Get the free Steel and Aluminum Tariffs: Thousands of Exclusion

Show details

Steel and Aluminum Tariffs: Thousands of Exclusion

Requests from US Firms

Christine McDaniel and Danielle Parks of the Mercator Center, George Mason University

January 2019

About the data

Under Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign steel and aluminum tariffs

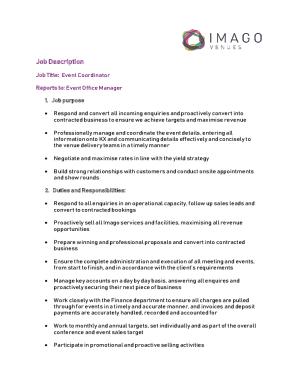

Edit your steel and aluminum tariffs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your steel and aluminum tariffs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing steel and aluminum tariffs online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit steel and aluminum tariffs. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out steel and aluminum tariffs

How to fill out steel and aluminum tariffs

01

Determine the type and level of steel and aluminum tariffs you want to impose. This could include import duties, quotas, or other trade restrictions.

02

Consult with trade experts, industry representatives, and government officials to gather information on the potential impact of the tariffs.

03

Assess the potential benefits and drawbacks of the tariffs for your country's economy, domestic industries, and national security.

04

Develop a strategy for implementing the tariffs, considering factors such as timing, enforcement mechanisms, and any potential exemptions or exceptions.

05

Communicate the rationale behind the tariffs to the public and key stakeholders, addressing concerns and providing transparent information about their purpose and expected outcomes.

06

Establish a mechanism for monitoring the effectiveness and impact of the tariffs, and be prepared to make adjustments or modifications as needed.

07

Coordinate with international trade partners and organizations to address any potential trade disputes or challenges that may arise from the imposition of the tariffs.

08

Continuously evaluate and review the tariffs to ensure they align with your country's trade objectives and are meeting the desired results.

Who needs steel and aluminum tariffs?

01

Countries that want to protect their domestic steel and aluminum industries from unfair competition or dumping practices by foreign producers.

02

Countries that view steel and aluminum as critical industries for national security and want to ensure their availability during times of conflict or geopolitical tensions.

03

Countries that aim to reduce their trade deficit by limiting imports of steel and aluminum and promoting domestic production.

04

Countries that want to negotiate better trade deals by using tariffs as leverage during trade negotiations.

05

Countries that want to create or preserve jobs in their steel and aluminum industries through protectionist measures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my steel and aluminum tariffs in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your steel and aluminum tariffs and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit steel and aluminum tariffs online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your steel and aluminum tariffs to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit steel and aluminum tariffs on an Android device?

You can make any changes to PDF files, like steel and aluminum tariffs, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is steel and aluminum tariffs?

Steel and aluminum tariffs are taxes or duties placed on imported steel and aluminum products.

Who is required to file steel and aluminum tariffs?

Importers or manufacturers of steel and aluminum products are required to file steel and aluminum tariffs.

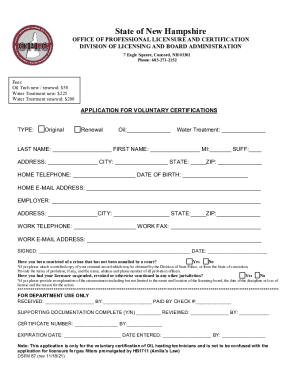

How to fill out steel and aluminum tariffs?

Steel and aluminum tariffs can be filled out online through the customs website or by submitting a paper form to the customs office.

What is the purpose of steel and aluminum tariffs?

The purpose of steel and aluminum tariffs is to protect domestic steel and aluminum industries from unfair competition from foreign producers.

What information must be reported on steel and aluminum tariffs?

Information such as the country of origin, value of the products, and classification codes must be reported on steel and aluminum tariffs.

Fill out your steel and aluminum tariffs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Steel And Aluminum Tariffs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.