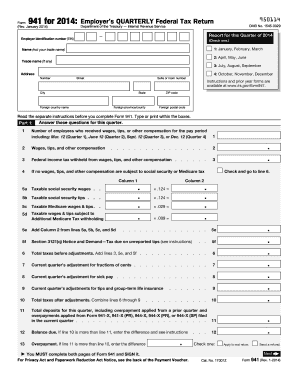

OH ODT IT 3 2011 free printable template

Show details

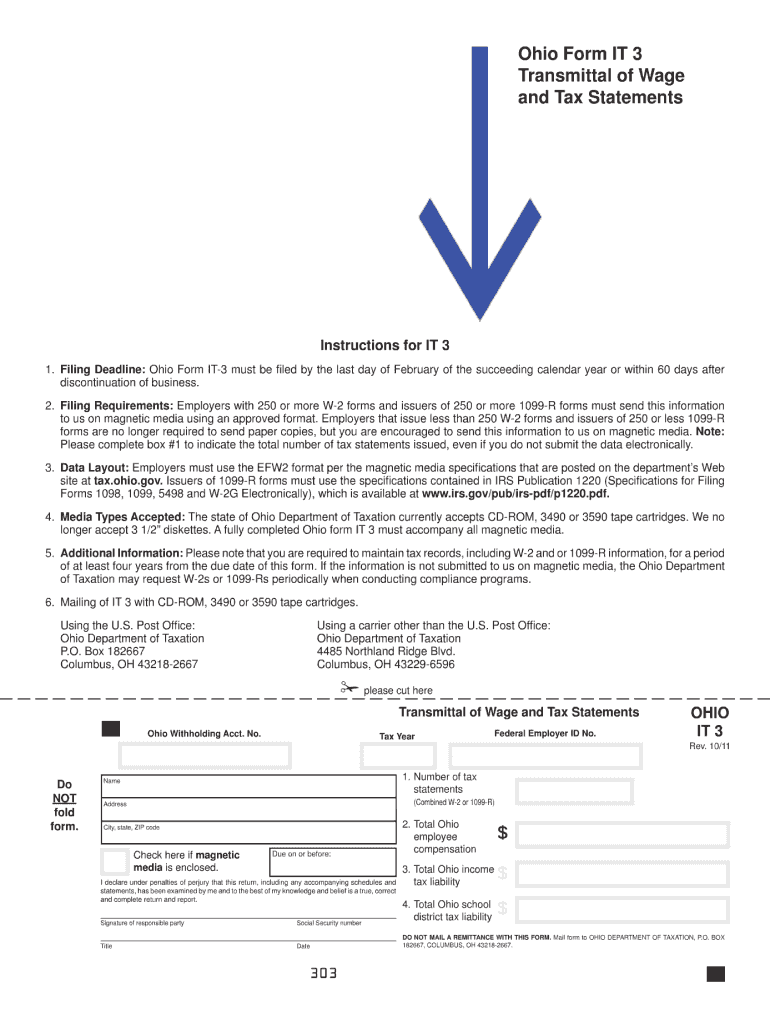

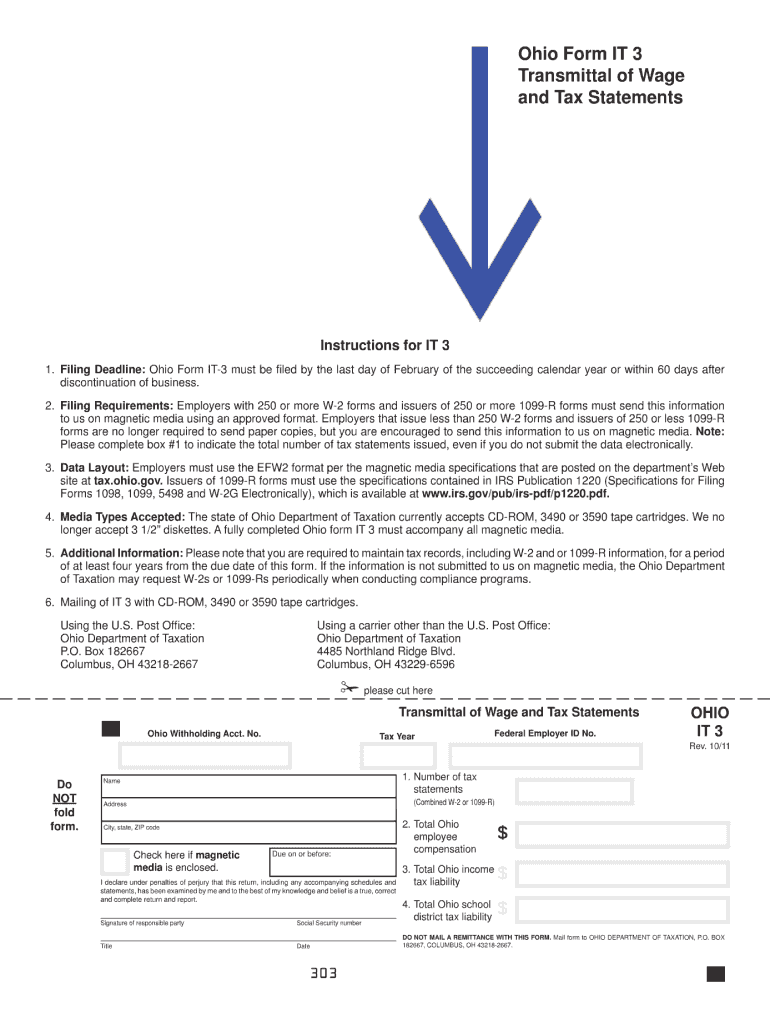

Ohio Form IT 3 Transmittal of Wage and Tax Statements Instructions for IT 3 1. Filing Deadline: Ohio Form IT-3 must be filed by the last day of February of the succeeding calendar year or within 60

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH ODT IT 3

Edit your OH ODT IT 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH ODT IT 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH ODT IT 3 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OH ODT IT 3. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ODT IT 3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH ODT IT 3

How to fill out OH ODT IT 3

01

Gather all necessary financial documentation for the tax year.

02

Obtain a copy of the OH ODT IT 3 form from the Ohio Department of Taxation website or your local tax office.

03

Fill in your personal information, including name, address, and Social Security number.

04

Report your total income accurately in the specified section.

05

Calculate any deductions or credits that apply to your situation.

06

Enter your tax due based on the calculations and applicable tax rates.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the form electronically or mail it to the appropriate tax office.

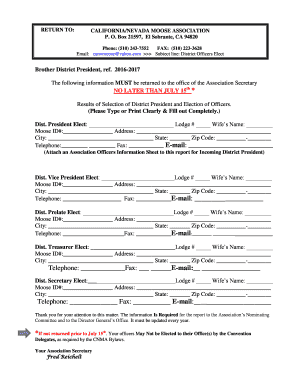

Who needs OH ODT IT 3?

01

Individuals residing in Ohio who have earned income and are required to file a state income tax return.

02

Business owners and self-employed individuals who need to report their income.

03

Tax professionals preparing returns for clients in Ohio.

Fill

form

: Try Risk Free

People Also Ask about

What is the form to file Ohio state taxes?

Ohio IT 1040 and SD100 Forms.

Where can I get a state of Ohio tax form?

The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple purposes. Most forms are available for download and some can be filled or filed online.

Does Ohio have a state income tax form?

2022 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P.

What is an Ohio IT 4 form?

Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate. The employer is required to have each employee that works in Ohio to complete this form.

Am I exempt from Ohio income tax?

Every resident and part-year resident of Ohio is subject to state income tax. Nonresidents with Ohio-source income also must file returns.

Does Ohio have an IT 3?

Filing Deadline: The Ohio IT 3 must be filed by January 31st or within 15 days after discontinuation of business.

Who is exempt from Ohio withholding?

Reciprocity Exemption: If you are a resident of Indiana, Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax on your compensation. Instead, you should have your employer withhold income tax for your resident state.

Who is not subject to withholding?

Taxable income not subject to withholding - Interest income, dividends, capital gains, self employment income, IRA (including certain Roth IRA) distributions. Adjustments to income - IRA deduction, student loan interest deduction, alimony expense.

Can I file Ohio it 3 online?

Only paper file the IT-3, the transmittal of W-2 form. The Ohio Department of Taxation may still request W-2 information to be submitted via Ohio Business Gateway W-2 Upload Feature when conducting compliance programs.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH ODT IT 3 for eSignature?

To distribute your OH ODT IT 3, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the OH ODT IT 3 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign OH ODT IT 3 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit OH ODT IT 3 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign OH ODT IT 3. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is OH ODT IT 3?

OH ODT IT 3 is a tax form used for reporting Ohio's individual income tax for various types of income, including withholdings and estimated taxes.

Who is required to file OH ODT IT 3?

Individuals who earn income in Ohio, have Ohio tax withheld, or need to report their tax liability may be required to file OH ODT IT 3.

How to fill out OH ODT IT 3?

To fill out OH ODT IT 3, gather all relevant income information, complete sections for income details, tax withholdings, and any credits, then review and submit to the appropriate Ohio tax authority.

What is the purpose of OH ODT IT 3?

The purpose of OH ODT IT 3 is to provide the Ohio Department of Taxation with the necessary information to assess and collect individual income tax from residents and non-residents earning income in Ohio.

What information must be reported on OH ODT IT 3?

The information that must be reported on OH ODT IT 3 includes personal identification details, income sources, total income amount, tax withheld, credits, and any other adjustments relevant to Ohio tax obligations.

Fill out your OH ODT IT 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH ODT IT 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.