Get the free Delivering Retirement Solutions

Show details

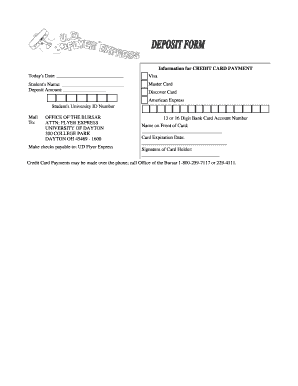

Expense Payment AuthorizationDelivering Retirement SolutionsInstructionsVIP Services: (833) 2487878 IRA support poly comp.net 3000 Lava Ridge Ct., Suite 130, Roseville, CA 95661 Please use this form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delivering retirement solutions

Edit your delivering retirement solutions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delivering retirement solutions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing delivering retirement solutions online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit delivering retirement solutions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out delivering retirement solutions

How to fill out delivering retirement solutions

01

To fill out delivering retirement solutions, follow these steps:

02

Gather all necessary documents and information, such as client details, retirement goals, financial assets, and any specific requirements or preferences.

03

Determine the client's risk tolerance and investment objectives to recommend suitable retirement solutions.

04

Conduct a thorough analysis of the client's current financial situation, including income, expenses, debts, and existing retirement savings.

05

Assess the client's desired retirement lifestyle and estimate the retirement income needed to meet those goals.

06

Evaluate various retirement solutions available, such as annuities, pension plans, individual retirement accounts (IRAs), or employer-sponsored plans.

07

Compare and analyze the features, benefits, costs, and potential risks of different retirement solutions.

08

Create a tailored retirement plan based on the client's unique needs and goals. This may involve diversifying investments, considering tax implications, and ensuring adequate protection.

09

Present the retirement plan to the client, explaining the recommended solutions and strategies.

10

Address any questions or concerns the client may have.

11

Assist the client in completing and submitting the necessary paperwork to set up retirement accounts or investments.

12

Monitor and review the retirement plan on a regular basis to ensure it remains aligned with the client's changing circumstances and goals.

13

Provide ongoing support, advice, and adjustments as needed throughout the client's retirement journey.

14

It is important to consult with a qualified financial advisor or retirement specialist for personalized guidance and expertise.

Who needs delivering retirement solutions?

01

Delivering retirement solutions may be beneficial for the following individuals and groups:

02

- Individuals approaching retirement age and seeking guidance on how to secure their financial future.

03

- Employees looking to maximize their retirement savings and optimize employer-sponsored retirement plans.

04

- Self-employed individuals or freelancers who need to set up retirement accounts and investment strategies on their own.

05

- Those who want to explore different retirement options and understand the potential benefits and risks associated with each.

06

- Individuals who require expert advice on tax-efficient strategies, estate planning, and wealth protection during retirement.

07

- Organizations or institutions looking to provide retirement planning services as part of their employee benefits package.

08

- Financial advisors or professionals specializing in retirement planning who want to enhance their service offerings.

09

By delivering retirement solutions, individuals and organizations can help facilitate a secure and comfortable retirement for their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send delivering retirement solutions to be eSigned by others?

Once your delivering retirement solutions is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get delivering retirement solutions?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific delivering retirement solutions and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute delivering retirement solutions online?

With pdfFiller, you may easily complete and sign delivering retirement solutions online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is delivering retirement solutions?

Delivering retirement solutions involves providing financial products and services to individuals who are planning for retirement.

Who is required to file delivering retirement solutions?

Financial institutions, investment advisors, and insurance companies are required to file delivering retirement solutions.

How to fill out delivering retirement solutions?

Delivering retirement solutions can be filled out electronically through the designated platform provided by the regulatory body.

What is the purpose of delivering retirement solutions?

The purpose of delivering retirement solutions is to ensure that individuals have access to proper financial planning tools and products to support their retirement goals.

What information must be reported on delivering retirement solutions?

Information such as retirement savings products offered, fees charged, investment options, and eligibility criteria must be reported on delivering retirement solutions.

Fill out your delivering retirement solutions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delivering Retirement Solutions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.