Get the free AirBNB & 1099-Misc w/ Panel Discussion - National Association of Tax ...

Show details

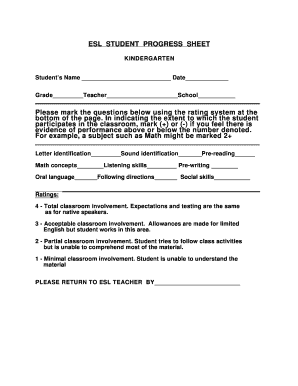

NATIONAL ASSOCIATION OF TAX PROFESSIONALS HAWAII CHAPTERAirBNB & 1099Misc w/ Panel Discussion 8:00 am 10:00am May 18, 2017 (2 hr. CPE) Breakfast Buffet Starts at 7:30am Clubhouse at Wankel, Cooley

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign airbnb amp 1099-misc w

Edit your airbnb amp 1099-misc w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your airbnb amp 1099-misc w form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit airbnb amp 1099-misc w online

To use the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit airbnb amp 1099-misc w. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out airbnb amp 1099-misc w

How to fill out airbnb amp 1099-misc w

01

Start by logging into your Airbnb account and navigating to your Host Dashboard.

02

Click on the 'Tax Info' tab on the left-hand side of the page.

03

Under the '1099 Tax Documents' section, click on the 'View' button for the applicable tax year.

04

Review the information provided and make sure it matches your records. If there are any discrepancies, contact Airbnb support.

05

Once you have verified the information, click on the 'Download' button to save the 1099-MISC form to your computer.

06

Open the downloaded form using a PDF reader.

07

Fill out the required fields, including your personal information, rental income details, and any other relevant information.

08

Double-check all the information for accuracy and completeness.

09

Save the filled-out form to your computer.

10

If you have any questions or need assistance, consult a tax professional or contact Airbnb support.

Who needs airbnb amp 1099-misc w?

01

Anyone who earns income from hosting on Airbnb and meets the IRS criteria must file a 1099-MISC form.

02

According to the IRS, if you are an individual who rents out property and receives payments of $600 or more during a tax year, you are generally required to report that income on a 1099-MISC form.

03

Therefore, anyone who hosts guests on Airbnb and earns $600 or more in a tax year must file a 1099-MISC form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find airbnb amp 1099-misc w?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific airbnb amp 1099-misc w and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the airbnb amp 1099-misc w in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your airbnb amp 1099-misc w in seconds.

How do I fill out the airbnb amp 1099-misc w form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign airbnb amp 1099-misc w and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is airbnb amp 1099-misc w?

Airbnb amp 1099-misc w is a tax form used by Airbnb to report income earned by hosts through the platform.

Who is required to file airbnb amp 1099-misc w?

Hosts who earn more than $600 in income through Airbnb are required to file the 1099-misc w form.

How to fill out airbnb amp 1099-misc w?

To fill out the Airbnb amp 1099-misc w form, hosts need to report their total earnings and any expenses incurred while hosting.

What is the purpose of airbnb amp 1099-misc w?

The purpose of the Airbnb amp 1099-misc w form is to report income earned by hosts to the IRS for tax purposes.

What information must be reported on airbnb amp 1099-misc w?

The information that must be reported on the Airbnb amp 1099-misc w form includes the host's total earnings and any expenses incurred.

Fill out your airbnb amp 1099-misc w online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Airbnb Amp 1099-Misc W is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.