Get the free Life Insurance Benefits for Members of the Baltimore Teachers Union - bavc bcps k12 md

Show details

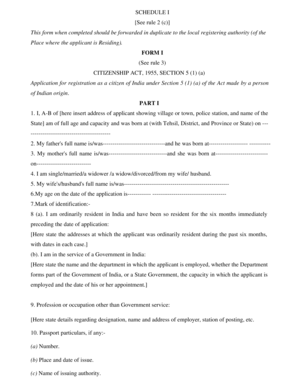

Baltimore City Public Schools Teachers Union Teachers Employee Term Life Coverage Accidental Death and Dismemberment Coverage Dependents Term Life Coverage Foreword We are pleased to present you with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance benefits for

Edit your life insurance benefits for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance benefits for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance benefits for online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance benefits for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance benefits for

How to fill out life insurance benefits:

01

Obtain the necessary forms: Contact your life insurance provider to request the forms needed to file for life insurance benefits. They will guide you through the specific documents required for your policy.

02

Gather supporting documents: Collect all the necessary supporting documents, such as the original policy document, the insured person's death certificate, identification documents, and any other relevant paperwork requested by the insurance provider.

03

Complete the forms accurately: Carefully fill out the forms, ensuring that all information is accurate and up-to-date. This may include providing personal details about the insured person, beneficiaries, and contact information.

04

Review the forms and seek assistance if needed: Double-check the completed forms for any errors or missing information. It's advisable to consult with an insurance agent or a professional if you have any doubts or require clarification during the process.

05

Submit the forms to the insurance provider: Once the forms are completed, sign and date them accordingly. Make copies for your records and send the original forms to the insurance provider through a secure channel, such as certified mail or online submission.

Who needs life insurance benefits:

01

Breadwinners: Individuals who financially support their families or dependents should consider life insurance benefits to provide financial security in the event of their untimely death. This ensures that loved ones are not burdened with financial responsibilities or debts.

02

Parents: Parents, especially those with young children, should prioritize life insurance benefits to protect their family's future. The coverage can assist in covering childcare expenses, education costs, and any outstanding debts.

03

Homeowners: Homeowners with mortgages should consider life insurance benefits to help cover the outstanding home loan balance if they pass away. This ensures that their loved ones can continue residing in the home without the added financial strain.

04

Business owners: Business owners may require life insurance benefits to safeguard their company's future and protect their partners or co-owners in case of their death. This can help cover business expenses, ensure a smooth transition of ownership, and provide financial stability during such a challenging time.

05

Anyone with financial obligations: Individuals with outstanding debts, such as student loans, personal loans, or credit card debts, may need life insurance benefits to prevent their loved ones from inheriting the financial burden.

Note: It is essential to review your specific circumstances and consult with a qualified insurance professional to determine the exact requirements and insurance coverage suitable for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life insurance benefits for?

Life insurance benefits are designed to provide financial support to the beneficiaries of the policyholder upon the insured's death.

Who is required to file life insurance benefits for?

The beneficiaries of the life insurance policy are typically responsible for filing for the benefits.

How to fill out life insurance benefits for?

To fill out life insurance benefits, the beneficiaries must contact the insurance company, provide necessary documentation such as the death certificate, complete any required forms, and follow the company's specific procedures.

What is the purpose of life insurance benefits for?

The purpose of life insurance benefits is to provide financial assistance to the loved ones of the deceased insured, helping them cover expenses and maintain their standard of living.

What information must be reported on life insurance benefits for?

Information such as the policyholder's name, policy number, date of death, cause of death, and the beneficiary's information must be reported on the life insurance benefits form.

How can I manage my life insurance benefits for directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your life insurance benefits for as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send life insurance benefits for for eSignature?

Once your life insurance benefits for is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in life insurance benefits for?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your life insurance benefits for to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your life insurance benefits for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Benefits For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.