OH ODT IT 3 2019 free printable template

Show details

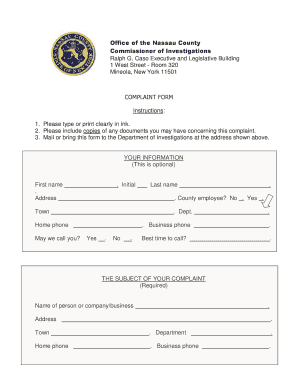

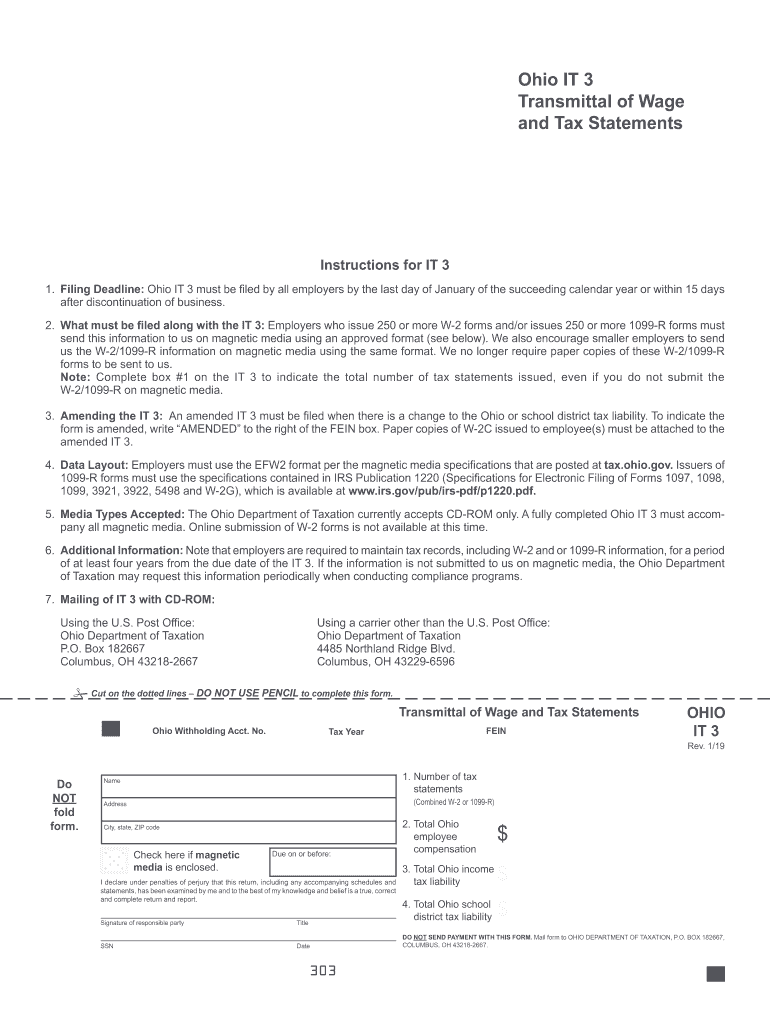

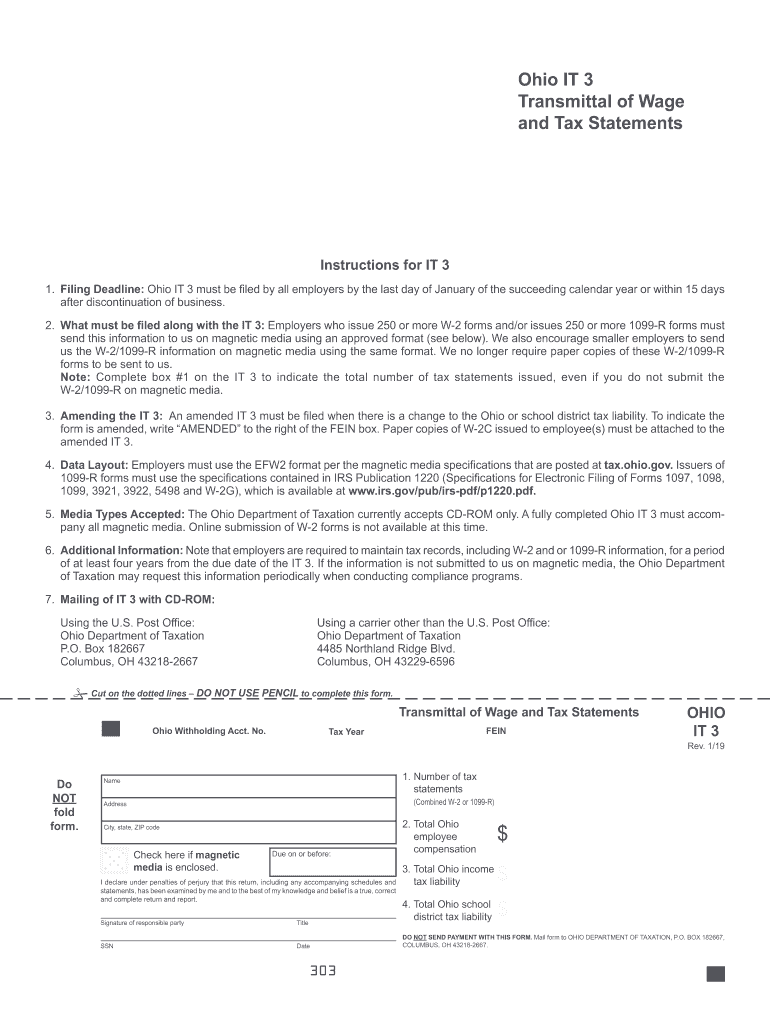

Amending the IT 3 An amended IT 3 must be filed when there is a change to the Ohio or school district tax liability. Ohio IT 3 Transmittal of Wage and Tax Statements Instructions for IT 3 1. Filing Deadline Ohio IT 3 must be filed by all employers by the last day of January of the succeeding calendar year or within 15 days after discontinuation of business. Cut on the dotted lines DO NOT USE PENCIL to complete this form. Reset Form Ohio Withholding Acct. No. FEIN Tax Year OHIO IT 3 Rev. 1/19...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH ODT IT 3

Edit your OH ODT IT 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH ODT IT 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH ODT IT 3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OH ODT IT 3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ODT IT 3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH ODT IT 3

How to fill out OH ODT IT 3

01

Begin by gathering all necessary personal information and documentation.

02

Open the OH ODT IT 3 form and read the instructions carefully.

03

Fill out the identification section with your name, address, and Social Security number.

04

Complete the eligibility section by confirming your qualifications.

05

Provide any required financial information and documentation.

06

If applicable, disclose any additional relevant information as prompted on the form.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form according to the instructions provided, either online or by mail.

Who needs OH ODT IT 3?

01

Individuals applying for specific state or federal assistance programs.

02

Applicants seeking to report changes in financial or personal circumstances.

03

Those required to update their information due to changes in eligibility.

Fill

form

: Try Risk Free

People Also Ask about

Does Ohio have an IT 3?

Filing Deadline: The Ohio IT 3 must be filed by January 31st or within 60 days after discontinuation of business.

Can I file Ohio school district taxes online?

ePayment. Allows you to electronically make Ohio individual income and school district income tax payments. This includes extension and estimated payments, original and amended return payments, billing and assessment payments.

What forms need to be filed with Ohio tax return?

Top Individual Forms IT 1040/SD 100 Instructions. Tax Year: 2022. Revised on 02/23. IT 1040 Tax Return. Tax Year: 2022. Revised on 12/22. IT 40P. Tax Year: 2022. Revised on 12/22. IT 1040 ES. Tax Year: 2023. Revised on 12/22. SD 100 Tax Return. Tax Year: 2022. SD 40P. Tax Year: 2022. SD 100 ES. Tax Year: 2023. IT 10. Tax Year: 2022.

How much is the Ohio IT 1040 exemption?

Ohio Income Tax Tables. For tax year 2022, Ohio's individual income tax brackets have been modified so that individuals with Ohio taxable nonbusiness income of $26,050 or less are not subject to income tax. Additionally, Ohio taxable nonbusiness income in excess of $115,300 is taxed at 3.99%.

Can I file Ohio it 3 online?

Only paper file the IT-3, the transmittal of W-2 form. The Ohio Department of Taxation may still request W-2 information to be submitted via Ohio Business Gateway W-2 Upload Feature when conducting compliance programs.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OH ODT IT 3 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your OH ODT IT 3 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find OH ODT IT 3?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the OH ODT IT 3 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make edits in OH ODT IT 3 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your OH ODT IT 3, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is OH ODT IT 3?

OH ODT IT 3 is a tax form used in Ohio for reporting income generated from businesses and other sources. It is specifically designed for individuals and entities that have received income from sources that are subject to Ohio's commercial activity tax.

Who is required to file OH ODT IT 3?

Individuals and entities that are subject to Ohio's commercial activity tax and have received taxable income within the state are required to file OH ODT IT 3.

How to fill out OH ODT IT 3?

To fill out OH ODT IT 3, taxpayers must provide their identifying information, report their total income, and calculate the tax owed based on the applicable rates. Detailed instructions are provided on the form itself to assist in accurate completion.

What is the purpose of OH ODT IT 3?

The purpose of OH ODT IT 3 is to report and remit the appropriate taxes on income generated in Ohio, ensuring compliance with state tax laws regarding commercial activities.

What information must be reported on OH ODT IT 3?

The information that must be reported on OH ODT IT 3 includes the taxpayer's identification details, types and amounts of income earned from Ohio sources, deductions (if applicable), and the calculated tax due.

Fill out your OH ODT IT 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH ODT IT 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.