CA Business Tax/Permit Application - Carson 2017 free printable template

Show details

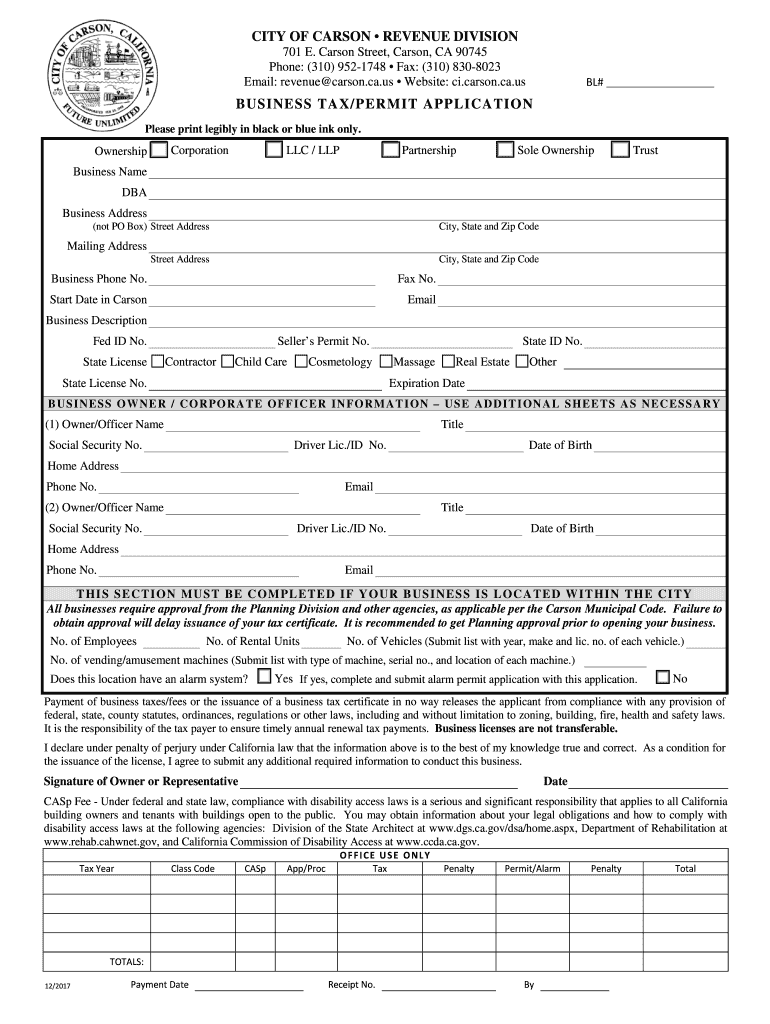

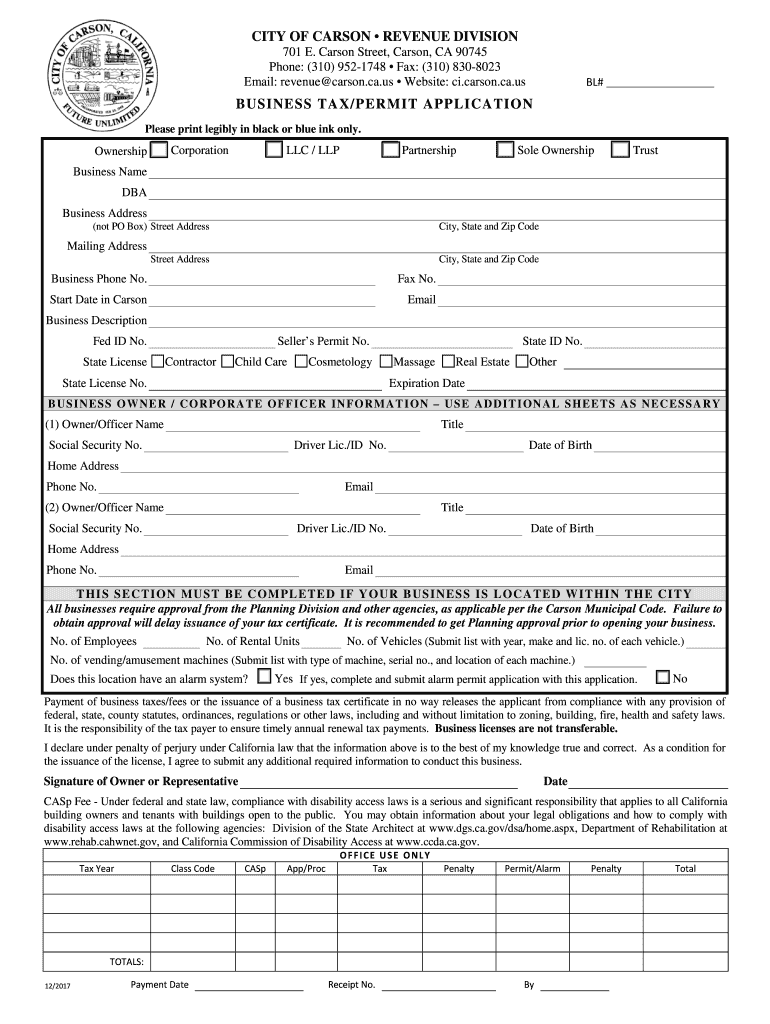

CITY OF CARSON REVENUE DIVISION 701 E. Carson Street, Carson, CA 90745 Phone: (310) 9521748 Fax: (310) 8308023 Email: revenue Carson.ca.us Website: CI.Carson.ca.USB# BUSINESS TAX/PERMIT APPLICATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Business TaxPermit Application - Carson

Edit your CA Business TaxPermit Application - Carson form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Business TaxPermit Application - Carson form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Business TaxPermit Application - Carson online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA Business TaxPermit Application - Carson. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Business Tax/Permit Application - Carson Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Business TaxPermit Application - Carson

How to fill out CA Business Tax/Permit Application - Carson

01

Obtain a copy of the CA Business Tax/Permit Application form from the Carson city website or office.

02

Fill in the business information section, including the business name, address, and contact information.

03

Select the appropriate business type (e.g., sole proprietorship, partnership, corporation).

04

Provide details on the business activities and describe the services or products offered.

05

Include your federal employer identification number (EIN) if applicable.

06

Specify the date when the business started operations in Carson.

07

Indicate the number of employees anticipated in the business.

08

Review the application for completeness and accuracy.

09

Sign and date the application where indicated.

10

Submit the application in person or via mail to the Carson business tax office.

Who needs CA Business Tax/Permit Application - Carson?

01

Any individual or entity planning to operate a business within the city of Carson.

02

Businesses that require a tax permit to comply with local regulations.

03

Entrepreneurs intending to establish a new business in Carson.

04

Companies expanding operations or opening new branches in Carson.

Fill

form

: Try Risk Free

People Also Ask about

Will I get caught if I don't file taxes?

The IRS typically won't look much further than six years for enforcement of unfiled taxes, ing to IRS Mind. However, it's important to note that if you don't file taxes, the IRS will likely catch up to you within three years of your missed tax filing deadline.

How long should filing taxes take?

If you filed your tax return on paper through the mail, you can expect a process time of 6 to 8 weeks from the date the IRS received your tax return documents. Here's the process in which the IRS processes your tax return: Check status 24 to 48 hours after e-filing using the IRS app or visiting the Where's My Refund?

How long can you go without filing taxes?

You will have 90 days to file your past due tax return or file a petition in Tax Court. If you do neither, we will proceed with our proposed assessment.

What is the rule for filing taxes?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

What happens if you don't file taxes?

The penalty for not filing your return is typically 5% of the tax you owe for each month or partial month your return is late. This penalty also maxes out at 25% of your unpaid taxes. If your return was over 60 days late, the minimum penalty is $435 for 2022 or 100% of the tax on the return — whichever is less.

When can I file my taxes for 2023?

The 2023 eFile Tax Season starts in January 2023: prepare and eFile your IRS and State 2022 Tax Return(s) by April 18, 2023. If you miss this deadline, you have until October 16, 2023. If you owe taxes, you should at least e-File a Tax Extension by April 18, 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CA Business TaxPermit Application - Carson from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including CA Business TaxPermit Application - Carson, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in CA Business TaxPermit Application - Carson?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your CA Business TaxPermit Application - Carson to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out CA Business TaxPermit Application - Carson on an Android device?

Use the pdfFiller mobile app and complete your CA Business TaxPermit Application - Carson and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA Business Tax/Permit Application - Carson?

The CA Business Tax/Permit Application - Carson is a form that businesses need to complete in order to obtain a business permit and pay business taxes within the city of Carson, California.

Who is required to file CA Business Tax/Permit Application - Carson?

Any individual or entity planning to conduct business within the city limits of Carson, including but not limited to sole proprietors, partnerships, corporations, and LLCs, is required to file the CA Business Tax/Permit Application.

How to fill out CA Business Tax/Permit Application - Carson?

To fill out the CA Business Tax/Permit Application - Carson, you will need to provide your business name, address, contact information, type of business, and ownership details, as well as any relevant tax identification numbers and payment information.

What is the purpose of CA Business Tax/Permit Application - Carson?

The purpose of the CA Business Tax/Permit Application - Carson is to register a business within the city and ensure compliance with local tax regulations, enabling the city to collect necessary taxes and fees for services provided.

What information must be reported on CA Business Tax/Permit Application - Carson?

The information that must be reported includes the business name, business location, ownership details, estimated gross receipts, tax identification numbers, and any other information as required by the city of Carson.

Fill out your CA Business TaxPermit Application - Carson online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Business TaxPermit Application - Carson is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.