MS DoR 81-110 2018 free printable template

Show details

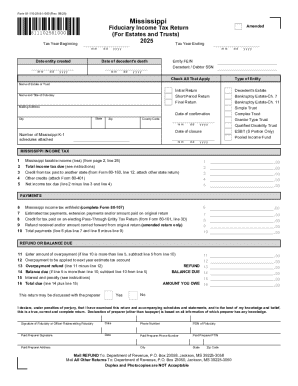

Reset Form Form 81-110-18-8-1-000 Rev. 08/18 Print Form Mississippi Amended Fiduciary Income Tax Return For Estates and Trusts Tax Year Ending 811101881000 Tax Year Beginning mm Date entity created dd yyyy Entity FEIN Date of decedent s death Decedent / Debtor SSN Check All That Apply Type of Entity Name of Estate or Trust Initial Return Decedent s Estate Name of Fiduciary Short Period Return Bankruptcy Estate-Ch. 7 Final Return Title of Fiduciary Date of confirmation Simple Trust Complex...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MS DoR 81-110

Edit your MS DoR 81-110 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MS DoR 81-110 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MS DoR 81-110 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MS DoR 81-110. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 81-110 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MS DoR 81-110

How to fill out MS DoR 81-110

01

Obtain the MS DoR 81-110 form from the official website or designated office.

02

Review the instructions provided with the form to understand the requirements.

03

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Provide information regarding the purpose of the request accurately.

05

Include any supporting documentation required for your specific request.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form by mailing it to the specified address or delivering it in person as instructed.

Who needs MS DoR 81-110?

01

Individuals or organizations applying for specific permits or licenses.

02

Participants in state-funded projects requiring documentation.

03

Anyone requesting information related to regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is the threshold for fiduciary income tax?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100.

Can a fiduciary do your taxes?

As a trustee or administrator, you are the fiduciary of the trust or estate. This means that you are the person responsible for overseeing the estate or trust—which includes filing all necessary tax returns.

What is the minimum taxable income for a 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts.

What does fiduciary mean on tax form?

IRS Definition A fiduciary is any person in a position of confidence acting on behalf of any other person. A fiduciary assumes the powers, rights, duties, and privileges of the person or entity on whose behalf he or she is acting.

What is the difference between fiduciary and estate tax return?

While fiduciary income tax is the income taxation of a person's estate or trust assets, estate tax is a tax on the right to transfer property when a person passes away.

What is the minimum income to file fiduciary income tax return?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100. An alternative minimum tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MS DoR 81-110 for eSignature?

When your MS DoR 81-110 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit MS DoR 81-110 online?

The editing procedure is simple with pdfFiller. Open your MS DoR 81-110 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit MS DoR 81-110 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share MS DoR 81-110 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is MS DoR 81-110?

MS DoR 81-110 is a form used for reporting certain financial and operational data in a specified format to meet regulatory requirements.

Who is required to file MS DoR 81-110?

Entities and individuals engaged in specific activities that fall under the jurisdiction of the regulatory body overseeing the form are required to file MS DoR 81-110.

How to fill out MS DoR 81-110?

To fill out MS DoR 81-110, follow the provided instructions meticulously, filling in the required fields with accurate and pertinent information and ensuring compliance with the guidelines.

What is the purpose of MS DoR 81-110?

The purpose of MS DoR 81-110 is to ensure transparency and accountability by collecting necessary data from reporting entities for regulatory oversight.

What information must be reported on MS DoR 81-110?

The information that must be reported on MS DoR 81-110 includes financial data, operational metrics, compliance information, and other relevant data as specified by the regulatory body.

Fill out your MS DoR 81-110 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MS DoR 81-110 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.