Get, Create, Make and Sign maryland 507 form 2019

Editing maryland 507 form 2019 online

Uncompromising security for your PDF editing and eSignature needs

MD Comptroller MW 507 Form Versions

How to fill out maryland 507 form 2019

How to fill out MD Comptroller MW 507

Who needs MD Comptroller MW 507?

Instructions and Help about maryland 507 form 2019

This is Joe from how to form an LLC dot org, and today we're going to be forming an LLC in the state of Maryland now the first step with forming an LLC is before we can even get into here is you have to decide a name for your LLC and the reason that is because the number one reason why an LLC gets rejected is because it has the same or similar name to another name already registered so if you want to go in the description of this video there's a link to this webpage you want to click in it, and then you want to go down to the Maryland LLC search tool that we have on our website you click that and as it loads you'll be brought to its solar website, but we have the Maryland government web page embedded in our site so that you can search and all you have to do is scroll down under name just type in the name that you want for example if we want the name real estate for a real estate LLC what we can see if the record exists, and it's searching the database right now, and we'll see in a second or two if this LLC exists or not, but this is a perfect tool just because that's the number one reason why now it looks like that usually we'll say real estate LLC that was LLC this says its personal properties that that does not count ok here we go the real estate LLC, so that's really close to real estate also you see have a chance at getting rejected for that, so you might want to try something else, but you weren't looking to do that anyway, but that's just to give you an example of how that works but let's say that you've gone through it, you chose a name that didn't exist, and you're ready to go through well Maryland you still have to do a paper filing Maryland hasn't moved to online yet, but hopefully they will in the near future but for now it's still a paper app location, so we have the actual application right on our website you just click the Maryland articles of organization link and what will pop up is an Adobe PDF form that is the state form, and it's you can fill it in so once this thing gets open, so it's just very generic the name of the limited liability company type that in here purpose for which it is filed if you're a real estate company just type in this if you're really secretive, and you don't want anyone to know you can just write any lawful purpose or anything legal under the state of Maryland you just have to have something here they're not so much interested in what you're doing the address of the company registered in agent now this is something that tricks up a lot of people the resident agent is a representative of your LLC it's it can be the owner, but it doesn't have to be this is where all legal notice is going to be sent to this person and their address, so you want to make sure that this is correct at all times because whether someone's trying to get in contact with you legally or it's the actual state trying to contact you they're going to be sending everything to this address, so you want to make sure that this is filled in...

People Also Ask about

Do I need to fill out a MW507 form?

What is the MD MW507 form?

How many exemptions can you claim for MW507?

Who needs to fill out a MW507?

Do I have to fill out a MW507 form?

What happens if you claim exempt all year?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find maryland 507 form 2019?

How do I edit maryland 507 form 2019 online?

Can I create an electronic signature for the maryland 507 form 2019 in Chrome?

What is MD Comptroller MW 507?

Who is required to file MD Comptroller MW 507?

How to fill out MD Comptroller MW 507?

What is the purpose of MD Comptroller MW 507?

What information must be reported on MD Comptroller MW 507?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.