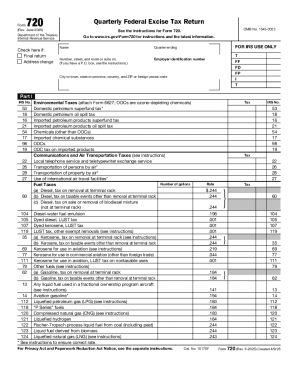

IRS 720 2019 free printable template

Instructions and Help about IRS 720

How to edit IRS 720

How to fill out IRS 720

About IRS previous version

What is IRS 720?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 720

What should I do if I realize I made a mistake on my IRS 720 after filing?

If you discover an error on your IRS 720 after submission, it's crucial to file an amended return. You should prepare a corrected IRS 720 using the appropriate procedures outlined by the IRS, ensuring to indicate clearly that it's an amendment on the submission. This process helps to rectify any inaccuracies and maintain compliance with IRS regulations.

How can I verify if my IRS 720 has been received and is being processed?

To track the status of your submitted IRS 720, you can utilize the IRS online tools available for checking submission statuses. Be aware of any common e-file rejection codes you might encounter, as these can impact processing. If you experience issues, contact the IRS directly for assistance in clarifying your submission status.

Are e-signatures acceptable on the IRS 720?

Yes, e-signatures are acceptable on the IRS 720, provided they comply with IRS guidelines regarding electronic signatures. Make sure you're familiar with the privacy and data security measures that apply to e-filed documents to protect sensitive information. Maintaining secure records is also essential for your documents.

What should I do if I receive a notice from the IRS regarding my IRS 720?

If you receive a notice or letter from the IRS about your IRS 720, it's vital to respond promptly and thoroughly. Gather the necessary documentation to address the inquiry and follow any instructions provided in the notice. This proactive approach can help resolve any issues efficiently, ensuring your compliance is maintained.

What common errors should I watch out for when filing the IRS 720?

When filing the IRS 720, be wary of typical mistakes such as incorrect data entry, failure to sign and date the form, and discrepancies in reported payment amounts. Double-checking your entries and following the guidelines can help minimize these errors, ultimately aiding in the smooth processing of your IRS return.

See what our users say