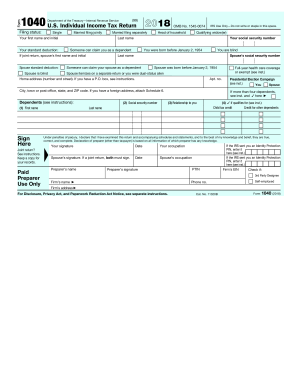

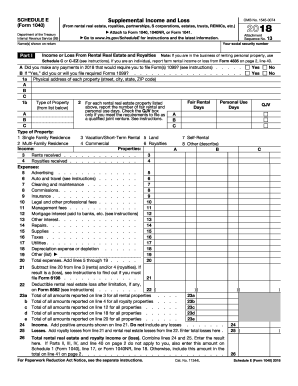

MO W-4 2018 free printable template

Get, Create, Make and Sign MO W-4

How to edit MO W-4 online

Uncompromising security for your PDF editing and eSignature needs

MO W-4 Form Versions

How to fill out MO W-4

How to fill out MO W-4

Who needs MO W-4?

Instructions and Help about MO W-4

How×39’s it's going everybodTibetanatherehe bush today IN×39’goinTonyna show you how to fill out your w-4 form properly so that you do not owe the government any money and that you do not get an excessive tax return at the end of the year this is anywhere that is more than a thousand dollars it's generally not a good idea because you×39’re essentiallgivinghgovernmentnt a loan of $1,000 or so forth whole year now if you stick this in the bank instead well you×39

People Also Ask about

What is the difference between a federal W4 and a state W4?

Can I print my own W-4 forms?

Does Missouri have a W4 form?

What is the difference between state and federal withholding?

Is there a separate w4 for state and federal?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MO W-4 online?

Can I create an electronic signature for signing my MO W-4 in Gmail?

How can I fill out MO W-4 on an iOS device?

What is MO W-4?

Who is required to file MO W-4?

How to fill out MO W-4?

What is the purpose of MO W-4?

What information must be reported on MO W-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.