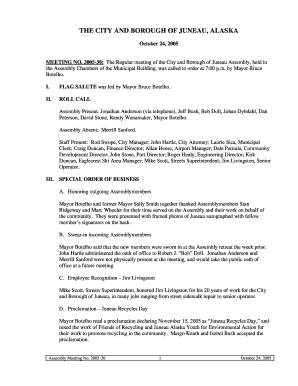

Get the free Cost Allocation and Rate Setting Services Award #23050 - Office of ...

Show details

NEW YORK MUNICIPAL INSURANCE RECIPROCALINSURANCE APPLICATION CHECKLIST 1. Completed Supplemental Application and Applications/Schedules.2. Signatures on Applications and Statement of Values where

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost allocation and rate

Edit your cost allocation and rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost allocation and rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cost allocation and rate online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cost allocation and rate. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost allocation and rate

How to fill out cost allocation and rate

01

To fill out cost allocation and rate form, follow these steps:

02

Begin by entering the basic information required, such as your name, company name, and contact details.

03

Specify the period for which the cost allocation and rate is being calculated. This could be a specific month, quarter, or year.

04

List all the cost categories that need to be allocated, such as labor, materials, overhead expenses, etc.

05

Allocate the costs to specific cost centers or projects. This may involve distributing the costs based on predetermined formulas or metrics.

06

Calculate the rates for each cost category by dividing the allocated costs by the corresponding cost driver. Cost drivers could be hours worked, quantity produced, etc.

07

Ensure that the allocated costs and rates are accurate and properly calculated.

08

Double-check all the entered information to avoid any errors or discrepancies.

09

Once everything is filled out accurately, review the form and sign it.

10

Submit the completed cost allocation and rate form to the appropriate department or authority.

Who needs cost allocation and rate?

01

Cost allocation and rate are needed by various entities, including:

02

- Businesses or organizations that want to accurately track and allocate their costs to different cost centers or projects.

03

- Government agencies or institutions that require cost allocation and rate information for budgeting or auditing purposes.

04

- Non-profit organizations that need to evaluate their cost structure and allocate expenses to different programs or activities.

05

- Cost accountants or financial analysts who analyze and interpret cost data for decision-making or performance evaluation.

06

- Investors or stakeholders who want to assess the cost efficiency and profitability of a company or project.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cost allocation and rate directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your cost allocation and rate along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get cost allocation and rate?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the cost allocation and rate in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the cost allocation and rate electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your cost allocation and rate in seconds.

What is cost allocation and rate?

Cost allocation is the process of dividing costs between two or more cost objectives, while the cost rate is the amount of money allocated per unit of an activity or program.

Who is required to file cost allocation and rate?

Organizations that receive government funding or grants may be required to file cost allocation and rate reports to account for how the funds are being used.

How to fill out cost allocation and rate?

Cost allocation and rate reports can be filled out by detailing the costs incurred and the methods used to allocate those costs to different programs or activities.

What is the purpose of cost allocation and rate?

The purpose of cost allocation and rate is to accurately track and distribute costs among different projects or programs to ensure proper financial management and accountability.

What information must be reported on cost allocation and rate?

Information such as total costs incurred, allocation methodologies used, cost rates calculated, and supporting documentation may need to be reported on cost allocation and rate reports.

Fill out your cost allocation and rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Allocation And Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.